Employer of Record (EOR) in the Philippines

An Employer of Record (EOR) in the Philippines is your go-to solution for hiring talent without the need to establish an entity in the country. It is a 3rd-party entity that legally hires and onboards talent, manages their payroll, and ensures compliance with the local labor laws and tax regulations.

To staff your open positions, you can leverage Global Squirrels, an employer of record company in the Philippines. We offer a staffing and payrolling platform that makes remote hiring cost-effective and fast. Our platform handles every step of the hiring process from sourcing candidates based on your job and sharing curated profiles in 2-5 business days to scheduling interviews, onboarding your chosen candidates, and managing their HR, payroll, and benefits.

As your EOR, Global Squirrels will assume employer obligations and liabilities. We ensure zero risks to our clients by complying with the employment laws in the Philippines. In addition to this, our staffing and EOR/AOR platform also provides tools to help you manage your remote workforce, such as timesheet and leave management, pay increase, termination, and SquirrelTracker (tracks their time, productivity, and activities).

Global Squirrels also operates as a Professional Employer Organization (PEO) in the Philippines, enabling compliant hiring of professionals without having to set up an entity in the country.

Trusted by growing businesses & enterprises

Recognized for excellence across leading review platforms

EXCELLENTTrustindex verifies that the original source of the review is Google. Working as a VA with Global Squirrels has been a nice experience. They connected me with a client, set clear expectations, and maintain smooth communication. The support team is responsive, and the overall process allows me to focus on delivering quality work. I’d highly recommend Global Squirrels to both clients and VAs.Posted onTrustindex verifies that the original source of the review is Google. I feel confortable working with global squirrels because it is a reliable company and, above all, very punctual with payments. I AM very happy and highly recommended themPosted onTrustindex verifies that the original source of the review is Google. Works well for teams hiring across different countries. Keeps payroll and documentation organized.Posted onTrustindex verifies that the original source of the review is Google. A clean interface and logical flow make it easier to manage international HR needs.Posted onTrustindex verifies that the original source of the review is Google. I value Global Squirrels’ communication and support systems the most. Their transparency, timely updates, and responsiveness make it easy to stay informed and confident at every step. Well-structured processes and efficient coordination create a smooth experience and provide real peace of mind, knowing everything is handled with professionalism and care.Posted onTrustindex verifies that the original source of the review is Google. 5* company, allows me to work fully remote with a good salary, they're professional and very helpful, both for talent and employers. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I’ve been working with Global Squirrels for almost a year and a half, and my experience has been excellent. They are a very professional and well-organized company, and everything has always run smoothly. I’ve never had any inconvenience with the arrangements, and everything is handled on time and as expected. What I appreciate the most is that they are always attentive and available—whenever I have a question or concern, they are quick to respond and resolve it. I’m truly happy I came across such a reliable and professional company. I highly recommend Global Squirrels.Posted onTrustindex verifies that the original source of the review is Google. We’ve been working with this company for several months now, and the experience has been excellent. Their team provides highly efficient, professional, and cost-effective support, which has made a big difference in streamlining our operations. The hiring and onboarding process was smooth, and the staff they provided came with strong healthcare backgrounds and good understanding of medical terminology, which made training much easier. They’ve been reliable, flexible with scheduling, and consistently available during our business hours in the U.S. What I appreciate most is that payroll, hiring, and HR tasks are all managed by their team, which saves our management staff a tremendous amount of time.Posted onTrustindex verifies that the original source of the review is Google. I've been a part of Global Squirrels for more than two years now and my experience is nothing short of phenomenal !!! Services provided by global squirrels have been good. Salaries are credited on time.Posted onTrustindex verifies that the original source of the review is Google. Global squirrel simplify things and made it super easy for me to update the timesheet, In short term (Easy to use platform). The team are highly professional and truly responsible towards the client requirement. I never face any issues or error on , they always keep me updated and answering questions quickly. I appreciate their attention and response which having more details and high level of service. it's a reliable solution that has made day to day process much more efficient. I'm truly happy by experiencing Global squirrel platform. Highly recommended!

