W-9 vs 1099 forms: get to know the differences between them

Are you a business owner in the USA looking to streamline your contractor management and ensure bulletproof tax compliance? Understanding the difference between the W-9 vs 1099 forms is a foundational step. While both relate to non-employee payments, the W-9 serves as your tool for collecting necessary tax information, while the 1099 is the document you will issue to report those payments. This blog will provide a practical guide to these essential forms, clarifying who is responsible for each, the specific scenarios for their use, and the real-world impact of failing to adhere to IRS regulations. Let us clarify the W-9 vs 1099 to optimize your processes and protect your bottom line.

What is a W-9 form?

The W-9, officially titled “Request for Taxpayer Identification Number and Certification,” is an Internal Revenue Service (IRS) form used in the United States. Its primary purpose is for businesses and other entities (the payer) to collect essential information from individuals and entities (the payee) they are paying as non-employees. Below is a sample picture of a W-9 form.

Who needs to fill out the W-9 form?

– Independent contractors

– Freelancers

– Self-employed individuals

– Vendors and suppliers (who are not incorporated in some cases)

When to fill out a W-9 form?

– Payments for services: When you pay an independent contractor or freelancer more than $600 in a year.

– Financial transactions: Dividend, interest income, or proceeds from real estate sales.

– Debt cancellation: To report forgiven debts for tax purposes.

What are the consequences of not obtaining the W-9 form?

The consequences of not obtaining a W-9 form from individuals or entities you pay as non-employees can be significant for your business (the payer):

- Backup withholding liability: If you fail to obtain a correct Taxpayer Identification Number (TIN) from the payee, you are legally required by the IRS to perform backup withholding on payments made to them. The current backup withholding rate is 24% (for 2024 and 2025). This means you must withhold this portion of their payment and remit it directly to the IRS.

- Penalties from the IRS: The IRS can impose penalties for failing to file correct information returns (Form 1099) that include the payee’s correct TIN. If you don’t have a W-9, you’re likely to file a 1099 with a missing or incorrect TIN, leading to penalties. For returns due in 2025, these penalties can range from $60 to $330 per form, depending on how late the filing is. For intentional disregard, the penalty is significantly higher ($660 per form).

- Disallowed business expenses: During an IRS audit, if you cannot demonstrate that you made reasonable attempts to obtain a W-9 and correctly report payments on Form 1099, the IRS may disallow the deductions you took for those payments. This increases your taxable income and overall tax liability.

- Increased audit risk: Failure to comply with information reporting requirements, such as obtaining W-9s and filing 1099s, can increase your business’s risk of being audited by the IRS.

- Administrative burden: Trying to rectify issues related to missing W-9 forms after payments have been made can create a significant administrative burden for your business. It involves contacting payees multiple times, potentially dealing with non-responsive individuals, and trying to reconstruct the necessary information.

What is the 1099 form?

1099 is a series of tax forms used in the United States to report various types of non-employee income. Unlike the W-2 form, which is issued to employees, the 1099 form is issued by the payer (you) to independent contractors, freelancers, and other non-employees who receive payments from the business or entity.

The 1099 form is the preferred way to document income received by individuals or entities other than their employer. Non-employment income can include payments for services rendered, interest income, dividends, and so forth.

By the deadlines set by the Internal Revenue Service (IRS), the payer (the party who pays) is responsible for filling out this form and sending copies to the recipient and the IRS by January 31 of the following year.

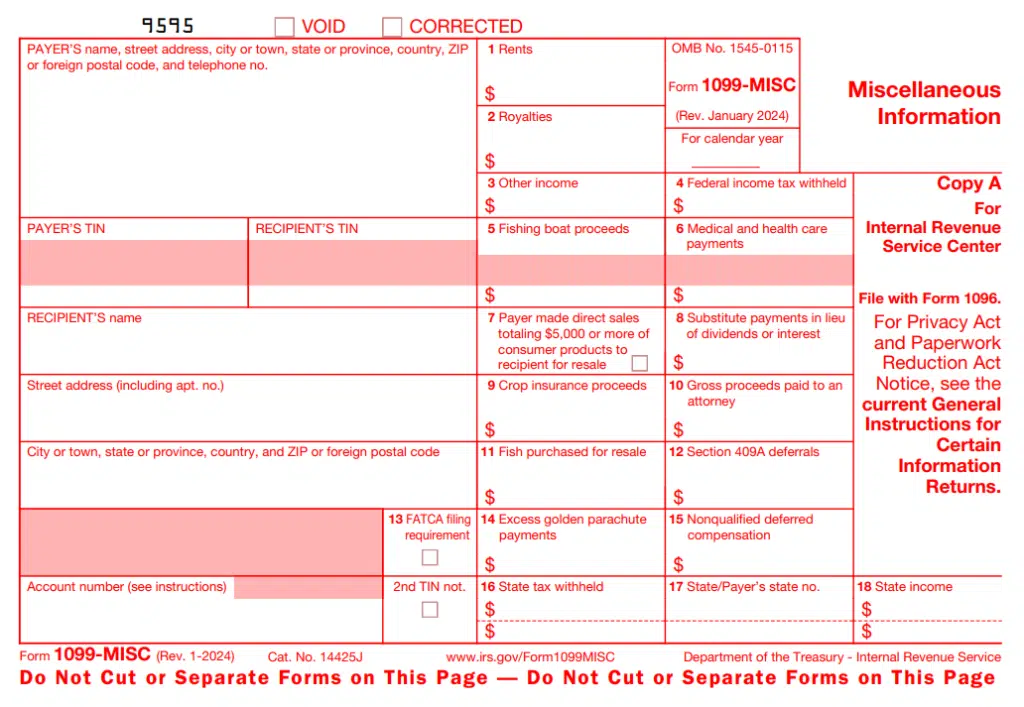

Below is a sample picture of the 1099-MISC form.

