Hire Employees in the Philippines

Hiring employees in the Philippines offers a multitude of advantages for businesses looking to expand their global workforce. With its highly skilled and English-proficient workforce, strategic geographical location, and cost-effective labor market, the Philippines has become a prime destination for companies seeking to tap into top-tier talent while optimizing their operational costs.

Table of Contents

Hire Employees in the Philippines – An Ultimate Guide

In this blog, we’ll explore the numerous benefits and key considerations that make the Philippines a compelling choice for international recruitment, and we’ll guide you through the essential steps to successfully hire employees in this dynamic Southeast Asian nation. Whether you’re a start-up looking to scale or an established enterprise seeking specialized skills, the Philippines presents a world of opportunities for your business growth.

Welcome to the land of opportunities! The Philippines isn’t just a tropical paradise; it’s also a thriving business hub with immense potential for growth. As you consider expanding your team, let’s embark on a journey to uncover the vibrant landscape of talent waiting to join your ranks.

Getting it right: Grasping the local hiring scene’s ins and outs

Success begins with understanding. Navigating the Philippines’ job market requires more than just the usual playbook. It’s about immersing yourself in the nuances of the local culture, legal framework, and recruitment dynamics to ensure your hiring endeavors hit the mark.

Your roadmap ahead: What to expect and how to navigate this guide

Buckle up, because this guide is your compass in the world of Philippine hiring. We’ll delve into the core aspects of recruitment, from understanding the job market to crafting impeccable benefits. Each section is a stepping stone, guiding you through uncharted territory to build a team that thrives.

With the ease of remote work, countries like the Philippines have emerged as a hotbed of potential, attracting employers from around the world. If you’ve been contemplating expanding your team by tapping into the Filipino talent pool but are perplexed about the hiring nuances, local labor laws, and other requirements, you’ve landed at the right guide.

This comprehensive Philippines Hiring Guide seeks to answer all your questions, elucidate the benefits of Filipino hiring, and provide you with insider tips to make your recruitment process smooth and efficient.

Overview of Philippines

Capital: Manila

Currency: Philippine peso

Languages: Filipino, English

Population: 11.39 crores (2021);

Payroll frequency: Bi-monthly or Monthly

Timezone: (GMT+8)

Cost of living rank: 89th out of 197

Public holidays: 18 (based on region)

Why hire employees in Philippines?

1. Abundant skilled workforce

The Philippines stands proud as one of Southeast Asia’s major economies, brimming with a vast, skilled workforce. With the median age at a youthful 23, it offers a dynamic talent pool eager to make their mark.

2. Educational proficiency

The emphasis on education is evident, with a significant chunk of the population holding college degrees in pivotal areas like Business, Education, Engineering, IT, and Agriculture.

3. Cost-effective hiring

Economical wages complemented by a relatively low cost of living make the Philippines an attractive hiring destination. To give you perspective, the average daily minimum wage can be as low as USD 5.70, making it financially viable for businesses.

4. English proficiency

Language barriers often pose a challenge in cross-border hiring, but not with the Philippines. Thanks to historical influences, nearly 90% of the Filipino population speaks and understands English, ensuring seamless communication.

Finding the best talent in the Philippines

If you’re wondering where to start, referrals often pave the way for successful hires in the Philippines. Leveraging local contacts can be beneficial. However, for those new to the Philippine hiring landscape, there are specific cities that have established themselves as talent hubs:

1. Metro Manila

As the bustling capital region, it’s home to several top-tier universities and a massive pool of qualified candidates.

2. Cebu and Davao

Known for their educational institutions, these cities offer a blend of skill and proficiency.

3. Cagayan de Oro & Zamboanga

Rapidly emerging as talent-rich regions, they’re gaining traction among employers seeking specialized skills.

To further refine your search, consider exploring talent from universities in these cities, as they often boast higher education levels and superior English proficiency.

In addition to the given information, it’s worth noting that the Filipino culture embodies qualities of loyalty, dedication, and a strong work ethic, further enhancing their attractiveness as ideal employees.

Get skilled support with experienced virtual assistants from the Philippines for admin, creative, or tech tasks remotely and affordably.

Work culture in the Philippines

Culture colors every aspect of Filipino life, including work. Embrace a nuanced understanding of local norms, values, and customs to forge strong employer-employee relationships and foster a thriving work environment.

The Philippines, an archipelago nation with over 7,000 islands, boasts a rich tapestry of cultures, traditions, and histories. Central to Filipino culture is the concept of “Bayanihan,” which epitomizes the spirit of communal unity, work, and cooperation. This deep-rooted sense of community, drawn from both indigenous traditions and centuries of foreign influences, emphasizes harmony, respect, and a collective approach to tackling challenges.

In the workplace, this often translates to a collaborative environment where employees rally together to achieve common goals, highlighting the importance of interdependence and mutual support.