Customers

Employees

This platform worked out well for us. Instead of working with agencies we were able to hire resources from Philippines on a long term basis. We are currently paying payroll cost and monthly license fee per employee. The value we seen with this company is they were able to source us curated profiles based on our job needed and pricing is great compared to other EOR platforms.

How it works?

1. Legally hires talent

Our employer of record company in the Philippines can legally hire professionals and ensure their compliance with local laws and regulations.

2. Manage HR-administrative tasks

We handle the administrative duties, allowing you to focus on collaborating with the hired staff to achieve business goals.

3. Compliance management

We will ensure that the offer letters/contracts, payroll, and benefits comply with the Filipino labor laws and regulations.

4. Benefits administration

Our EOR will provide benefits provisions, such as health insurance, leaves, retirement benefits, allowances, and other entitlements as per the law.

Global Squirrels is one of the best EOR service providers in the Philippines. Hire top talent without employer obligations.

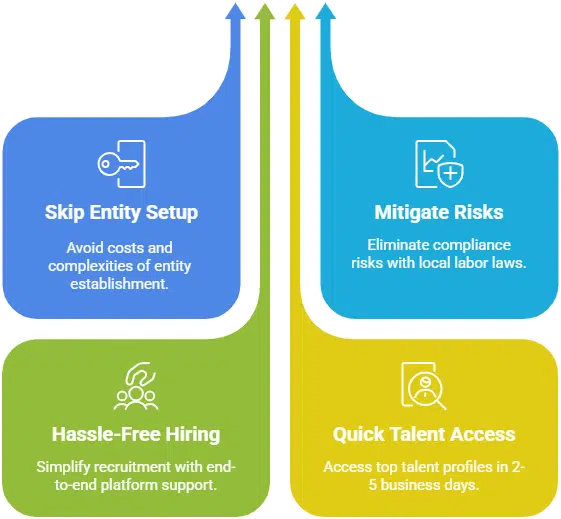

Benefits

- Skip entity setup: You can hire talent without incurring high costs, time, or dealing with complex legal formalities to establish an entity.

- Mitigate risks: An EOR offers zero risks to your business by eliminating the possibility of non-compliance with the local labor and tax laws.

- Hassle-free and quick hiring: Just post your job, and our platform will handle the end-to-end recruitment process to bring top talent to your team.

- Quick access to the best talent: Significantly reduce your time to source candidates. Get curated profiles of top talent within 2-5 business days after posting your job requirements on our platform.

Expand your teams with our Employer of Record services in the Philippines.

Table of Contents

Worker classification in the Philippines

Global Squirrels is a staffing and payrolling platform that can legally hire Filipino talent or onboard your self-sourced contractors while staying compliant with the local laws and regulations. Our employer of record platform offers three hiring plans that cater to the job requirements of businesses. The Orange Plan sources and recruits talent based on your job requirements and manages their AOR/EOR. The Blue Plan offers similar features and allows your hired staff to work from one of our dedicated offices in the Philippines. This plan is suitable for companies that prefer better management and security. If you have already sourced a candidate, you can use our Purple Plan to onboard them. It will also handle offer letter generation/negotiation, payroll/payments, legal compliance, and benefit administration.

Connect with qualified Filipino talent, hassle-free. Global Squirrels manages your payments and compliance for all workers (employees & contractors).

Classifying workers in the Philippines

The Department of Labor and Employment has categorized Filipino employees and contractors quite differently. Classifying them accurately can make a huge difference in smoothly running your global operations and avoiding paying huge fines and penalties. The classifications of workers in the Philippines include:

Full-time employment

In full-time employment, employees usually work 40 hours per week. This is also called regular or permanent employment. These employees will receive a salary that does not change, irrespective of how many hours they work. Additionally, they have access to company benefits ranging from health insurance to sick leave.

