Hire Employees in Canada

Canada, one of the top destinations, is enriched with talented professionals. Employers find a massive talent pool from various industries. The best part is that the cost-effective hiring process encourages employers to hire employees from Canada. The corporate tax benefits and lower hiring expenses influence employers’ decisions in hiring in Canada.

In this guide, we will show you the hiring in Canada in detail.

Table of Contents

Hiring in Canada – facts

The country’s geographic locations, rich resources, and cost-effective hiring process make Canada a dream destination for many employers so far.

A glimpse about Canada:

- Capital: Ottawa

- Official language: French & English

- Population: 40,097,761 ( approx)

- Currency: Canadian dollar

- Cost of living index: 66.1

- Payroll frequency: monthly & semi-monthly. A few territories offer weekly & bi-weekly options.

- VAT rate – 5%

Canada job market detail

There are several domains available in Canada, and so do the professionals. Below, we discuss the job market in detail to better understand how remote professionals contribute to their economy.

Talent pool:

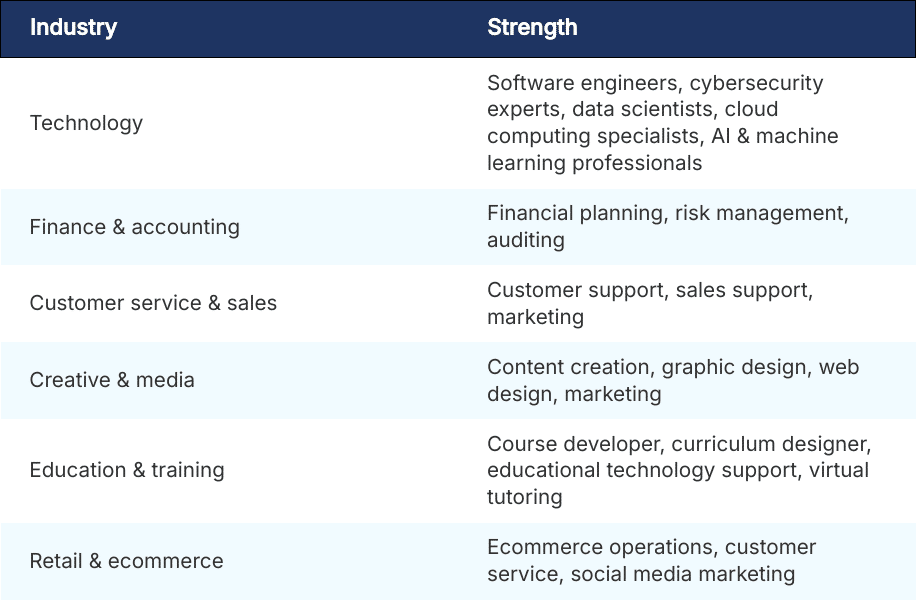

Canada boasts a vibrant and diverse remote talent pool, offering valuable resources for various industries.

See the below table:

Highly demanded remote jobs:

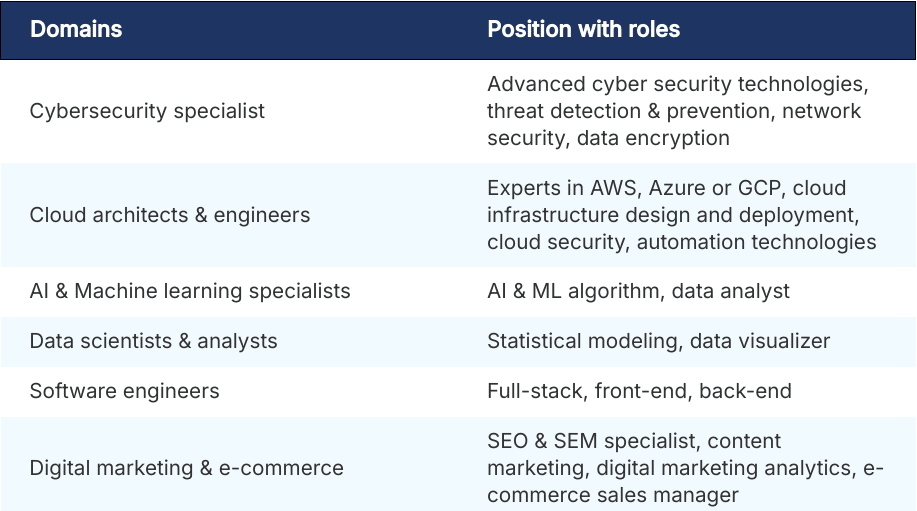

The demand for skilled remote workers in Canada continues to skyrocket across various industries. Here are some of Canada’s most demanding job roles.

