Texas Employment Law Compliance: A Guide for Businesses

Understanding Texas employment laws is not just about following the rules but also about building a workplace where everyone feels secure and valued. From fair wages to anti-discrimination policies, staying informed helps protect both you and your employees. When you know the laws, you can create a work environment that is not only compliant but also fair, productive, and built on trust.

In this blog, we will outline several important employment laws in Texas you should be aware of, addressing issues such as work hours, leave policies, benefits, and anti-discrimination laws. We will also examine the possible outcomes of failing to comply and, in conclusion, present how Global Squirrels can assist in optimizing your HR procedures and guarantee you remain legally compliant through their all-inclusive plans.

What are some key Texas labor laws?

Minimum wages & overtime pay

The current basic minimum wage rate in Texas is $7.25 per hour. This matches the federal minimum wage set under the Fair Labor Standards Act (FLSA) as of 2025. According to the employment laws in the USA, employees must be paid 1.5 times their hourly wages when working overtime.

Work hours

Like New York, Texas offers a 40-hour work week. Both states emphasize fair work-hour regulations to ensure employee well-being. Click here to read more about the employment laws in New York.

Leaves

Texas laws provide state employees with a range of leave options to accommodate personal, family, medical, and civic needs and to allow for flexibility and support of their well-being. These provisions are integral to maintaining compliance with employment laws in Texas.

- Vacation leave: According to the employment laws in Texas, employees are entitled to an accumulating vacation leave, which starts with 8 hours per month for employees with less than 2 years of service and increases to 21 hours per month for employees with more than 35 years of service. Employees can save unused leaves and carry them forward to set limits for the next fiscal year.

- Sick leave: Employees are entitled to 8 hours of sick leave per month. Personal illness or injury or to care for an immediate family member may be used for sick leave. If the leave exceeds three consecutive work days, the employee has to provide documentation to his employer.

- Emergency leaves: Employees are also entitled to emergency leave for the passing of a family member or other emergencies approved by the agency administrative head. Employees are also eligible for paid leave because agency closures due to weather or other emergencies are considered closures.

- Family and medical leave (FMLA): Employees with at least 12 months of service and 1,250 work hours are entitled to up to 12 weeks of unpaid leave for qualifying reasons, including childbirth or serious health. Paid parental leave may also be available to newly implemented policies for eligible employees according to the employment laws in Texas.

- Volunteer and civic duties leave: Employees may take leave without a salary deduction for volunteer and civic duties, including donating blood (up to four times a year), voting, jury duty, becoming a volunteer firefighter, or an emergency medical volunteer. Court-appointed special advocates (CASA) volunteers are also entitled to leave for related responsibilities.

Partner with Global Squirrels for seamless HR and compliance solutions!

Simplify your workforce management with Global Squirrels! From managing payroll and benefits to ensuring compliance with employment laws in Texas and streamlining your HR processes.

Get a demoBenefits

According to the employment laws in Texas, employees must have access to comprehensive benefits designed to promote their health, financial security, and overall well-being.

- Health coverage: The Texas Employees Group Benefits Program (GBP) provides health coverage for employees, retirees, and their families.

- State contributions: According to the employment laws in Texas, the state covers 100% of the monthly premium for full-time employees and 50% for eligible family members.

- Shared costs: Employees share costs through copays, coinsurance, and deductibles. The state typically contributes over twice as much as employees toward health costs.

- Defined benefit plan: The Employees Retirement System of Texas (ERS) is a defined benefit plan in which employees automatically become members upon employment. The retirement pension also provides a stable monthly annuity for life.

- Retirement eligibility: It is based on the employee’s hire date, years of service, age, and salary.

- Employees hired before September 1, 2022, receive a benefit based on salary and years of service.

- Employees hired after that date received a 150% or 300% match (according to years of service) on their ERS accounts when they retire.

- Supplemental income: The employment laws in Texas require you to encourage employees to save for retirement using the Texa$aver 401(k)/457 Program to supplement their ERS pension and Social Security benefits.

Other benefits include:

- Dental insurance: Comprehensive plans for dental care.

- Vision insurance: Coverage for eye exams, glasses, and more.

- Life insurance: Options include:

- Optional life insurance for employees and retirees.

- Dependent Term Life Insurance for family members.