Project-based employment

Project-based employment is temporary and attached to the completion of a certain project. This is usually referred to as contract employment. It has a fixed start and end date. In this set-up, there are usually clear tasks which should be completed within an agreed timescale. Again, there is no assurance that there would be more work once it’s complete.

Seasonal employment

This category does not include permanent work. Employers will hire seasonal workers during peak periods throughout the year. Companies might keep these employees as regular seasonal employees, thus giving them fewer hours during the off-season and more hours during the peak season. Workers assist with the greater demand for services and goods.

Fixed-term employment

Fixed-term employment has a start and end date, which is especially mentioned in the employment contract. As a fixed-term employee, you might work anywhere from three months to two years with a company, depending on the staffing needs. This is similar to project-based employment but has a fixed term rather than being project-based. You might be continuously rehired for the same kind of work from the same employer.

Probationary employment

You might have a trial period of a few weeks or a few months in a probationary job. This aids them in assessing your suitability for the position. Often referred to as a six-month probationary period, this is a probationary period that typically lasts no longer than six months. Probationary employment is special since it is not used in every nation. Every nation has different probationary employment laws and regulations.

Penalties for misclassifying workers in the Philippines

Businesses that have misclassified employees in the Philippines tend to face serious financial consequences. Given below are some of the potential costs, fines, and penalties:

- If a worker is terminated, the company will have to do back pay and benefits reimbursement to the employee.

- Court-ordered damages of up to $8,594.9, plus associated attorney fees.

- Separate monetary fines and possible prison sentences for companies that don’t make necessary contributions to entitlement programs such as the Social Security System (SSS), the Home Development Mutual Fund (also known as the Pag-IBIG fund), and the Philippine Health Insurance Corporation (PhilHealth).

- Additional interest fees and fines until the unpaid contributions are settled.

The financial danger is not the only risk. Businesses that are caught misclassifying employees may face further repercussions, including legal challenges, harm to their brand, trouble hiring new employees, a decline in employee morale, and heightened regulatory monitoring.

In order to boost their tax collection, the Bureau of Internal Revenue (BIR) and other Philippine authorities are encouraged to audit and look into companies they believe are misclassifying employees. Since intentional or unintentional misclassification is dangerous and can be highly expensive, it is usually advised for businesses to work with an employer of record company in the Philippines.

Employment agreements/contracts in the Philippines

Global Squirrels auto-generates contracts/offer letters as per local laws for your hired staff in the Philippines. Want to see our platform in action?

The Filipino Labor Code is the general employment legislation of the Philippines. It will regulate the relationship between employees and their employers. This law will apply to every Filipino enterprise and joint ventures. It also includes all the employment relationships between Filipino nationals and foreign enterprises.

There are also various other laws that specify the statutory minimum employment benefits and standards, which an employer must legally comply with. The Philippines Department of Labor and Employment is the main government agency that is responsible for enforcing employment laws within the country.

Types of employment contracts in the Philippines

According to the nature of the job, Filipino employment law recognizes a few categories of employment contracts, which are as follows:

Full-time employment

The most prevalent kind of work contract is a full-time contract. They usually require putting in a set number of hours per week, usually between 35 and 40. Benefits, including health insurance, paid time off, and retirement plans, are typically provided to full-time employees. This kind of agreement provides stability and employment security.

Contract for part-time work

Employees with part-time contracts typically work fewer than 35 hours per week, which is fewer than full-time employees. For people who have other obligations or are looking for a work-life balance, these contracts are perfect. Part-time workers might not, however, be entitled to the same benefits as full-time workers.

Zero-hour contract

There is no minimum number of hours guaranteed by zero-hour contracts. Because workers are brought in as needed, this kind of contract offers a great deal of flexibility. Zero-hour contracts can be quite flexible, but because there are no set work hours, they also lead to financial instability.

Casual contract

Similar to zero-hour contracts, casual contracts are usually utilized for seasonal or short-term work. Workers don’t have a predetermined timetable; they work as needed. This kind of contract is typical in sectors with variable demand, such as retail and hospitality.

