Florida Payroll Tax: Compliance, Requirements & Deadlines

Navigating the complexities of payroll taxes in Florida can be a daunting task for any business, especially with its unique regulations. Understanding what Florida payroll taxes are, their purpose, and how to accurately calculate and submit them is crucial for staying compliant and avoiding penalties.

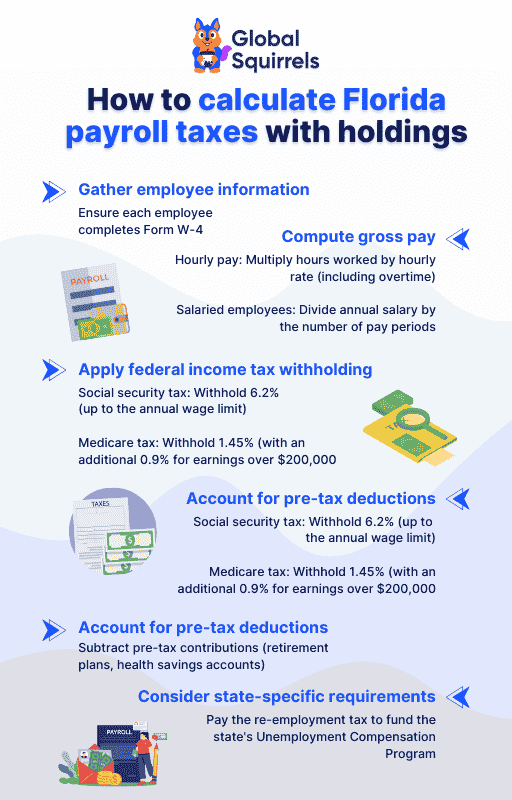

This blog post will serve as your comprehensive guide to payroll taxes in Florida, which you need to address, covering everything from calculating withholdings and paying unemployment insurance to important deadlines and submission methods. We will also delve into the potential consequences of non-compliance with Florida state payroll tax, ensuring you are well-informed and equipped to handle your payroll tax obligation. Finally, we will look at how Global Squirrels can help streamline your payroll process and ensure continued compliance with Florida payroll tax.

If your business doesn’t have a legal entity in the U.S. but wants to hire employees and manage payroll in compliance, an Employer of Record in the USA can handle all employment, tax, and compliance responsibilities on your behalf.

What is payroll tax?

Payroll tax is a mandatory contribution that both you and your employees must pay to federal, state, and sometimes local governments to fund essential programs like Social Security, Medicare, and unemployment insurance. When it comes to payroll taxes in Florida, businesses benefit from the absence of a state income tax, but they must still comply with federal payroll tax requirements and Florida state payroll tax obligations, such as unemployment insurance (SUTA). Like payroll tax in Texas, Florida tax laws follow a similar structure, where you handle payroll taxes but do not deduct state income tax from employees’ wages. Whether managing Florida payroll taxes or handling payroll in Texas, staying informed about payroll tax laws is essential for smooth business operations.

What is the purpose of payroll taxes?

Payroll taxes play a crucial role in funding essential public programs that benefit both employees and society. Payroll taxes in Florida contribute to federal programs such as Social Security and Medicare, ensuring financial security for retirees and disabled individuals. Since Florida does not have a state income tax, businesses primarily focus on federal payroll tax obligations and Florida state payroll tax for unemployment insurance (SUTA). These taxes ensure funding for healthcare, public infrastructure, and unemployment benefits, making compliance essential for your business. Understanding and managing Florida payroll taxes properly helps businesses avoid penalties while fulfilling their financial responsibilities toward their employees and the broader economy.

Meanwhile, you must account for state-specific payroll tax obligations if your business operates in multiple states, such as Florida and Pennsylvania. Payroll tax in Pennsylvania includes state income tax and local tax, which differ from Florida, where there is no state income tax. Managing payroll taxes across different states can be complex, but ensuring compliance is crucial to avoiding financial and legal risks.

Simplify payroll compliance with Global Squirrels!

Facing difficulty managing payroll taxes in Florida? Global Squirrels’ payroll platform ensures seamless tax calculations, withholdings, and compliance with all local, state, and federal regulations. Experience hassle-free payroll management!

Paying unemployment insurance

In Florida, unemployment insurance is funded through your contributions rather than deductions from employee wages. Your company is required to pay the Florida Reemployment Tax, administered by the Florida Department of Revenue, to support the state’s Reemployment Assistance Program. Businesses that meet certain payroll thresholds—such as having a quarterly payroll of $1,500 or more or employing at least one worker for 20 weeks in a calendar year—must pay this tax. New employers typically start with a 2.7% tax rate on the first $7,000 of each employee’s wages, though this rate may adjust based on their layoff history. Unlike many other states, Florida does not impose a state income tax, meaning there is no direct state payroll tax on employee wages. You must file quarterly reports and payments to remain compliant, as failure to do so can result in penalties and interest charges.

