Employment laws in New York you should know

Maneuvering through the complex employment laws in New York can pose a difficult challenge for businesses. From adhering to labor laws in NY regarding minimum wage and overtime pay to understanding intricate leave policies and anti-discrimination safeguards, adherence to these laws is essential for nurturing a successful and legally sound workplace.

In this blog, we detail essential New York labor laws, covering wage and overtime laws, leaves including sick leave, paid time off, and required employee benefits. It also emphasizes crucial steps to avert discrimination and harassment in the workplace. Staying updated on these regulations is not only a legal obligation but also the foundation for encouraging a just and efficient workplace. Furthermore, this blog explores the dangers linked to non-compliance and how Global Squirrels can help you manage the intricacies of employment laws in New York for smooth and compliant operations.

What are some key New York labor laws?

Minimum wages

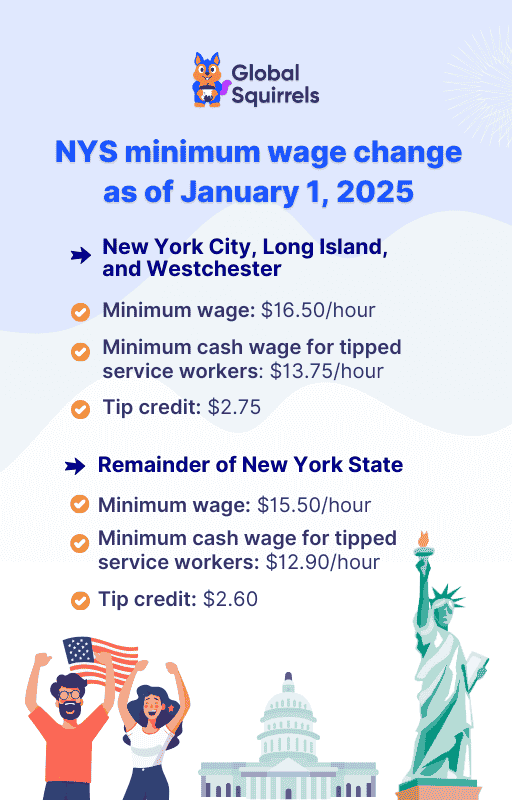

As of January 1, 2025, New York’s minimum wage differs by region, with New York City, Long Island, and Westchester established at $16.50 per hour, while the rest of the state stands at $15.50 per hour. In New York City, Long Island, and Westchester, the minimum cash wage for tipped service workers is $13.75, with a $2.75 tip credit, while for the remainder of the state, it is $12.90 with a $2.60 tip credit.

Work hours & overtime pay

According to New York labor laws, workers typically have the right to overtime compensation at 1.5 times their standard hourly pay for each hour worked over 40 hours in a workweek, as per the employment laws in New York. This is similar to the employment laws in Arkansas. Your business must follow these guidelines to ensure fair treatment and avoid fines. Labor laws in NY also regulate the maximum allowable work hours, meal breaks, and rest periods, enhancing worker safety and health. Adhering to these employment laws in New York is essential for you to uphold a productive and legally compliant work environment.

Leaves

In New York, employees are entitled to take leaves under the NYC paid safe and sick leave law, which ensures that eligible employees can take time off for personal or family health, legal or social support, or safety actions in cases of domestic violence, stalking, or human trafficking. If your company has 100 or more employees, you are required to offer up to 56 hours of paid leave per year, whereas those with 5 to 99 employees need to provide 40 hours of paid leave annually.

Benefits

Employment benefits in New York aim to offer extensive support and motivation for your employees. This ensures a balance between professional growth and personal well-being. These benefits consist of competitive pay adjusted to job specifications, education, experience, and workplace location.

Retirement plans are provided via the NYS Employee’s Retirement System (ERS), which provides income post-retirement and additional benefits such as loan options, disability retirement, and death benefits. Full-time permanent employees must enroll in ERS, with retirement benefits based on credited years of service, age at retirement, and average final salary. Workers also keep their service credit when moving between State agencies.

Manage compliance in New York effortlessly!

Global Squirrels simplifies compliance with labor laws and eases your hiring process by managing HR functions from fair wages and managing work hours to offering employee benefits and paid leaves.

Request a demoDiscrimination and harassment laws in New York

New York State enforces strong laws against discrimination and harassment to guarantee equal job opportunities and safeguard individuals from unjust treatment in the workplace. According to the New York State Human Rights Law, it is illegal to discriminate against individuals based on age, race, color, national origin, sexual orientation, gender identity or expression, military status, sex, disability, familial status, marital status, genetic predisposition, or status as a survivor of domestic violence. These regulations pertain to every facet of employment, encompassing recruitment, termination, advancements, compensation, and working environments.

Harassment is forbidden, including any verbal, physical, or job-related behavior that belittles or frightens individuals based on protected characteristics. You must take proactive measures to avert discrimination and harassment by establishing policies, offering yearly training, and promptly and thoroughly addressing complaints.

What are the consequences of not complying with New York laws?

Failing to adhere to New York labor laws presents significant legal, financial, and reputational risks for your business. According to New York Labor Law (NYLL), not paying wages is a criminal act, where initial violations are treated as misdemeanors and subsequent violations within six years are escalated to felonies.

Sentences may involve imprisonment for a maximum of one year and one day, alongside fines reaching $20,000. Corporate leaders and major shareholders of corporations and LLCs may also face personal liability for unpaid wages, increasing their financial risks. Moreover, not delivering wage supplements or benefits within the required timeframe is penalized under NYLL 193-c, raising the consequences for non-compliance even more.

The challenges are intensified by robust whistleblower protections, which shield your employee who discloses wage infractions from retribution. If you penalize whistleblowers, you may incur consequences, such as fines and criminal accusations. Whistleblowers are also entitled to seek private legal recourse under NYLL 741, which could result in expensive settlements or rulings.

Federal statutes such as the Employee Retirement Income Security Act of 1974 (ERISA) might supersede specific state claims, introducing an additional level of complexity to labor law conflicts. In instances of employer bankruptcy, outstanding wages and benefits can go unresolved, leading to additional legal issues. These risks emphasize the necessity of complying with employment laws in New York to prevent considerable legal, financial, and operational repercussions. These challenges are not unique to New York; for instance, Florida employment laws also impose strict penalties for wage violations and other non-compliance issues.

How does Global Squirrels help you stay compliant with the NY employment laws?

Global Squirrels is a staffing and payroll platform that helps you manage your employees effectively. Our Purple plan helps you handle all HR functions, enabling you to handle all compliance-related challenges as well. Our staffing and payroll platform analyzes and prioritizes all complex employment laws in New York. It has built-in functionalities such as payroll and timesheet setup, task and performance management, benefits administration, and compliance with all local labor and tax laws.

A key feature of the Purple plan is its comprehensive compliance management. The platform ensures adherence to national and state-specific employment laws, including the complexities of New York labor regulations. Automated payroll and tax processing guarantee accurate salary calculations, timely statutory deductions, and compliance with local laws. Our platform provides secured and streamlined control over payroll operations, timesheets, and performance tracking.

How does the Purple plan work?

The Purple plan helps you effortlessly onboard an already-sourced candidate or your current freelancer as a full-time employee. To begin, you must sign up and choose the Purple plan. Here, you will need to fill in the candidate’s details, such as full name, email address, the location where you want the candidate to work from, job title, job duties, expected start date, and any onboarding document you wish to attach. Our platform will then handle all HR functions, including payroll and timesheet setup, benefits administration, task & performance management, and compliance with national employment laws in the USA.

Do you have any questions? Request a demo today!