Freelance contract

Independent contractors who offer services on a project-by-project basis are covered by freelance contracts. Although freelancers are free to select the projects and clients they work on, they do not have the same perks as full-time or permanent workers. Contracts of this kind are typical in technological and creative domains.

Union contract

A union negotiates union contracts on behalf of a group of workers. The terms of employment, such as pay, benefits, and working conditions, are described in these contracts. Employees may be required to pay union dues, but this provides them with collective negotiating power.

Executive contract

High-level workers like CEOs and senior managers are the target of executive contracts. These agreements frequently contain particulars on pay, bonuses, stock options, and severance benefits. The purpose of executive contracts is to draw in and keep top talent.

At-will contract

AT-will contract will allow both the employer and the employee to end the employment relationship at any time and for any cause (except for unlawful ones). Although this gives freedom, the employee’s job security is also diminished.

Confidentiality and non-compete contracts

These are supplemental agreements that are frequently incorporated into employment contracts in order to safeguard the economic interests of the employer. Confidentiality agreements safeguard sensitive data, while non-compete agreements prohibit workers from working with rival businesses for a predetermined amount of time after leaving the company.

Fixed-term contracts

Contracts with fixed terms have a set duration, after which they expire. These are frequently employed for short-term tasks or to cover for departing staff members. Although they offer flexibility, fixed-term contracts cannot give long-term work stability.

Important components of the employment contracts in the Philippines

An employment contract is an important document that outlines the terms and conditions of the employer-employee relationship in the Philippines. For businesses, especially those working with an EOR company in the Philippines, having a well-structured employment contract is important for compliance with local labor laws.

Job title and responsibilities | It should include the job title, specific task, and expectations, which will ensure that the employee understands the role in the company. |

Working hours | Specify the expected working hours, including the start and end times, breaks, and overtime policies. In the Philippines, the standard working hours are eight per day, with a mandatory one-hour meal break. |

Overtime | Overtime pay is a mandatory payment for work done beyond the usual 8-hour workday, with at least 125% of the regular wage. Additional multipliers will apply for work done on holidays or rest days, and a night shift differential of at least 10% is added for work between 10 p.m. and 6 a.m. However, exemptions exist for certain roles like managers. |

Probation period | A probationary employee’s tenure should be limited to a maximum of six months or 180 days from their start date. During this period, the employer should assess the employees’ standards for the company. |

Anti-discrimination laws | The Philippines has anti-discrimination laws, including the Labor Code, Anti-Age Discrimination Act, and Safe Spaces Act, which protect against discrimination based on age, gender, sexual orientation, etc. |

Health and Safety Act | The health and safety laws in the Philippines include RA 11058, the Occupational Safety and Health Standards Law, and Book Four of the Labor Code. These will require employers to ensure workplace safety, provide protective equipment, and report accidents and injuries. |

Notice period | Employees must provide a 30-day written notice before resigning; however, this can be waived in certain circumstances. The notice period can also be longer if required by the employment contract. It may specify a longer notice period, and the employee should comply with it if it’s higher than the 30 days required by the law. |

Intellectual Property (IP) | The Philippines’ intellectual property is governed by the Intellectual Property Code, which protects patents, trademarks, copyrights, and creations with automatic copyright protection and enforcement via the Bureau of Customs. |

Dispute Resolution | Includes a three-tiered system of amicable settlement, judicial dispute resolution, and trial. The Alternative Dispute Resolution Act will provide a framework for using arbitration, mediation, and negotiation outside of the court system. |

Post-Employment (Post-Termination) | Covers retirement benefits, termination, and restrictions. Retirement benefits will include at least half a month’s salary every year of service for employees aged 60-65 with 5+ years of service. |

Payroll in the Philippines

Global Squirrels, an Employer of Record in the Philippines, handles payroll, taxes, and ensures legal compliance for your hired employees, contractors, and freelancers.