See the table below:

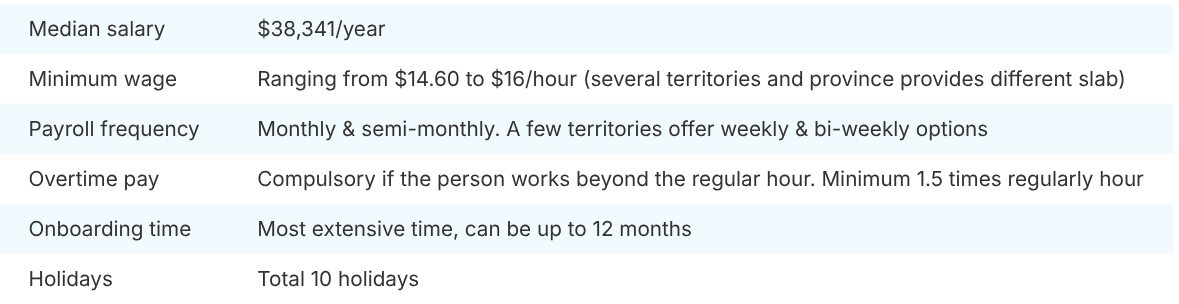

Employment detail in Canada

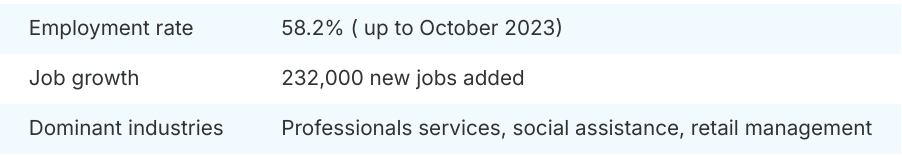

Understanding Canada’s employment landscape is crucial for anyone seeking work or doing business there. Therefore, employers and business owners get several advantages in hiring Canadian employees remotely.

See the data on employment in Canada:

Minimum wage in Canada:

Salary and wage factors depend on job roles, experience, expertise, qualifications, that you must keep in mind while hiring in Canada.

See the breakdown below:

Competitive benefits package in Canada

A competitive benefits package in Canada can vary depending on the industry, company size, and location. However, some general elements are considered essential in attracting and retaining top talent:

Health insurance: All Canadian residents can access government-funded healthcare through the Canadian healthcare system.

Dental insurance: Coverage for dental exams, cleanings, and some procedures is increasingly common.

Vision insurance: Many Canadians rely on private vision insurance to help offset the costs.

Mental health support: Health insurance also covers mental health support.

Pension plan: Companies offer defined-benefit pension plans, providing guaranteed income in retirement. Under the Canadian Pension Plan ( CPP), individuals can avail of $760 on an average monthly basis and $15,678 yearly ( approx). The retirement age is 60. However, it can be extended based on medical fitness.

Life & disability insurance: Individuals under 65 who contributed sufficiently to the Canadian Pension plan are eligible for the benefit. Generally, incurable, mental impairment or prolonged disease patients may receive the insurance benefit.

Salary structure in Canada

The salary structure in Canada is industry-specific, and the employees get the industry standard package. There are a few parameters that influence the salary structure, including:

- Job title & industry

- Experience & skills

- Education & certifications

- Location

- Company size & culture

- Benefits & perks

The above measures decide the wages of Canadian workers, irrespective of the domain. Based on the positions, see the salary structure below:

