1040 vs 1099 forms: What’s the difference?

Tax season doesn’t have to be a source of anxiety, even though the IRS forms can often feel like an “alphabet soup” of numbers. The two most essential forms for individuals and business owners are Form 1040 and Form 1099.

Understanding how these forms interact is the key to avoiding audits and ensuring you don’t overpay. Here is everything you need to know about navigating the differences

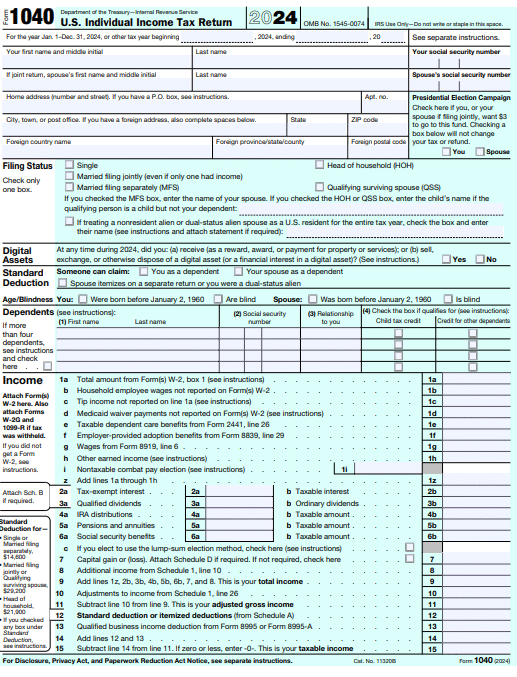

What is the 1040 Form?

The United States Individual Income Tax Return (Form 1040) serves as the primary filing instrument for American citizens who file their annual federal income taxes. Through this form, taxpayers report their income and claim deductions to determine their tax balance or refund for the year. Each year, the IRS issues updated versions of Form 1040 to reflect changes in tax legislation and inflation adjustments.

Types of Form 1040

Form 1040 comes in several different versions that meet the needs of unique taxpayer circumstances.

- Form 1040: For most individual taxpayers, this standard form serves as their primary tool for reporting income and evaluating tax obligations and refund eligibility.

- Form 1040-SR: Senior citizens over 65 years of age receive a simplified version of Form 1040 with large print and a straightforward design, along with a chart showing the higher standard deduction ranges available to older taxpayers.

- Form 1040-NR: Non-resident aliens must use this form to report their income earned from the United States. The length and complexity of this form exceed those of the standard Form 1040.

- Form 1040-X: Participants use this form to modify their previously submitted IRS Form 1040. Taxpayers need this form to correct mistakes or update information on previously filed tax returns.

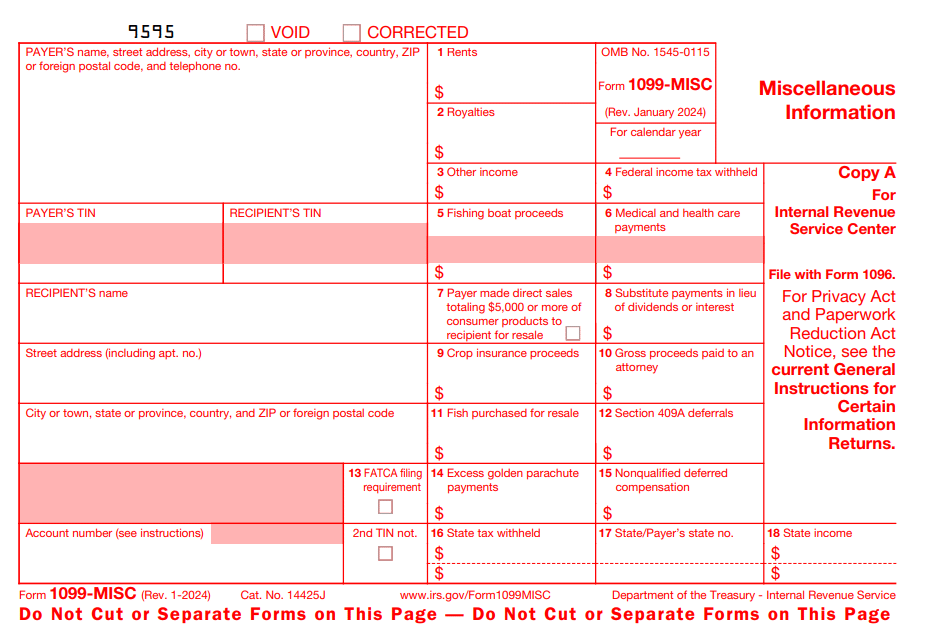

What is the 1099 Form?