The payroll in the Philippines is governed by labor laws, which include the Labor Code and various regulations set by government agencies like the Department of Labor and Employment. Employers should comply with these laws to make sure that employees are compensated fairly while also meeting the legal requirements.

The key payroll components are:

1. Basic salary

This is the agreed-upon compensation for the work performed by an employee, which excludes bonuses or allowances.

2. Allowances

Employers should provide additional allowances like meal allowances, transportation allowances, or dearness allowances. These are usually added to the basic salary and might be taxable or non-taxable depending on the nature.

3. Overtime pay

Employees who work beyond the regular working hours are entitled to overtime pay, which is usually calculated at 125% of their hourly rate for regular days, and higher rates on holidays or rest days.

4. 13th-month pay

The 13th-month pay is a mandatory benefit under Philippine law. It is a form of bonus which equals one-twelfth of an employee’s total income in a year. It is usually given at the end of the year.

5. Deductions

Employers are required to deduct certain amounts from employees’ wages. This will include:

– Social Security System (SSS) contributions

– PhilHealth contributions (health insurance)

– Pag-IBIG Fund contributions (housing and savings)

– Tax withholding for income tax

Payroll contributions | Amount or % |

Social Security System, including employer contributions and provident fund (WISP) | 14% capped at USD 49.5 |

The Home Development Mutual Fund (HDMF) (Formerly called Pag-IBIG) | 2% |

PhilHealth Contribution | 5% with a minimum of $4.30 and capped at $42.97. (Rates increase annually) |

13th-month Pay | 8.335% |

Total payroll cost per hire | Up to 14% |

Employee benefits in the Philippines

Another advantage of working with Global Squirrels is that you do not have to worry about benefits management. Our EOR platform will ensure that the talent we hire receives the Government-mandated benefits and entitlements, such as Social Security Insurance, PhilHealth, 13th Month Pay, and more.

As your Employer of Record in the Philippines, Global Squirrels will provide your hired staff with the benefits mandated by law.

Employee benefits in the Philippines are designed to protect workers’ welfare and ensure their well-being. These benefits are provided by law or as a part of company policies, and employers should follow the mandates set by the Philippine government. Understanding the different types of employee benefits will help businesses maintain compliance and enhance employee satisfaction.

Social Security System (SSS)

The SSS will provide employees with social security benefits, which include sickness, maternity, disability, retirement, and death benefits. Both employers and employees contribute to this fund based on a percentage of the employee’s monthly salary.

PhilHealth

PhilHealth is the national health insurance program in the Philippines. Employees are entitled to health coverage, which will include hospitalization, surgery, outpatient care, and several other medical services. Again, the contributions are shared between the employer and the employee.

Pag-IBIG Fund

The Pag-IBIG Fund will provide employees with access to savings and housing benefits. Employees can save for their future housing needs and receive a low-interest loan for housing, education, and other personal needs. In this benefit, the contributions are made by both the employer and employee.

Retirement benefits

In addition to SSS retirement benefits, companies may offer company-sponsored retirement plans, such as 401(k)-type savings plans or pension schemes, to provide financial security for employees upon retirement.

An EOR in the Philippines will ensure that all employee benefits, from mandatory statutory contributions to additional perks, are fully managed and catered to in compliance with the local labor laws. Businesses can guarantee that employees receive the appropriate benefits like social security, health insurance, and leave entitlements without any administrative burden.

Leave policy in the Philippines

Leverage our EOR platform’s built-in tools to manage and track your staff’s leaves. Track everything from leave balance, leave application, and approval to public holidays.

In the Philippines, leave policies are governed by the Labor Code, government regulations, and company-specific policies. These laws will ensure that employees are able to take time off to rest, recover, and attend to personal matters while also maintaining workplace fairness and well-being. Understanding the different types of leave benefits will help businesses ensure compliance and improve employee satisfaction. The various types of leaves are explained below.

