Texas payroll taxes explained: 2025 rates, deadlines & filing guide

Handling payroll taxes in Texas might not be the most exciting part of running your business, but getting it wrong can cost you time and money. From understanding tax types to ensuring compliance, staying on top of payroll obligations is crucial.This guide will walk you through everything you need to know about calculating, filing, and submitting your payroll taxes in Texas. You’ll also learn how to avoid penalties, stay compliant with Texas employment laws, and simplify the entire process.

We will go through the essentials and begin by defining what payroll tax is and what its purpose is. You will learn how to calculate withholdings, file taxes for unemployment insurance, and know what deadlines to pay attention to. We will also explore the method for submitting your Texas payroll taxes and highlight the consequences of non-compliance. We will also provide a solution to eradicate errors and simplify your payroll tax management. Ready to simplify your process and ensure compliance with employment laws in Texas? Let us dive in!

If you’re expanding into Texas or other U.S. states without setting up your own U.S. entity, an Employer of Record in the USA can hire employees on your behalf and manage payroll tax compliance across states.

What is payroll tax?

Payroll tax in Texas plays a crucial role in funding essential programs like Social Security, Medicare, and unemployment benefits. If you operate in the state, navigating payroll taxes in Texas requires an understanding of the components, payment responsibilities, and compliance with relevant laws, including employment laws in Texas.

Components of payroll taxes

Federal, state, and local income taxes, as well as Federal Insurance Contributions Act (FICA) taxes for Social Security (12.4%) and Medicare (2.9%), total 15.3% of payroll taxes. This is an equal responsibility of you and your employees. In addition, you are also obliged to pay federal and state unemployment taxes. While there is no state income tax, payroll taxes in Texas contribute to funding critical services, such as healthcare, public infrastructure, and workers’ compensation.

Payment responsibility

Payroll taxes are withheld from employee earnings and are paid over to the appropriate agencies by you. They also bear their share of FICA taxes and unemployment taxes, ensuring timely payments to avoid penalties and compliance risks.

Compliance with employment laws

Adhering to employment laws in Texas is essential to avoid legal complications. These laws ensure that you pay fair wages, pay on time, and withhold correctly, promoting the business to operate smoothly and meet federal and state requirements.

What is the purpose of filing payroll taxes?

Payroll taxes in Texas are essential contributions levied by federal, state, and local governments on both you and your employees. These are taxes paid by employees, expressed as a percent of what an employee makes in wages or salary, but they are by far the most important part of funding efforts to fund things that public services would otherwise not be possible. You must stay informed about payroll tax in Texas, which is key to ensuring compliance with employment laws while supporting community welfare.

Funding social insurance programs

A significant portion of payroll taxes finances essential social insurance programs like Social Security and Medicare. However, these programs offer financial aid to retirees, persons with disabilities, and other such people who are greatly in need of it to survive economically.

Supporting unemployment programs

The unemployment insurance programs provided by payroll taxes give temporary financial help to workers who have lost their jobs. Stability during times of economic uncertainty would be highly dependent on this support.

Funding essential services

Payroll taxes in Texas are vital for funding services such as healthcare, public transportation, and policing. They also contribute to infrastructure projects that benefit businesses and residents alike.

How Employer Experience Affects Your Tax Rate

In Texas, the unemployment insurance tax rate is not fixed for every employer. The employer’s experience rating plays a major role in determining the tax rate. This rating is based on:

- How frequently your former employees file unemployment claims

- The total benefits paid to former employees

- Your consistency in timely tax payments

Employers with fewer claims and consistent compliance may receive lower tax rates, while businesses with high claims history may face higher rates.

Streamline your payroll compliance with Global Squirrels!

Global Squirrels simplifies payroll processes, from tax withholdings to unemployment contributions, and complies with all payroll taxes in Texas.

Request a demoHow to calculate payroll tax withholdings?

To calculate payroll taxes in Texas, it is necessary to undertake several steps to comply with Texas and federal regulations. Start by obtaining employee information through Form W-4 for federal income tax withholding. The next step is to calculate gross pay, paying wages, overtime, and bonuses, and to pay the FICA taxes – 6.2% for Social Security (up to the wage base limit) and 1.45% for Medicare, plus 0.9% for higher payers.

Paying unemployment insurance

State unemployment insurance (UI) taxes are paid by employers in Texas to provide unemployment benefits to qualified workers. First, register with the Texas Workforce Commission (TWC) and obtain a TWC Tax Account Number. After registration, you can file quarterly wage reports and pay UI tax through the Unemployment Tax Services (UTS) system sponsored by TWC. The UTS platform allows you to send payments to bank accounts for free through Automated Clearing House (ACH) debit payments. Alternatively, you can pay by using credit cards. However, charges may be involved. Texas requires UI taxes to be filed and paid electronically, and failing to do so may result in penalties. You must refer to the TWC’s official resources for detailed instructions on registration, filing, and payment processes.

