What is Severance pay? When & why it’s offered

Whether you are the CEO of an enterprise or the hiring manager in a mid-sized startup, you will likely agree that expanding your footprint often means navigating a labyrinth of local labor laws. Among the most crucial factors to consider, and often misunderstood, is severance pay.

Far from a simple handout, severance is a complex financial and legal consideration that can significantly impact your bottom line and reputation. For business leaders, understanding its nuances isn’t just about compliance; it’s a strategic imperative.

You may have long-standing unanswered questions like, “how much is the severance pay in that country?” or “how do I calculate severance pay?”.

This blog will unravel the complexities of severance pay, explaining why it’s offered, when it becomes a legal obligation, and the minimum severance pay across countries. We will also brief the dire consequences of non-compliance and introduce our EOR solution to keep your global operations seamless and legally sound. EORs are crucial when expanding into new international markets.

What is severance pay?

Severance pay is compensation provided to employees who are laid off or terminated. It often includes a lump sum or extended benefits to ease the transition after job loss. For businesses, severance serves several strategic functions:

- Legal de-risking: In many jurisdictions, offering severance is a mandatory legal requirement, especially in cases of redundancy or termination without “just cause.” Adhering to these laws shields your business from costly lawsuits, penalties, and reputational damage.

- Mitigating litigation: Even where not legally mandated, a well-structured severance agreement can include a release of claims. This protects your company from future wrongful termination lawsuits by ensuring the departing employee waives their right to pursue legal action in exchange for the package.

- Preserving employer brand: How you treat departing employees speaks volumes about your company culture. A fair severance process fosters a positive image, crucial for attracting and retaining top talent in a competitive global market.

When is severance pay required?

Severance is most commonly triggered by specific termination scenarios:

- Redundancy/layoffs: When a position is eliminated due to restructuring, downsizing, or economic factors, not poor performance.

- Termination without cause: When an employment relationship is ended without a specific, legally recognized reason (e.g., gross misconduct, repeated performance failures).

- Mutual separation agreements: When both employer and employee agree to part ways, often with negotiated terms including severance.

Generally, severance is not required for voluntary resignations or terminations for “just cause” (as defined by local law), but local nuances and company policies always play a role.

What is the minimum severance pay across countries?

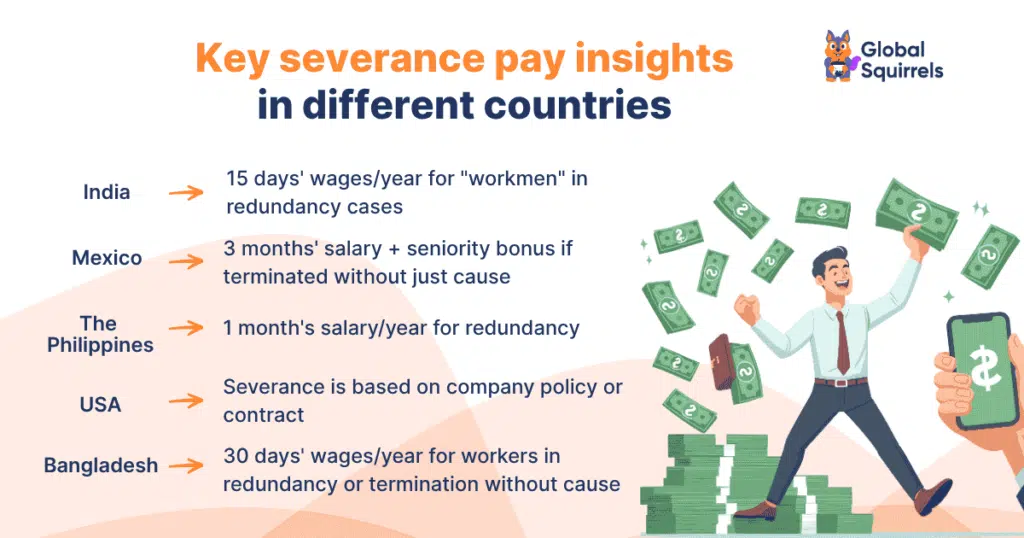

Hiring global talent requires a deep understanding of local labor laws. If you have been wondering, “when is the severance due or how much is the severance pay across different jurisdictions”, here are some examples that will address your queries.

India

In India, retrenchment compensation is primarily governed by the Industrial Disputes Act, 1947.

- Eligibility: Mandatory for “workmen” (non-managerial, non-supervisory roles) with at least one year of continuous service, in cases of redundancy.

- Calculation: Typically 15 days’ wages for each completed year of service (or part exceeding six months).

- Notice period: Generally one month’s notice or pay in lieu for industrial workers. Managerial/executive staff adhere to contractual notice.

See how EORs help navigate employment law in countries like India.

Mexico

Mexico’s Federal Labor Law (FLL) offers robust employee protections, making termination without just cause potentially costly.

- Eligibility: Employees are entitled to severance if terminated without “just cause“ (as defined by the FLL, e.g., gross misconduct). If just cause cannot be proven, it’s considered wrongful termination.

- Calculation (termination without just cause): Includes three months’ salary (Constitutional Indemnification), and a seniority bonus (12 days’ salary per year of service, potentially capped).

- Notice period: No mandated minimum notice; a written notice of termination reasons must be provided immediately.

The Philippines

Severance pay, or “separation pay,” is mandatory for authorized causes of termination in the Philippines.

