Form 1099-NEC vs 1099-MISC: How to file them

For small businesses working with freelancers, understanding the nuances between 1099-NEC and 1099-MISC is essential for accurate tax reporting and compliance. These forms are used to report non-employee compensation and other types of payments, but they serve different purposes. In this blog, we will clarify the differences between 1099 MISC and 1099 NEC, discuss filing requirements, and show you how to simplify the process for your business.

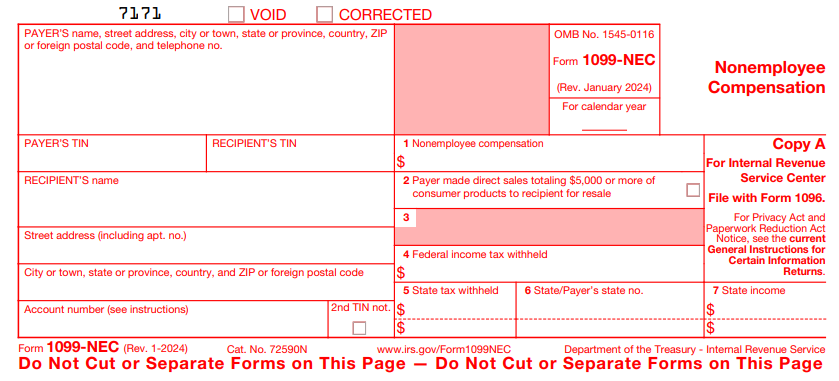

What is Form 1099-NEC?

Form 1099-NEC (Non-employee Compensation) is to report payments of $600 or more to people or businesses for services by those who are independent contractors, freelancers, or other non-employees.

Source link: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

How to file Form 1099-NEC?

To file Form 1099-NEC electronically, you may submit electronically through the IRS FIRE system or by mailing paper forms. If you issue 10 or more forms, you must file them electronically. However, because the form 1099-NEC is an electronic filing, one must fill the form by January 31 every year.

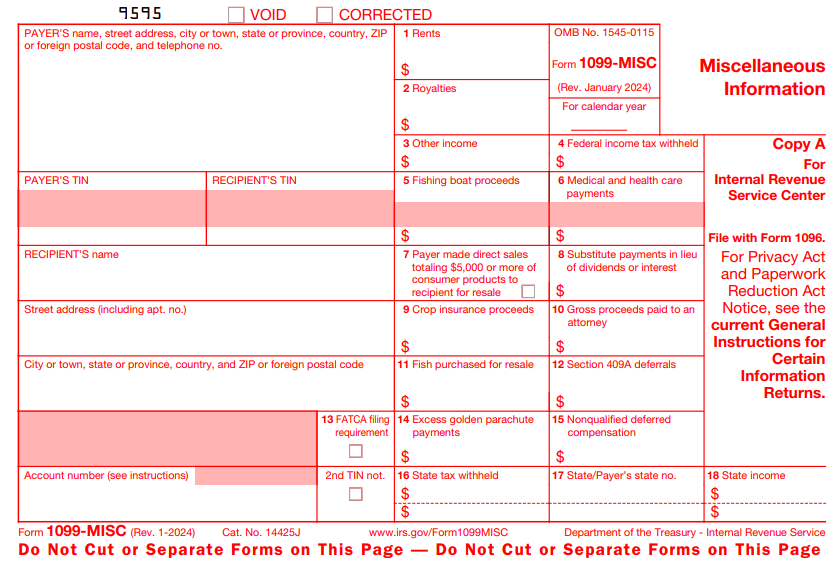

What is Form 1099-MISC?

Miscellaneous Information (Form 1099-MISC) is used to report certain types of income not otherwise reported on Form W-2 or Form 1099-NEC. That includes rent, royalties, medical and legal payments, prizes, or awards.

Source link: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Who requires a Form 1099-MISC?

Businesses that have made a certain kind of payment for that year, one of at least $600 in rent or $10 in royalties, must file Form 1099-MISC.

How to fill out Form 1099-MISC?

– Box 1: Enter amounts for rents

– Box 2: Royalties have to be in the $10 or more range

– Box 3: Other taxable income, such as awards and taxable damages

– Box 6: Make medical or healthcare payments

– Box 10: Report gross proceeds that attorneys receive

Difference between Form 1099-NEC vs 1099-MISC

Reporting payments to non-employees is a requirement, and you must ensure compliance with IRS tax regulations. Two types of common forms used are 1099-NEC and 1099-MISC, which have different purposes. Here’s a detailed breakdown to help businesses understand 1099 NEC vs MISC and ensure compliance.