Source: IRS

What are the different types of 1099 forms issued?

- Form 1099-A: Usually reports the acquisition or abandonment of secured property in the context of a foreclosure situation.

- Form 1099-B: Used to report proceeds from broker and barter exchange transactions, including sales of stocks and commodities.

- Form 1099-C: This form is issued if a lender forgives a debt of $600 or more.

- Form 1099-CAP: It provides reports of changes in corporate control and capital structure that are material to shareholders as a result of significant company changes.

- Form 1099-DIV: It is used for reporting dividends and distributions received from investments such as stock or a mutual fund.

- Form 1099-G: It reports on certain payments from the government, such as unemployment compensation and state tax refunds.

- Form 1099-INT: It is issued for income earned from bank accounts or other financial institutions.

- Form 1099-K: Businesses receiving payments through platforms like PayPal use this to report payment card and third-party network transactions.

- Form 1099-LTC: It reported receiving reports of long-term care and accelerated death benefits.

- Form 1099-MISC: Specific form for miscellaneous income not covered by other specific forms, such as rents, prizes, or awards.

Who receives the 1099 form?

If you work with independent contractors or freelancers, ensure to issue the Form 1099-NEC when they earn $600 or more in a year. This also includes payments for services provided, such as freelance work or consulting.

When to issue the 1099 form?

- By January 31 of the year after the year in which the income was earned, most 1099 forms must be sent to recipients. The deadline is pushed back to the following business day if this date occurs on a weekend.

- Many 1099 forms, such as the 1099-S, have a due date of February 15.

- These forms also must be submitted by payers to the IRS, generally by the end of February for paper filings and March 31 for electronic filings.

What are the consequences of not issuing the 1099 forms?

- Penalties from the IRS for incorrect or late filing of 1099s: The IRS imposes penalties for failing to file correct information returns (Form 1099) by the due date, failing to include all required information, or filing with incorrect information. These penalties vary based on how late the filing is and the size of the business.

- Backup withholding: If the payer is required to perform backup withholding due to a missing or incorrect W-9 and fails to do so, they could be liable for the uncollected tax.

- Disallowed business expenses: If the IRS audits a business and finds that it should have issued 1099 forms but didn’t, they may disallow the deductions for those payments, increasing the business’s taxable income and tax liability.

- Increased audit risk: Failure to comply with information reporting requirements can increase the risk of an IRS audit.

- Civil and criminal penalties: In cases of intentional disregard of the filing requirements or misuse of Taxpayer Identification Numbers (TINs) obtained from Form W-9, both civil and criminal penalties can apply.

Related read: Everything you need to know about the W-8 BEN form

How Global Squirrels can help you stay compliant and avoid IRS penalties

As Global Squirrels, a staffing and payrolling platform, we are specifically designed to help businesses like yours in the USA stay compliant with IRS regulations and avoid penalties, particularly when it comes to managing your workforce, including both employees and freelancers. Global Squirrels will act as the legal employer of your hired talent (employees, independent contractors, and freelancers), and handle all employer obligations, ensuring zero risks to your business.

Here’s how our Orange Employee and Purple Freelancer Plans help you achieve this:

Orange Employee Plan:

- Accurate payroll processing: Global Squirrels ensures precise calculation of wages, deductions (federal, state, and local taxes, benefits), and timely payments to your employees. This minimizes errors that could lead to IRS issues.

- Proper tax withholding: Our platform accurately withholds the correct amounts for income tax, Social Security, and Medicare taxes from your employees’ paychecks.

- W-2 management: The platform can handle the generation and distribution of accurate W-2 forms to your employees and file the necessary W-2 information with the Social Security Administration (SSA) and the IRS by the required deadlines.

Purple Freelancer Plan:

- Proper worker classification: Global Squirrels ensures the individuals you onboard as freelancers meet the IRS criteria for independent contractor status, minimizing the risk of misclassification penalties.

- W-9 collection and management: Our onboarding process for freelancers includes the secure collection of their W-9 forms. We ensure you have the necessary Taxpayer Identification Numbers (TINs) and other required information for accurate reporting.

- Accurate payment records: Our platform maintains detailed records of all payments made to freelancers, making the 1099 preparation process efficient and accurate.

How does it work?

The Orange Employee Plan ensures you find and hire talent that meets all your specific requirements. This can be done once you sign up for our platform and choose the Orange plan. After this, fill in details like job title, job description, budget, expected start date, educational background, and skills. Once you submit your request for new resources, you will receive curated profiles within 2 to 5 business days. Select your preferred candidates and choose three interview time slots. After interviewing them, you will receive an email requesting that you provide feedback. Once you have decided on the candidates you wish to hire, our platform will begin the onboarding process and manage all HR functions mentioned above.

The Purple Freelancer Plan, on the other hand, will let you onboard a self-sourced freelancer. Our platform will handle onboarding and all the administrative functions such as freelance contract generation, payment management, task & timesheets, and performance management.

Are you ready to hire & manage your employees and freelancers efficiently? Request a demo!