Moreover, Filipinos place a high premium on interpersonal relationships and respect, often using honorifics and formal language, especially when interacting with elders or superiors. “Pakikisama” or smooth interpersonal relationships is crucial, often driving decision-making and interactions in the professional realm. Respect for hierarchy, combined with a genuine warmth and hospitality, defines the Filipino workplace.

Understanding financial aspects of hiring in the Philippines

As businesses continue to expand and tap into global markets, understanding the financial nuances of hiring in different countries becomes paramount. Here, we’ll deep-dive into three pivotal aspects of hiring in the Philippines: the minimum wage, average salaries, and the tax structure.

1. Minimum wage in the Philippines

The Philippines adopts a regional approach to minimum wage, making it crucial for employers to acquaint themselves with local standards. For instance:

- In the bustling hub of Metro Manila, employees are entitled to a minimum wage of PHP 537.00 (approx. $10.24) daily.

- Across the country, the average daily minimum wage hovers around PHP 343.63 (approx. $6.22).

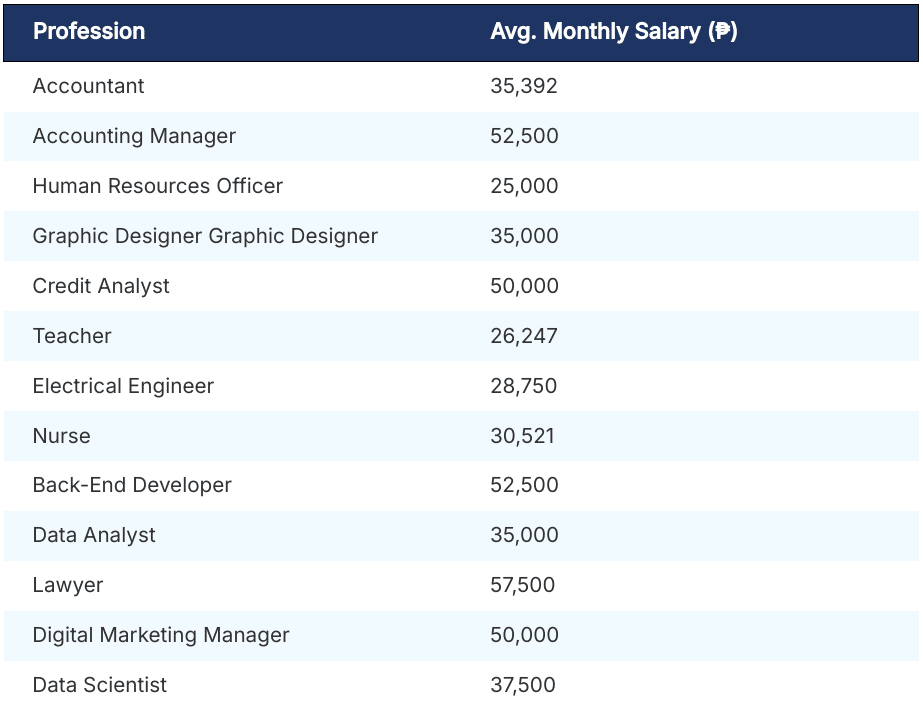

2. Deciphering average salaries in the Philippines

To make an informed hiring decision, one must understand the average salary scales. Salaries differ based on job roles and their inherent responsibilities. Here’s a snapshot:

The average monthly salaries in the Philippines span a diverse range, reflecting the country’s multifaceted job market. Professionals in the legal and IT fields tend to earn higher average salaries, with lawyers earning ₱57,500 and back-end developers earning ₱52,500.

In contrast, educators and healthcare professionals see figures such as ₱26,247 for teachers and ₱30,521 for nurses. The transportation sector displays one of the highest average salaries for delivery drivers at ₱87,263.

Know more about Philippines salary structures across various professions.

The Philippine Institute for Development further segments families into income groups, aiding businesses in comprehending the overall financial landscape.

3. Navigating the tax maze

Taxation plays a pivotal role in remuneration. Here are some key pointers:

Working hours – A typical Filipino employee works 8 hours daily for 5 days a week, inclusive of a mandatory 1-hour break.

Overtime pay – If your employee works beyond the stipulated hours, you’ll incur an additional 25% over the standard hourly pay rate for each overtime hour. The duration for such overtime doesn’t have a statutory maximum and is at the employer’s discretion.

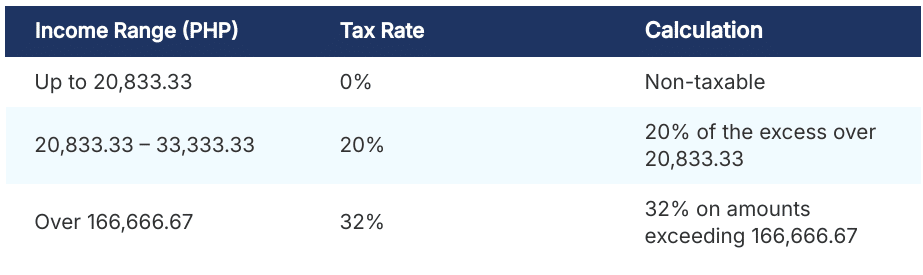

Income tax structure

Despite these clear-cut guidelines, the Philippines’ high personal and corporate tax rates (32% and 30% respectively) have led to tax evasion tendencies among certain sections. The growth of the freelance market, especially post-COVID-19, has further complicated tax matters.