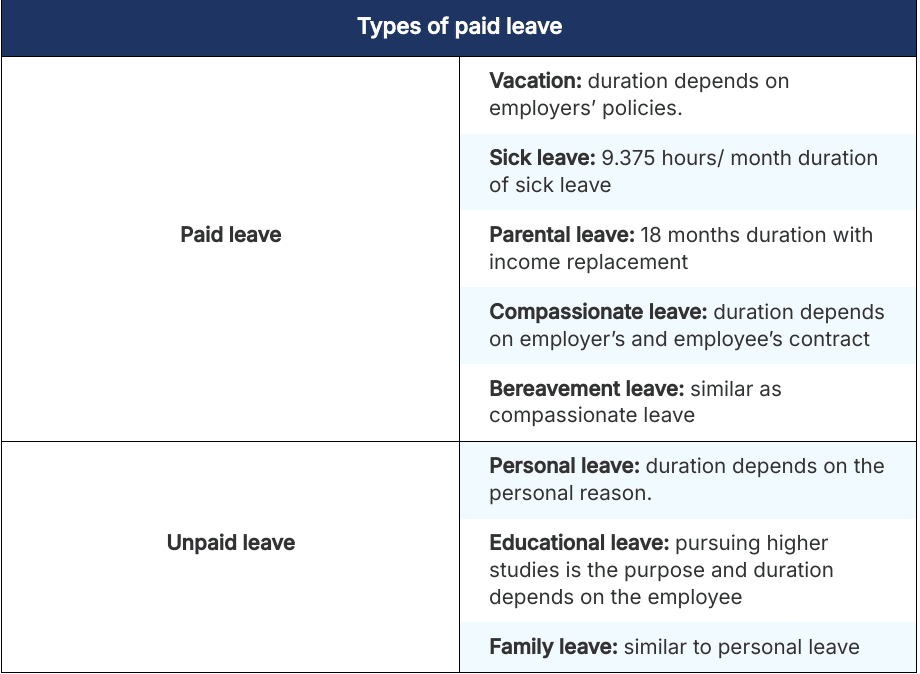

Types of Leaves in Canada

Remote employees in Canada enjoy the same types of leaves as their office-based counterparts, with some potential for additional flexibility depending on the employer’s policy and individual circumstances.

See the breakdown below in the table:

On-boarding rules in Canada

Probation period:

While employers onboard the employees remotely, they need to follow the Canadian employment rules. Based on the guidelines, the Probation period is three months, a standard duration.

Notice Period:

The Notice period duration is two weeks. Employers must inform the employees by written notice for two weeks, and it has to be paid. Similarly, employees also serve a two-week notice period when they leave the organization.

Payroll tax details in Canada

Navigating payroll taxes in Canada can be complex, but understanding the key components is crucial for businesses and employees. Here’s a breakdown of the essential details:

1. Deductions at Source:

Employee Contributions:

- Canada Pension Plan (CPP): 5.95% of earnings up to a yearly maximum of $3,754.45 in 2023.

- Employment Insurance (EI): 1.58% of wages up to an annual maximum of $5,665.00 in 2023.

- Income Tax: Based on a progressive tax system, with deductions calculated at source through a payroll system.

Employer Contributions:

- CPP: Matches employee contributions.

- EI: 1.4 times the employee contribution.

2. Remittances and Filings:

- Employers must remit deductions and contributions to the Canada Revenue Agency (CRA) regularly, typically monthly or quarterly.

- Tax slips (T4 and T4A) must be issued to employees annually, summarizing their earnings and deductions.

- Annual payroll tax returns (T4 and TP1) must be filed with the CRA.

3. Additional Taxes and Considerations:

- Provincial/Territorial Taxes: Some provinces and territories have additional payroll taxes, varying from 0% to 1.95%.

- Quebec Pension Plan (QPP): Applies only in Quebec, replacing CPP contributions.

- Benefits and Expenses: Employee benefits and expenses may be subject to additional deductions or tax implications.

Hiring and payroll management systems can streamline the intricate hiring in Canada. Global Squirrels, a leading hiring and payroll management platform, provides effective solutions.

How does Global Squirrels help you to hire employees in Canada?

Global Squirrels is one of the leading platforms to hire employees in Canada. The platform has an extensive global talent pool for hiring in Canada remotely. Employers can sign up with us for free and access the professionals’ profiles.

Besides hiring in Canada, Global Squirrels can manage the payroll management system, which has several benefits for employers in remote hiring scenarios.

Why do you choose Global Squirrels in hiring in Canada?

When you sign up with Global Squirrels, you will receive -multiple benefits from the platform, including:

- You can access a massive global talent pool

- There is no need to pay bloated markups or agency fees

- You need to pay only the license fee per hire

- With payroll management, the platform covers everything – payroll, benefits sheet, leave sheet, tax calculation, etc

- Global Squirrels will assist you in compliance with international law

- Global Squirrels manages local labor laws and regulations

- Employers do not need to set up an entity for the hiring process

There are three plans to avail of Global Squirrels’ service. The starting price is $199/employee/month. However, you can select any plan based on your requirements.

In conclusion

Streamline your remote hiring in Canada with Global Squirrels. No entity setup is needed, just seamless talent acquisition. Global Squirrels takes the hassle out of remote hiring in Canada, saving you time and resources. Focus on what matters most – finding the perfect remote candidate! Global Squirrels handles the rest. Simplify your remote hiring journey in Canada, sign up with Global Squirrels and unlock the power of Canadian talent.