Vacation leave

Vacation leave is an employer-provided benefit that allows employees to take paid time off for rest, recreation, and personal matters.

- Minimum leave: The Labor Code has not mandated vacation leave; however, it is common for companies to provide 5 days per year for regular employees.

- Company-specific policies: Many companies offer a high number of vacation leave, which can range from 10-15 days every year.

Sick leave

Sick leave will allow employees to take paid time off when they are ill or injured and have to recover.

- No statutory requirement: There is no mandatory sick leave under the Labor Code for all employees, though multiple private companies offer 5 to 10 days every year.

- Paid sick leave: Most companies will provide paid sick leave based on the internal policy, which ensures that employees do not lose income when they are unable to attend work due to illness.

Maternity leave

Female employees are entitled to maternity leave for miscarriage or childbirth.

- Duration: 105 days of paid leave for female employees with full pay, and an extra 15 days for single mothers.

- Eligibility: Employees are eligible for maternity leave if they have contributed to PhilHealth for at least 3 months within the 18-month period before the miscarriage or delivery.

Paternity leave

Male employees are entitled to paternity leave after the birth of the child.

- Duration: 7 days of paid leave

- Eligibility: The employee should be legally married to the mother and should have been employed with the company for a minimum of 6 months.

Solo parent leave

This leave benefit is provided to solo parents to assist them in managing both work and parental duties.

- Duration: 7 days of paid leave every year

- Eligibility: The employee should meet the definition of a “solo parent” as defined by the Solo Parents’ Welfare Act.

Special working days leave

In addition to regular public holidays, there are special working days that are recognized by law, like EDSA People Power Day and National Heroes Day.

- Payment for working on special days: If employees work on special working days, they are entitled to 130% of their regular rate.

Bereavement leave

While not made mandatory by the law, multiple companies will provide bereavement leave for employees to grieve the loss of a close family member.

- Duration: Typically 3 – 5 days of paid leave, which depends on the company’s policy.

Special leave benefits for women

The special leave benefits for women will entitle female employees to 2 months of paid leave for surgery related to gynecological conditions like hysterectomy or other surgical procedures.

Employment laws in the Philippines

As an EOR in the Philippines, Global Squirrels assumes the legal liability of complying with the labor laws and regulations in the Philippines.

Philippine employment laws, which are intended to balance the needs and rights of both employers and employees, provide the framework for just and equitable employment practices throughout the nation. These laws provide businesses with a framework for legal compliance and conflict resolution, defining the legal requirements for employment, such as pay, working conditions, hours, and benefits. They also guarantee that employees are treated with respect and dignity.

Regulations on recruitment and placement for foreign workers

Recruitment and placement activities, both domestically and internationally, are restricted to Filipino citizens or corporations, partnerships, or entities where at least 75% of the voting capital stock is owned and controlled by Filipinos. To hire foreign workers, an organization should first apply for an employment permit from the Department of Labor and Employment (DOLE).

Health and safety

The Philippines’ employment regulations, especially the Labor Code, specify the measures to protect workers’ health and well-being. The employer is responsible for making sure that the working conditions of their employees meet health and safety regulations and that they have access to emergency medical and dental care. In the event of a work-related disability or death, the Labor Code also guarantees that workers will receive benefits as soon as possible.

Anti-discrimination

The Anti-Age Discrimination in Employment Act, also known as Republic Act 10911, is a separate law even though the Labor Code already forbids discrimination against women and those who file pay grievances, join a registered union, or testify under the Code.

Anti-Sexual Harassment Act of 1995

By establishing rules for the avoidance and handling of such complaints, this law shields workers from sexual harassment at work. Employers are required by this legislation to avoid sexual harassment and to have a system in place for sexual harassment resolution, settlement, or prosecution. Because breaking this rule can result in fines and jail time, it is the employer’s duty to conduct background checks and other appropriate personnel screenings.

Telecommunication Act

This employment law, also known as Republic Act No. 11165, acknowledges telecommuting as a valid work arrangement and establishes standards to guarantee that remote workers receive equitable compensation, benefits, and chances for professional growth.