Solution?For international employers, leveraging Professional Employer Organizations (PEOs) or trusted payroll outsourcing services Philippines can be very helpful. These organizations streamline the payroll and tax process, ensuring compliance and simplicity

Philippines employment overview

1. Working hours

Standard work week – Filipino employees typically work 8 hours a day for 5 days a week.

Break time – A 1-hour break is mandated by law.

Overtime – If overtime is required, there’s an additional cost of 25% of the employee’s hourly rate. No legal cap exists on overtime hours; it’s at the employer’s discretion.

2. Mandatory benefits

13th-month pay -Employers are obligated to provide an additional month’s salary, termed the “13th-month pay“. This is essentially 1/12 of an employee’s annual pay, prorated for part-time staff, and disbursed on/before December 24.

Annual/sick leaves – Employees are entitled to a minimum of 5 days of annual leaves. This includes sick leaves. Unused leaves are compensated by employers at the end of the year.

Parental leaves

- Maternity leave: Mothers receive 105 days with full pay, with an option for fathers to claim 7 days

- Emergency maternity leave: 60 days at full pay for cases like miscarriages

- Solo parent leave: 120 days at full pay

- Paternity leave: Fathers receive 7 days

Statutory contributions

- Social security system (SSS): Aimed at providing benefits such as maternity, sickness, disability, and more. Contributions are required for employees below 60 who earn over PHP 1,000/month.

- PhilHealth: Compulsory health insurance, with a current rate of 3% of the employee’s monthly salary, which sees an annual increase of 0.5%.

- Pag-Ibig (HMDF): A national savings program and housing financing scheme. Contributions vary based on the employee’s salary.

3. Additional Benefits and Allowances

While not mandatory, many employers provide allowances for remote workers:

- Stipends – Including those for equipment, internet, telecom, and even transportation, particularly if the employee uses a co-working space.

- De minimis benefits – These tax-exempt benefits are provided to promote health, goodwill, and efficiency among employees.

Examples include:

- Monetized unused vacation leaves (up to 10 days/year).

- Medical cash allowance for dependents.

- Rice subsidies.

- Uniform allowances.

- Medical assistance.

- Laundry allowances.

- Achievement awards in tangible form.

- Gifts for special occasions like Christmas.

- Meal allowances for overtime or night shifts.

- Benefits via Collective Bargaining Agreement or productivity schemes (within limits).

Working and hiring in the Philippines: An overview

1. Working during holidays

Types of holidays

- Regular holidays: Fixed dates, e.g., New Year’s Day, Christmas, Independence Day, National Heroes Day, Labor Day.

- Special non-working days: More flexible and might be region-specific.

Compensation

- Regular holiday: 200% of daily rate for the first 8 hours.

- Special non-working day: 130% of daily rate for the first 8 hours.

2. Hiring remote employees in the Philippines

Probation periods

- Not mandatory. However, if chosen, they can’t exceed 6 months by law.

Payment modalities

- PEOs simplify the payroll and compliance process.

- Typically, payments are bi-monthly (15th & 30th), but monthly payouts can be arranged. Prior intimation to employees is recommended.

Currency for payments

- Though salaries might be based on the U.S. dollar, it’s preferred to pay in the local currency for ease in computing taxes and contributions.

- Using PEOs ensures that fluctuations in exchange rates won’t impact employees.

Termination Protocols

- Just Cause (e.g., misconduct, disobedience, neglect of duty, fraud, commission of a crime): Requires two notices at least 30 days apart and no severance pay.

- Authorized Cause (e.g., labor-saving devices, redundancy, retrenchment, business closure, illness): Requires 30 days’ prior written notice and severance pay based on tenure.

Due to stringent termination processes, many employers leverage the allowable 6-month probationary period.

For foreign businesses, hiring via a Professional Employer Organization (PEO) is advisable. PEOs, such as Global Squirrels to ensure compliance with local labor laws and facilitate payment processes.

Expand your global team by hiring experienced remote workers from the Philippines to access skilled talent and reduce costs.

How Global Squirrels helps businesses find talent in the Philippines

Explore Global Squirrels’ professional approach to employee hiring in the Philippines. Through our advanced AI technology, we streamline the talent acquisition process, facilitating your business expansion in the region. Focus on amplifying your business and fostering expansion plans as we take on the duty of assembling a team in the Philippines for you. Trust our expertise in handling the intricacies of compliance, benefits, and legalities, and focus solely on your business growth.