- Eligibility (authorized causes): Applicable for reasons like redundancy, retrenchment to prevent losses, business closure, installation of labor-saving devices, or incurable employee illness.

- Calculation:

- Redundancy / labor-saving devices: One month’s salary per year of service.

- Retrenchment / business closure (not due to serious losses) / incurable disease: One month’s salary or at least half a month’s salary per year of service, whichever is higher.

- Notice period: 30 days’ written notice to both employee and the Department of Labor and Employment (DOLE) for authorized causes.

USA

You must be wondering, “how much is severance in the US?”. Unlike many nations, the U.S. has no federal law mandating severance pay. It’s largely a matter of company policy or contractual agreement.

- Eligibility: Employers may offer severance for layoffs or terminations without cause, often contingent on the employee signing a release of claims.

- Calculation: Highly variable, often based on years of service (e.g., one or two weeks’ pay per year) or a negotiated flat sum.

- WARN Act: While not severance, the WARN Act requires 60 days’ notice for mass layoffs or plant closings by certain large employers; failure to comply can result in back pay and benefits penalties.

Canada

So, what is the severance pay in Canada?

Severance obligations in Canada vary by federal or provincial labor laws, generally requiring notice or pay in lieu, with additional severance in some cases.

- Federal (Canada Labour Code):

- Notice: Minimum 2 weeks’ written notice (for 3+ months service), up to 8 weeks (for 8+ years service), or pay in lieu.

- Severance pay: For employees with 12+ months service, the greater of 2 days’ wages per year of service or 5 days’ wages, applicable for layoffs or dismissals not for just cause.

- Provincial: Each province has its own rules. For instance, Ontario may require severance for employees with 5+ years of service if the employer’s payroll exceeds $2.5 million or in mass termination scenarios.

Bangladesh

Bangladesh’s Labor Act, 2006, mandates severance pay for “workers.”

- Eligibility: Applies to “workers” with at least one year of continuous service, in cases of retrenchment (redundancy) or employer-initiated termination without cause.

- Calculation: Generally, 30 days’ wages for each completed year of service (or part exceeding six months).

- Notice period: Prescribed notice or pay in lieu (e.g., 120 days for monthly-rated workers terminated without cause).

- Resignation: Even employees who resign after a certain period may be entitled to severance (e.g., 14 days’ wages per year for 1-5 years service, 30 days’ for 5+ years).

What happens when an employer does not comply with severance laws?

Ignoring global severance pay requirements isn’t just risky; it can be catastrophically expensive for your business:

- Escalating legal battles: Unpaid or incorrectly paid severance can trigger costly lawsuits, protracted legal battles, and substantial legal fees, often resulting in far higher payouts than initial compliance would have demanded.

- Heavy fines and penalties: Labor authorities worldwide are increasingly vigilant. Non-compliance can lead to severe statutory fines and penalties that erode your profits.

- Reputational damage: News of unfair employee treatment travels fast. Negative publicity can severely tarnish your employer brand, making it difficult to attract and retain top talent, and even impacting customer perception.

- Employee morale and productivity drop: When your existing workforce witnesses non-compliance or unfair treatment, trust erodes, morale plummets, and productivity often follows suit.

- Reinstatement orders: In some jurisdictions, if a termination is deemed unlawful, courts may order the employee’s reinstatement with full back pay, creating significant operational and financial disruption.

Hire top remote talent while staying 100% compliant with labor laws

The complexities of international severance pay laws are a significant barrier for many businesses aiming for global expansion. Manually navigating these diverse legal landscapes is time-consuming, resource-intensive, and fraught with risk. This is precisely where Global Squirrels steps in as your strategic partner. We are a SaaS staffing and payrolling platform and help companies like yours hire and retain great talent globally/locally by charging just the payroll costs and a flat licensing fee per hire. Yes, with our staffing platform, you no longer have to pay sky-high markups or hidden fees associated with other staffing agencies or BPOs.

Global Squirrels provides comprehensive Employer of Record (EOR) services, transforming global employment from a headache into a competitive advantage. Whether you want to hire talent from India, the Philippines, Mexico, or Bangladesh, we will:

- Ensure 100% legal compliance: As your legal EOR, Global Squirrels assumes responsibility for understanding and adhering to all local labor laws, including the intricate details of severance pay in each country where you operate. This dramatically reduces your legal exposure and risk of non-compliance.

- Simplify international payroll & benefits: Forget the complexities of multi-currency payroll, statutory contributions, and benefits administration. We manage it all, ensuring timely and accurate payouts, including compliant severance.

- Automate your HR-admin tasks: From onboarding and HR administration to offboarding, Global Squirrels handles the operational heavy lifting, freeing your internal teams to focus on strategic growth and core business objectives.

- Help your business mitigate uncertain costs and risks: By guaranteeing compliance with severance laws and implementing robust, legally sound agreements, Global Squirrels acts as your shield against potential disputes, fines, and reputational damage.

We offer three plans designed to cater to the specific needs of your business. For instance, you can choose pricing plans to hire and manage employees or freelancers. On the other hand, if you have already soured a talent, our Purple plan will handle their onboarding, payroll/payments, contract negotiation, offer letter generation, and termination.

Partner with Global Squirrels to confidently navigate the global employment landscape, ensuring seamless operations and unwavering compliance, from hiring to any necessary offboarding.

Have more questions? Click here to schedule a FREE demo!