Data Privacy Act of 2012

Enacted in 2012, the Philippine Data Privacy Act (formally known as Republic Act No. 10173) is a historic law designed to safeguard personal information in government and private sector information and communications systems. In accordance with global data protection requirements, it creates a thorough and stringent privacy and security framework for the handling of personal data.

Requirements to run payroll in the Philippines

Let Global Squirrels handle the complex payroll of your remote employees and contractors.

According to the National Internal Revenue Code of the Philippines, an employer who makes payment of wages must deduct and withhold tax on those payments, determined by the tax laws and regulations. Withholding of tax at source is necessary to collect the income tax upon the payment of wages made to an individual for the services rendered. The Government also mandates employers to register their employees for Tax Identification Numbers (TIN) and update employee information. This information is crucial when filing and remitting withheld tax on wages.

Registration with other government agencies

Both the employer and employee must register with the following government agencies:

- Social Security System (SSS) — RA No. 8282 (offers social insurance and health and retirement advantages to employees)

- Philippine Health Insurance Corporation (PhilHealth) — RA No. 7875 (provides health insurance coverage for medications of the employees and their dependents)

- Home Development Mutual Fund (HDMF) — RA No. 9679 (grants affordable short-term loans and housing loans to employees)

Ongoing compliance requirements

Monthly payroll tax

The employer must file the monthly withholding tax on wages (WTW) return by submitting the Monthly Remittance Return of Income Taxes Withheld on Compensation (BIR Form 1601-C). Employers are required to file the tax returns within the timeline, which depends on the type of taxpayer, as highlighted below:

- Manual taxpayers — The deadline for filing and remitting the WTW return and related tax liability is before the 10th day of the month following the month when the withholding was done. If the taxes were withheld in December, the employer must file and remit them on or before 15 January of the succeeding year.

- Taxpayers enrolled in the Electronic Filing and Payment System (EFPS)

- Employers must file the WTW return and remit it based on their industry classification. The deadline is typically from the 11th to the 15th day following the month-end.

- Employers must pay their tax liability on or before the 15th day of the month following the month when the withholding was made. For the taxes withheld in December, it must be paid on or before 20 January of the succeeding year.

Monthly statutory contributions

From the employee’s monthly compensation, the employer shall deduct the mandatory statutory contributions (i.e., SSS, PhilHealth, and HDMF). The share of the employer and employee must then be remitted to the authorized agencies in the month following the deduction. The deadlines are listed below:

- SSS — every last day of the month following the applicable month

- PhilHealth — depends on the last digit of the employer’s PhilHealth number (i.e., 11th to 15th or 16th to 20th day of the month)

- HDMF — depends on the first letter of the employer or business name (i.e., 10th to 14th, 15th to 19th, 20th to 24th, or 25th to last day of the month)

Year-end payroll tax compliance

At the end of a calendar year, the employer must calculate the annual tax to be withheld and compare it with the taxes already withheld from January to November. Based on the computations, if there is a tax deficiency, then the employer must withhold additional taxes from the employee in December. However, in case of excess tax withheld, the employer shall refund it to the employee before 25th January in the following year. Simultaneously, he/she must fill in and submit the Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes (BIR Form No. 1604-CF) before 31 January of the year following the calendar year.

Pension requirements

Registration of the retirement plan

If an employer has opted for a formal retirement plan that offers certain benefits to employees, the retirement plan has to be registered and certified with the BIR to qualify for income tax exemption. To obtain this certification, the employer must submit a written application along with the required documents to BIR.

Retirement benefits

According to the RA No. 7641, an employee may retire upon reaching the age of retirement as defined by the collective bargaining agreement (CBA) and other applicable employment agreement or contract. The employee is entitled to receive the retirement benefits under the existing law, CBA, and other contracts. The employer must ensure that the retirement benefits provided shall not be less than RA No. 7641. If there is no retirement plan or in the absence of an agreement that establishes the retirement benefits, the employee shall be entitled to receive at least half a month’s salary for every year of service with the employer.

