Hire and retain local & global talent with zero employer obligations

Attract top talent while reducing your staffing costs by up to 80%!

Post jobs for free. No cost until you confirm a hire!

What is

Global Squirrels?

Global Squirrels is an automated staffing platform that helps businesses find and retain local & remote global talent without employer obligations. Hire talent like your own employees while Global Squirrels handles recruitment, onboarding, and payroll—all for

just a flat fee & monthly payroll costs.

Top talent sourcing

Save time as we source curated talent from local onsite to remote global talent. Post your job for free to get started.

Automated payroll

Effortlessly manage payroll and benefits for your hired talent in their local currencies. All you need to do is approve their timesheets—we handle the rest.

Global compliance

Your hired resources operate just like your own employees, while we serve as the official Employer of Record (EOR). This means zero liability for you.

Unbeatable pricing

Our platform displaces the middlemen (Client - Staffing Agency - Worker). Just pay payroll costs and a flat licensing fee.

Trusted by growing businesses & enterprises

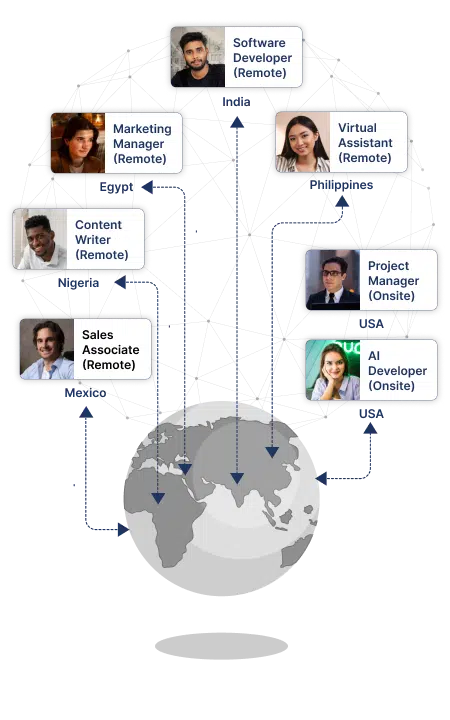

Break the borders to find the right talent

Find ideal team members regardless of geographical boundaries in the most cost-effective way. From on-site contractors to remote employees worldwide, we've got you covered.