The Internal Revenue Service (IRS) requires Form 1099 to document all non-employment income that falls outside standard wages and tips payments. People and your entity need to use this crucial report to present exact non-employment income data to the IRS for tax compliance purposes.

The IRS receives income reporting data about non-working income through Form 1099, which acts as an information return. Individuals must declare all income sources, including freelance earnings, interest earned on bank accounts, dividends from investments, and other miscellaneous sources. Your business, alongside financial institutions, must provide Form 1099 to everyone who obtained a minimum income of $600 from non-wage sources in a single tax year.

Types of Form 1099

Form 1099 comes in different variations to cover several types of income.

- 1099-DIV: Reports dividends and distributions from stocks or mutual funds.

- 1099-INT: The form shows interest earnings from savings accounts together with checking account deposits.

- 1099-MISC: Form 1099-MISC served to report miscellaneous payments that included payments to independent contractors before 2020.

- 1099-NEC: Non-employee compensation uses the 1099-NEC form as the official reporting standard for independent contractors starting in 2020.

For a deeper breakdown of contractor income reporting, explore the key differences between Form 1099-NEC and Form 1099-MISC and when each form applies.

Key differences between 1040 and 1099 forms

Understanding the distinctions between 1040 vs 1099 forms is crucial for accurate tax reporting. These forms differ in how they function, with separate requirements for completion and target specific user groups.

How individuals use them

- Form 1040: The basic tax return form used by individuals to report their yearly income from wages and salaries, as well as other sources. The form consolidates all income sources to compute tax obligations or tax refunds by showing deductions and credits to determine tax liabilities or refund eligibility.

- Form 1099: Organizations must submit this form to document payments to non-employee personnel, including freelancers and independent contractors. The IRS requires organizations to file a 1099 form whenever they pay non-employee compensation that reaches or exceeds $600.

Who files them

- Form 1040: All individuals who earn income through employment or freelancing must file Form 1040. The form uses W-2 employee data as well as payments reported through independent contractor 1099 forms.

- Form 1099: You need to complete this form when paying independent contractors and freelancers. All information must reach both the contractors and the IRS by the end of January following each tax year.

Read more: Everything you need to know about filing the W2 form

Penalties imposed by the IRS for not filing these forms

Taxpayers need to know the penalties associated with Form 1040 and Form 1099 filings to avoid issues when they file their taxes. An analysis of the penalties that apply to these forms, with their respective comparisons, follows below.

Form 1040 penalties

The standard individual tax return, Form 1040, is used to report annual income. Failure to comply with filing or payment obligations can result in the following penalties.

- ‘Failure to file’ penalty:

-

- Failure to submit your tax return on time results in this penalty.

- Paying 5% of unpaid taxes monthly results in penalties that may reach 25% of the unpaid amounts.

- The penalty fee is either $485 (for returns due after December 31 of the current year) or 100% of the unpaid tax, and it becomes mandatory when the tax return is filed more than 60 days past the due date.

- ‘Failure to pay’ penalty:

- Tax penalties apply when you delay payment of your taxes beyond the due date.

- The IRS charges late filing fees at 0.5% of your tax debt per month during the first 24 months.

- The penalty rate becomes 0.25% per month for those with an approved payment arrangement.

Form 1099 penalties

You are required to use Form 1099 to document non-employee payments, interest dividends, and additional types of income. You must pay penalties when they file or furnish incorrect payee statements beyond their required deadlines.

- Failure to file or furnish correct information returns:

-

-

- Penalty amounts depend on how late the form is filed:

- Up to 30 days late: $60 per form

- 31 days late through August 1: $130 per form

- After August 1 or not filed: $330 per form

- Intentional disregard: $660 per form (no maximum limit)

- Maximum penalty: $3,000,000 per year, with reduced limits if you have a small business

- Penalty amounts depend on how late the form is filed:

-

- Failure to file or furnish correct information returns:

-

-

- Taxpayers need not correct any errors under $100 ($25 for withheld amounts) unless the recipient chooses to fix the mistake.

-

- Intentional disregard:

-

- The penalty amount rises substantially when failures stem from intentional disregard, as there is no defined maximum.

Final take

The most important thing to remember is that Form 1040 and Form 1099 are partners, not competitors. While 1099s provide the individual pieces of your financial puzzle throughout the year, Form 1040 is where you put them all together to give the IRS a complete picture.

By staying organized and ensuring every 1099 you receive is accurately reflected on your 1040, you protect yourself from common filing errors and costly IRS penalties. Whether you are an individual filer, a freelancer, or a business owner, proactive record-keeping is your best defense against tax-season stress.