Purpose of the forms

Form 1099-NEC:

It is used to report non-employee compensation (NEC), which includes payments of $600 or more to independent contractors, freelancers, or other non-employees for services provided.

Form 1099-MISC:

Rents, royalties, prizes, and legal payments Other than non-employee compensation.

Key difference:

1099-MISC covers payments of all sorts, while 1099-NEC only focuses on non-employee services.

Types of income reported

Form 1099-NEC

Box 1: Freelance fees, independent contractor payments

Box 2: Firm sales of $5,000 or more of consumer products for resale

Example: Any payment made to a freelance designer or writer of over $600

Form 1099-MISC

Box 1: Office space, machinery rentals (e.g., rents)

Box 2: Royalties of $10 or more

Box 3: Prizes, awards, or taxable damages other income

Box 6: Payments by medical and healthcare providers

Box 10: Proceeds paid to an attorney

Box 7: Can be reported on either 1099-MISC or NEC, direct sales

Example: Payments for office space rent or for medical services

Penalties for late filing

Form 1099-NEC

If filed within 30 days of the deadline:

- Penalty: $50 per form

- Maximum penalty: Up to $206,000 a year for small businesses

If filed more than 30 days late but before August 1:

- Penalty: $110 per form

- Maximum penalty: Up to $588,500 annually

If filed after August 1 or not filed at all:

- Penalty: $290 per form

- Maximum penalty: Up to $1,177,500 annually

Form 1099-MISC

If filed within 30 days of the deadline:

- Penalty: $50 per form

- Maximum penalty: For small businesses, up to $206,000 annually

If filed more than 30 days late but before August 1:

- Penalty: $110 per form

- Maximum penalty: Up to $588,500 annually

If filed after August 1 or not filed at all:

- Penalty: $290 per form

- Maximum penalty: Up to $1,177,500 annually

Important notes

- Businesses issuing multiple late or incorrect forms will incur large penalties, as penalty amounts are performed

- A small business is a business with gross receipts of $5 million or less in the prior three tax years

Penalties apply for failing to:

- Filing forms with the IRS

- Make sure you provide them on time if you need recipient copies

- Frequently correcting inaccurate information

Besides ensuring that your business is in compliance with IRS regulations, filing the correct form helps your business avoid getting hit with penalties. Misfiling can lead to costly errors, making it critical to distinguish between 1099 NEC vs MISC requirements.

Note: In addition to filing 1099 forms, businesses hiring global freelancers or independent contractors may also need to manage international tax compliance. One key document for this purpose is the W-8 BEN Form, which ensures proper withholding tax documentation for foreign workers. To learn more about the importance of this form and how to file it, check out our detailed guide: Everything You Need to Know About the W-8 BEN Form.

By understanding the differences between 1099-NEC and 1099-MISC, your business can ensure accurate tax reporting and meet filing deadlines with confidence.

Why should you not worry about the 1099 forms when you partner with Global Squirrels?

Global Squirrels is a staffing and payrolling platform that allows you to hire and manage your employees efficiently and effectively. This is possible with the help of our solutions that allow you to hire top talent and manage them with the help of our administrative functions such as performance management, payroll setup, benefits administration, task & timesheet management, compliance with local & international labor & tax laws, and generate offer letters. By partnering with us, our platform will act as the legal employer of your hired global talent, and will ensure to collect the forms from all your workers. Thus, you will not have to worry about 1099 MISC or 1099 NEC, as our platform will handle all your HR functions effectively. By having these documents, you can safeguard yourself against any hefty penalties due to non-compliance.

Global Squirrels has two hiring plans that can serve as the EOR for your business: Orange and Purple freelancer plans.

If you are a business that has already sourced candidates, you can consider our freelancer Purple Plan. From the get-go, our platform handles all administrative tasks, such as performance tracking, freelancer payments, performance management, task and timesheet oversight, and adherence to local and international labor and tax regulations.

The Orange Freelancer Plan takes it a step further by finding and hiring freelancers who fit your business needs precisely. To start, just sign up and pick the Orange Plan. You will be asked to fill in important things like job title and job description. Then, you will state the educational qualifications one would require, the required and desired skills, and the country from which one would hire. After submission, you will get pre-screened, background-verified candidate profiles within 2 – 5 business days. Once you have narrowed down the candidates and picked out whom you think would suit you best, our platform will take care of all your above-listed HR duties.

Do you want to eliminate the worry of the 1099 forms? Get a demo today!