How to submit payroll taxes in Florida?

To submit payroll taxes in Florida, you must register for a Reemployment (unemployment) Tax Account with the Florida Department of Revenue (FDOR) using the Florida Business Tax Application. Since there is no Florida state payroll tax on wages, you must primarily need to file and pay Florida payroll taxes related to reemployment tax (unemployment insurance). Your business must file Form RT-6 (Employer’s Quarterly Report) at the end of each month following the end of a quarter, even if no wages were paid. Payments can be submitted electronically through the FDOR Reemployment Tax Website. The first $7,000 of wages per employee is taxable each year, and timely reporting is essential to avoid penalties. Government agencies can choose between tax-paying and reimbursement methods for unemployment insurance costs. While Florida payroll taxes do not include state income tax, compliance with federal payroll tax requirements is necessary.

What are the due dates for paying the payroll tax in Florida?

You must file Form 941 (Employer’s Quarterly Federal Tax Return) to report wages paid and employment taxes withheld. The due dates are:

April 30 – Covers wages paid in January, February, and March

July 31 – Covers wages paid in April, May, and June

October 31 – Covers wages paid in July, August, and September

January 31 (following year) – Covers wages paid in October, November, and December

Consequences of not complying with Payroll taxes in Florida

Failing to comply with payroll taxes in Florida can lead to severe financial penalties and legal action from the Florida Department of Revenue (FDOR) and the IRS. You must ensure timely filing and payment of Florida payroll taxes, including reemployment tax (unemployment insurance), or risk significant consequences.

-

Fines and penalties

-

-

- The IRS can impose penalties of up to 15% on late payroll tax deposits.

- Failure to file Form RT-6 (Florida Employer’s Quarterly Report) on time can result in a 10% penalty, plus 1% per month of delay, up to a maximum of 25%.

- Unpaid Federal Unemployment Tax (FUTA) can accrue interest at 3% to 6% annually.

-

-

Legal action and civil lawsuits

-

-

- The IRS aggressively collects unpaid employment taxes, which accounted for nearly 70% of all IRS revenue in recent years.

- As of June 30, 2016, more than $59.4 billion of reported payroll taxes remained unpaid nationwide.

- The Trust Fund Recovery Penalty (TFRP) allows the IRS to hold individuals personally liable for unpaid payroll taxes.

-

-

Criminal charges and prison time

-

-

- Willful failure to remit payroll taxes can result in felony charges punishable by up to 5 years in prison and fines of up to $250,000 for individuals or $500,000 for corporations.

- Payroll tax fraud cases contribute to an estimated $91 billion tax gap, with $79 billion remaining unpaid after collection efforts.

-

-

Business closure and asset seizure

-

-

- The FDOR and IRS can seize business assets, freeze bank accounts, and revoke business licenses for nonpayment of Florida payroll taxes.

- The IRS issues thousands of levies each year, seizing assets from businesses that fail to pay employment taxes.

-

- Personal liability and bankruptcy risks

-

- Under Trust Fund Recovery Penalties (TFRP), individuals—including business owners, CFOs, and payroll managers—can be held personally responsible for unpaid employment taxes.

- Personal assets, including bank accounts, homes, and investments, may be at risk.

- Payroll tax debts are not dischargeable in bankruptcy, meaning business owners may still owe even after declaring bankruptcy.

Global Squirrels: Stay compliant with all Florida payroll tax laws with our Purple Plan

Global Squirrels is a staffing and payroll platform that helps you hire and manage your employees effectively. Our Purple Plan is specifically designed to make it simpler for you to carry out your payroll and other HR-related functions so that you can focus on growing your business effectively.

Under this plan, our platform simplifies local compliance by ensuring your business adheres to all labor, payroll, and tax regulations, minimizing risks and penalties. From calculating employee salaries and managing statutory deductions to ensuring compliance with employment laws, we handle every aspect with precision and efficiency. Our payments and tax solution processes salaries accurately, aligns taxes with local regulations, and guarantees timely statutory deductions.

Our platform also handles other important areas, such as mitigating risks related to employee misclassification to keep your business audit-ready. Automated payroll processing ensures error-free calculations, enabling seamless payroll management through a secure dashboard, while our attendance and timesheet management system streamlines tracking, approvals, and compliance with labor laws and company policies.

So, how does the Purple Plan work?

You can onboard your already-sourced candidate or convert your current freelancer into a full-time employee. After signing up or logging in, select the Purple plan and enter details about your candidate, including their full name, email address, job title, job duties, expected start date, and any necessary onboarding documents. Our platform will start their onboarding process and manage all HR functions seamlessly. Sign up and get started!