- Country-specific recruitment teams to get top talent

- Evaluate candidate pay, skills & hiring cost pre-interview

- Automated interviews, offers & onboarding to save time

- Platform-enabled recruitment: Interact only with candidates

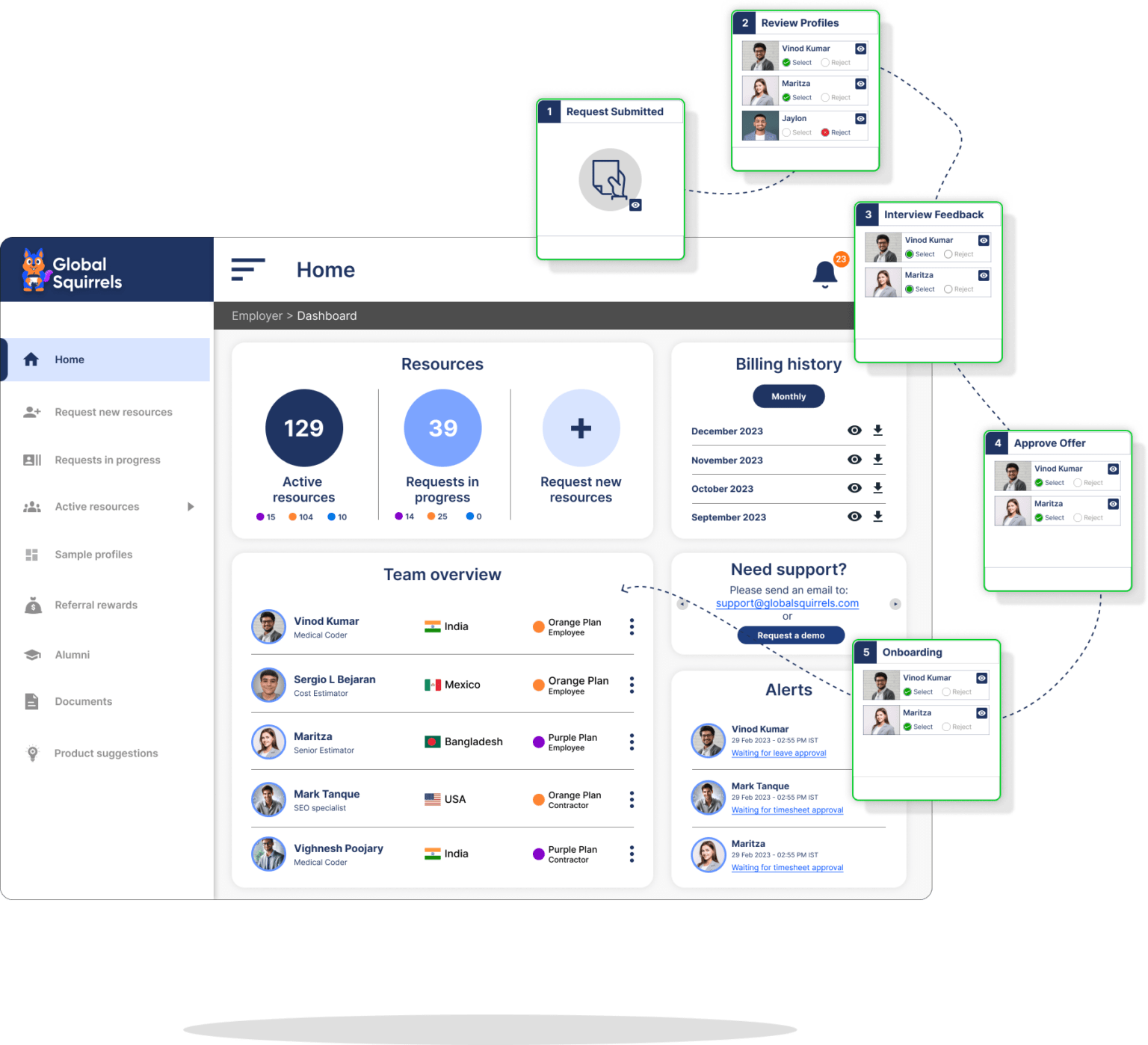

Built-in tools to manage and retain hired talent

As your Employer of Record (EOR) for recruited talent, our platform seamlessly manages time, attendance, payroll, performance, and offboarding

- Automated time tracking, payroll, benefits - just approve timesheets

- Approve leave or offer additional incentives and bonuses with a click

- Manage performance, pay raises, and offboarding easily within the portal

- Regular check-ins from country-specific local HR experts to boost retention

Testimonials

What our customers are saying ...

This platform worked out well for us. Instead of working with agencies we were able to hire resources from Philippines on a long term basis. We are currently paying payroll cost and monthly license fee per employee. The value we seen with this company is they were able to source us curated profiles based on our job needed and pricing is great compared to other EOR platforms.

Our

Global Talent Spotlight

Check out some of the profiles we recruited for our customers. Login and choose Orange plan to fill your hiring needs. Get curated profiles to interview and onboard in 2 to 5 business days.

The onboarding process was impressively fast and efficient, enabling me to start my contract without any delay. Additionally, I was always paid on time, which added to the overall positive experience with the platform.

Fast and Efficient

Dedrick

Registered Nurse

Using this platform was excellent. Managing my weekly timesheets through the portal was effortless. I always had clear access to my timesheets, pay rates, and pay stubs in one place, ensuring no questions about my pay details.

Highly Recommended

Lanic

LPN

Loved working with the team. Received regular text and email check-ins throughout my contract. Even though these are automated, I always got prompt support from the team whenever I responded.

Great Solution with right human touch

Moramay

CNA

Sruthi

.Net Developer

Est. Hiring Cost:

$937.50/month

INDIA

Vaishnavi

AR Analyst

Est. Hiring Cost:

$625.00/month

INDIA

Gary

Accountant

Est. Hiring Cost:

$2000.00/month

MEXICO

Alfonso Carlo

App. Developer

Est. Hiring Cost:

$1280.94/month

PHILIPPINES

Evita

Business Analyst

Est. Hiring Cost:

$2363.46/month

PHILIPPINES

Vraja Kishore

Solution Engineer

Est. Hiring Cost:

$3125.00/month

INDIA

Saravana

Copy Editor

Est. Hiring Cost:

$729.00/month

INDIA

Pilar Perez

HR Generalist

Est. Hiring Cost:

$857.00/month

MEXICO

Technology Integrations

Efficiently recruit top talent globally through our AI-enabled high-tech platform. Benefit from free advisory and implementation tools for managing remote workforces with our EOR/PEO services. Simply pay licensing costs to our technology partners.

Ready to hire top talent to grow your business or improve your SG&A?

No obligation until you interview and confirm a hire.