Breakdown of Texas Unemployment Insurance (UI) Tax Rates

| Component | Description |

| General Tax Rate (GTR) | Based on the employer’s claims history and business type. |

| Replenishment Tax Rate (RTR) | Used to replenish the UI trust fund when standard contributions fall short. |

| Obligation Assessment Rate (OA) | Covers bonds issued to repay federal loans for UI benefits. |

| Deficit Tax Rate (DTR) | Applied if the trust fund balance is too low. |

| Employment Training Investment Assessment (ETIA) | Used to fund job training initiatives. |

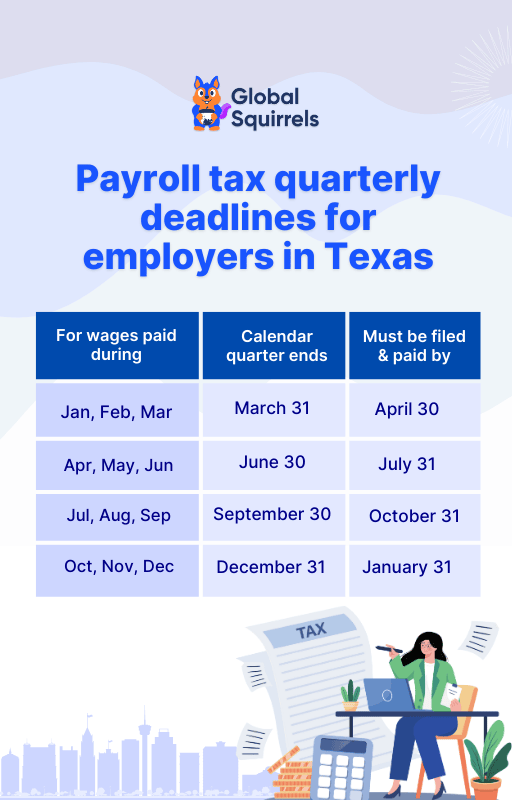

Payroll tax due dates for employers in Texas

When managing payroll tax in Texas, employers must adhere to quarterly deadlines for reporting wages and paying unemployment insurance taxes to the Texas Workforce Commission (TWC). For 2025, these deadlines are April 30, July 31, and October 31. To ensure compliance with payroll taxes in Texas, you are required to remit. These dates are critical under Texas payroll tax regulations to avoid penalties and interest for late submissions. In line with employment laws in Texas, most businesses are encouraged to use the TWC’s Unemployment Tax Services for electronic filing and payments, ensuring seamless and timely compliance with tax obligations.

How to submit payroll taxes in Texas?

In Texas, employers are required to submit payroll taxes, specifically the state unemployment insurance (UI) tax, to the Texas Workforce Commission (TWC) on a quarterly basis. To do this, you must first register your business with the TWC to obtain a TWC Tax Account Number. Once registered, you can file your Employer’s Quarterly Report (Form C-3) electronically through the TWC’s Unemployment Tax Services (UTS) system. The UTS platform allows you to file wage reports, make tax payments via Automated Clearing House (ACH) debit or credit card, and manage your account details. It is essential to adhere to the quarterly filing deadlines of April 30, July 31, October 31, and January 31 every year to avoid penalties. Staying compliant with these requirements ensures adherence to employment laws in Texas and helps maintain your business’s good standing.

Filing Options for Texas Payroll Taxes

The Texas Workforce Commission offers several electronic filing methods for submitting unemployment insurance tax reports:

- Unemployment Tax Services (UTS): The most commonly used platform. Submit reports, make payments, and manage your account online.

- QuickFile: A downloadable wage reporting software for employers or third-party providers.

- Intuit EasyACCT: For employers already using Intuit’s payroll/accounting tools.

- Hardship Waiver: Employers without internet access may request a hardship waiver to file by mail. Mail filings are only allowed upon waiver approval.

Consequences of not complying with Payroll taxes in Texas

Failing to comply with payroll tax in Texas can have severe consequences for businesses, including financial penalties and legal repercussions. The Texas Comptroller imposes a 5% penalty for payments made 1-30 days late, increasing to 10% for payments over 30 days late, with additional penalties for extended delays. Non-compliance with Texas payroll taxes can also result in liens, asset seizures, suspension of permits or licenses, and even criminal charges. At the federal level, the IRS enforces strict penalties for unpaid employment taxes, which can range from fines to prosecution. Adhering to employment laws in Texas and meeting payroll tax obligations is essential to avoid costly penalties, maintain compliance, and ensure smooth business operations.

Eliminate Payroll Compliance Risks with Global Squirrels

Global Squirrels simplifies staffing and payroll by automating HR functions like payroll, timesheet setup, performance tracking, and benefits administration. Our staffing platform ensures full compliance with labor and tax laws through centralized payroll processing and accurate statutory deductions. Choose from our Orange, Purple, Blue hiring plans to navigate local compliance with ease. Whether it’s calculating salaries, managing taxes, or avoiding misclassification risks, our tools keep your business audit-ready. Streamline approvals, track tasks, and stay compliant — all from one secure dashboard.

Let us help you ease your administrative burdens so you can focus on scaling your business! Request a demo!

Frequently Asked Questions about Texas Payroll Taxes

What payroll taxes do employers pay in Texas?

Texas employers pay federal payroll taxes (FICA, FUTA) and state unemployment tax (SUTA), but no state income tax is required.

Does Texas have state payroll tax?

Texas does not have a state income tax, but employers must pay state unemployment insurance (UI) tax to the Texas Workforce Commission.

How much is the payroll tax rate in Texas for employers?

New Texas employers typically pay 2.7% on the first $9,000 in wages, with rates adjusted annually based on experience.

When are Texas payroll taxes due each quarter?

Quarterly payroll taxes in Texas are due on April 30, July 31, October 31, and January 31.

How do employers file and pay payroll taxes in Texas?

Employers must register with the Texas Workforce Commission and file taxes electronically via the Unemployment Tax Services (UTS) system.