Some of the retirement benefits exempt from tax are as follows:

- Retirement benefits received under RA No. 7641

- Retirement benefits received under the employer’s private retirement plan are exempt as under:

- At least 10 years of service rendered by the retiring employee to the same employer

- At the time of retirement, the employee must be at least 50 years of age

Employment obligations

Minimum wage

The Wage Rationalization Act (RA No. 6727) establishes the applicable minimum wages for the different industry sectors, such as agriculture plantation/non-plantation, non-agriculture, handicraft/cottage, and retail. The Regional Tripartite Wages and Productivity Boards (RTWPB) set the prescribed minimum wage across the regions in each of these sectors. A minimum wage employee (MWE) earning only the statutory minimum wage shall be exempted from paying income taxes. This will also likely cover their holiday pay, overtime pay, night shift differential pay, and hazard pay. However, the employer shall withhold tax on any other compensation earned by the employee, such as commissions, fringe benefits, taxable allowances, and other benefits. The same applies to the income received from other sources, such as trading, conducting business, or payments received from concurrent employers.

Leave entitlement

An employee receives service incentive leave (SIL) of five days annually under the condition that he/she has rendered service of at least one year with the same employer. Certain employees also receive the following leaves along with their full compensation:

- Maternity leave — 105 days (additional 15 days for solo parents)

- Paternity leave — seven days

- Solo parent leave — seven days

- Others:

- Gynecology leave — two months

- Leave for women and their children who are victims of violence — 10 days

Rest hours

The normal work hours in any given day shall not exceed eight hours, and the time-off for regular meals given to employees must not be less than sixty minutes. The employer may provide time-off for meals of not less than 20 minutes under the following conditions:

- Due to the work being non-manual, which does not require physical exertion

- The regular operational hours of the entity are not less than 16 hours a day

- The work requires employees to operate on machinery, equipment, or installations

Beyond the eight hours of work in a day, employees are entitled to receive regular wages plus 25% of those wages. If the employee works on a holiday or rest day, the employer shall compensate them at the rate of the first eight hours worked plus 30% thereof. After a period of six normal work days, the employer must provide a rest day of not less than 24 consecutive hours.

13th-month pay

According to Philippine law (Presidential Decree No. 851), private sector employers must pay their rank-and-file employees a 13th-month pay before December 24th annually. This payment is calculated as one-twelfth (1/12) of the employee’s basic salary earned throughout the calendar year. The basic salary is defined as the regular earnings for services rendered. It specifically does not include other benefits such as cost-of-living allowances, profit-sharing, cash equivalents for unused leave, overtime, premium, night differential, or holiday pay. Any 13th-month pay or related benefits that are over the $1,549 USD threshold are taxable and must be included in the employee’s gross income.

Payroll requirements

Timing of wage payment

Wages are required to be paid at least once every two weeks or twice a month at intervals not exceeding 16 days. If, due to some circumstances beyond the employer’s control, the payment of wages can not be made, the employer must make the payment immediately after the issues are resolved. However, the payment frequency must be at least once a month. For wages subject to the nature of the work, which requires more than two weeks to complete, the employer must pay in proportion to the work completed at intervals not exceeding 16 days. Once the employee completes the work, the employer has to make the final payment immediately.

Pay slips

The pay slips shall be shared with the employees one working day before the pay day, either digitally or in a hard copy. Employers must pay their employees by the means of a payroll, which must have the following information/data for the respective staff:

- Length of time to be paid

- The rate of pay per month, week, day, or hours, piece, etc.

- The amount due for regular work

- The amount due for overtime work

- Deductions made from the wages of the employees

- Amount actually paid

Hire, onboard, and pay skilled and experienced professionals in the Philippines with zero entity cost. You get the best talent, while Global Squirrels will handle complex local payroll and compliance.