Differences Between Independent Contractors and Employees

In today’s ever-evolving workforce, understanding the differences between contractor and employee is crucial for both employers and workers. While both play significant roles in various industries, it is important to recognize the legal and practical differences that exist between these two classifications.

In this article, we will delve into the differences between contractor and employee to provide a comprehensive understanding of their unique characteristics and implications.

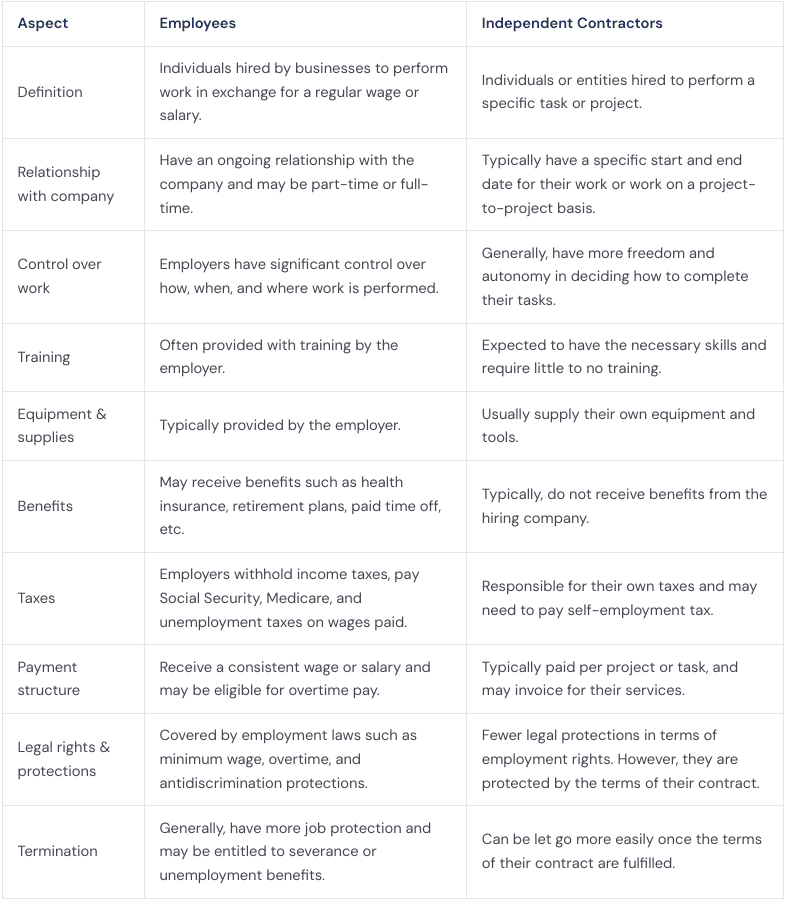

Table: Independent contractors vs employees

Also read: Employer of Record vs Staffing Agency

Conclusion

In the modern workforce landscape, employers often grapple with the decision of whether to classify a worker as an employee or independent contractor. Employees typically operate under structured supervision and benefit from protections and entitlements offered by their employers.

On the other hand, independent contractors enjoy a heightened sense of autonomy, flexibility, and potential financial independence. Accurate classification is paramount, not just for legal compliance but also for the smooth functioning of organizational dynamics.

For workers, discerning whether they hold the status of an employee or independent contractor proves crucial, as this classification entails significant implications for their rights and duties. By recognizing and respecting these distinctions, both employers and workers pave the way for a more equitable, transparent, and legally compliant working environment.