How to Hire an Accountant for Your Business

How to Hire an Accountant

1. Assess Your Business Needs Before You Hire an Accountant

Before you begin the hiring process, it’s essential to assess your business needs. Consider the size of your company, the complexity of your financial transactions, and the specific services you require from an accountant. This assessment will help you determine whether you need a full-time, part-time, or outsourced accountant. Additionally, ensure you comply with relevant financial regulations, such as IRS reporting requirements for U.S. businesses or IFRS standards for international operations.

2. Understand the Different Types of Accountants

Accounting is a diverse field, and accountants can specialize in various areas such as tax accounting, forensic accounting, audit, or general accounting. Understanding the different types of accountants will help you identify the specific skills and expertise required for your business. Common designations include Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Chartered Global Management Accountant (CGMA).

3. Determine Your Budget to Hire an Accountant

Establishing a budget for accounting services is crucial. Determine how much you are willing to invest in accounting services and whether you can afford a full-time, in-house accountant or if outsourcing is a more cost-effective option. Keep in mind that the cost of hiring an accountant can vary based on factors like experience, location, and the complexity of the work. According to the U.S. Bureau of Labor Statistics, the median annual wage for accountants is around $78,000, while freelance accountants may charge between $50 and $150 per hour.

4. Look for Relevant Qualifications and Verify Credentials

When reviewing potential candidates, focus on their qualifications and credentials. A CPA designation is often considered a gold standard in the accounting profession, as it signifies a high level of expertise and adherence to ethical standards. Additionally, check for relevant education, certifications, and experience that align with your business needs. Verify their credentials through regulatory bodies such as the American Institute of Certified Public Accountants (AICPA) or your country’s equivalent.

5. Experience Matters: Assess Track Record and Industry Knowledge

Experience is a key factor when hiring an accountant. Look for candidates who have a proven track record in handling accounting tasks similar to those your business requires. Experienced accountants are more likely to navigate complex financial situations, offer strategic advice, and identify potential issues before they become major problems. Also, hiring an accountant with industry-specific knowledge can be advantageous. For example, a retail business may require an accountant well-versed in inventory management, while a tech startup may need expertise in R&D tax credits.

6. Assess Technological Proficiency in Accounting Software

In today’s digital age, accountants must be proficient in accounting software and other financial tools. Assess the candidate’s familiarity with popular accounting software such as QuickBooks, Xero, or Sage. Additionally, knowledge of AI-powered financial tools and automation software like NetSuite or FreshBooks can be beneficial for streamlining financial processes, improving accuracy, and ensuring compliance with evolving tax regulations.

7. Evaluate Communication Skills for Effective Collaboration

Effective communication is paramount in the accounting profession. Your accountant should be able to explain complex financial concepts in a clear and understandable manner. Assess the candidate’s communication skills during the interview process, as this will be essential for collaboration with other team members and stakeholders. Some red flags to watch for include vague explanations, reluctance to answer questions, or overuse of technical jargon without clear explanations.

8. Check References to Ensure Reliability and Work Ethic

Before making a final decision, thoroughly check the candidate’s references. Contact previous employers, clients, or colleagues to gain insights into the candidate’s work ethic, reliability, and overall performance. References provide valuable information that may not be apparent from a resume or interview alone. Asking specific questions about the accountant’s accuracy, responsiveness, and ability to meet deadlines can help you make an informed hiring decision.

9. Consider Cultural Fit for Seamless Integration

Consider the cultural fit of the accountant within your organization. A good fit involves alignment with your company’s values, work culture, and overall environment. An accountant who integrates seamlessly into your team is more likely to contribute positively to the company’s success. If you are hiring remotely, ensure that they can adapt to your company’s communication and workflow processes.Looking to streamline your financial operations? Discover how you can hire offshore accountants for cost-effective and expert financial management.”

Mistakes to Avoid When Hiring an Accountant

- Hiring without verifying credentials – Always check for CPA or equivalent certifications.

- Choosing cost over expertise – A lower fee may come at the cost of inexperience.

- Not assessing industry-specific experience – Ensure the accountant understands your sector.

- Failing to check references – Past clients can provide crucial insights into work quality.

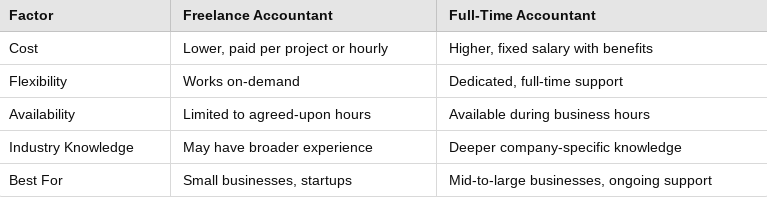

Freelance vs. Full-Time Accountant: Which One Should You Hire?

Businesses exploring global finance talent often compare hiring destinations. If you’re looking to hire accountants from India, this guide explains the benefits, costs, and hiring process. Similarly, companies planning to hire accountants from the Philippines can learn how to build reliable offshore accounting teams and scale financial operations efficiently.

How Much Does It Cost to Hire an Accountant?

The cost of hiring an accountant varies based on experience, location, and scope of services. According to AICPA, accountants charge anywhere from $50 to $150 per hour, while full-time accountants earn between $50,000 and $100,000 annually. Factors affecting the cost include:

- Complexity of work – Basic bookkeeping costs less than forensic accounting.

- Industry specialization – Niche industries may require higher expertise and fees.

- Geographical location – Urban areas often have higher accounting rates.

It’s crucial for businesses to weigh the cost against the value an accountant brings, considering the potential for improved financial management, compliance, and strategic decision-making.

Conclusion

Hiring the right accountant is a critical decision that can significantly impact the financial health and success of your business. By carefully assessing your needs, understanding the qualifications and experience required, and conducting a thorough evaluation of candidates, you can hire an accountant who not only meets your business requirements but also contributes to its long-term growth and prosperity.

Global Squirrels: Your Partner in Hiring Expert Accountants

As you embark on this crucial journey, consider exploring Global Squirrels, our innovative platform designed to simplify the process of finding, hiring, and managing payroll for highly skilled accountants worldwide. We offer both freelance and full-time accounting professionals, ensuring you find the right fit for your business. Our platform provides affordability, starting at just $199 per month per employee, making high-quality accounting expertise accessible to businesses of all sizes.With a user-friendly interface and cutting-edge features, Global Squirrels stands out in the international recruitment market, providing a seamless and efficient solution for all your accounting needs. Schedule a demo today and elevate your business with top-tier accounting talent globally.