- Income protection: Short-term and long-term disability insurance through the Texas Income Protection Plan (TIPP) offers income replacement during illness or injury.

- Accidental death & dismemberment insurance: Provides financial protection in case of accidental death or severe injuries.

- Flexible spending accounts (TexFlex): Tax-advantaged accounts for health care, dependent care, dental, and vision expenses.

- Discount purchase program: Discounts on various products and services.

Discrimination and harassment laws in Texas

Similar to the employment laws in Arkansas, Texas’ comprehensive laws protect employees from discrimination and harassment in the workplace. This creates fair treatment and gives employees fair market quotes in the event that they experience unlawful actions in accordance with their personal characteristics or identities.

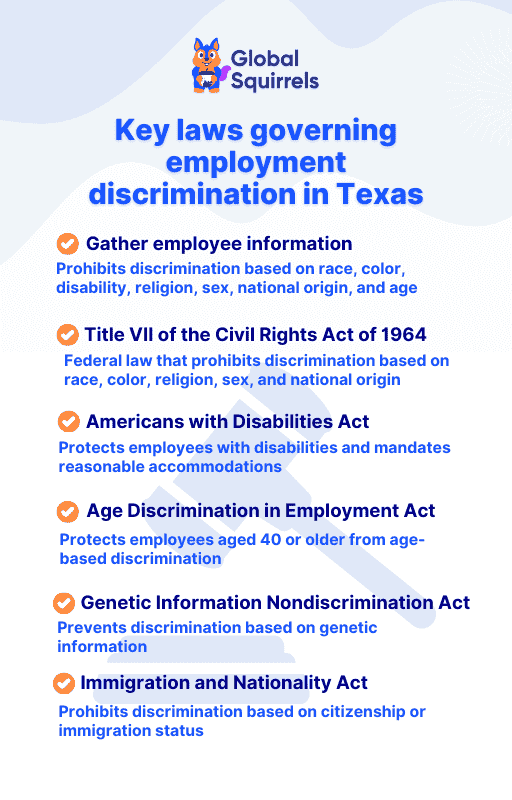

Discrimination laws

The following traits are prohibited by the employment laws in Texas workplaces for discrimination.

- Race and color: Race and color cannot be used to make decisions about hiring or treating someone unfairly.

- National origin: The employment laws in Texas prohibit an individual’s discrimination against their ancestry, birthplace, or cultural characteristics.

- Religion: According to the Employment laws in Texas, employees should not be treated differently or harassed for engaging in their religious beliefs. Reasonable accommodations have to be provided by employers unless it creates an undue hardship.

- Sex and gender: This prohibits discrimination based on sex, gender identity, pregnancy, sexual orientation, or sexual harassment.

- Age: This protects employees aged 40 or older under the Age Discrimination in Employment Act (ADEA).

- Disability: Employers must not discriminate against qualified employees with disabilities and must provide reasonable accommodations under the Americans with Disabilities Act (ADA).

- Genetic information: Protection under the Genetic Information Nondiscrimination Act (GINA) against discrimination based on genetic tests or family medical history.

- Citizenship or immigration status: Employers are prohibited from discriminating based on citizenship or immigration status under the Immigration and Nationality Act (INA).

Harassment laws

Harassment is a type of discrimination in which a person is harassed in the workplace on account of a protected characteristic.

- Sexual harassment: Includes unwelcome sexual advances, requests for sexual favors, or creating a hostile work environment through inappropriate jokes or comments.

- Racial harassment: This includes slurs, offensive stereotypes, or workplace segregation based on race.

- Other forms of harassment: Harassment related to religion, gender identity, disability, and other protected traits.

What are the challenges of not complying with Texas laws?

Non-compliance with employment laws in Texas can lead to severe consequences for your business.

Administrative violations by representatives of employees or legal beneficiaries

- Failing to attend dispute resolution proceedings without good cause.

- Withholding unauthorized amounts from benefits or settlements.

- Violating professional conduct rules (Sec. 415.001).

Employer violations

- Charging employees directly or indirectly for workers’ compensation premiums.

- Exposing themselves to lawsuits for damages due to such violations (Sec. 415.006).

Fraudulent acts

- Making false statements or fabricating documents to obtain or deny benefits.

- Employers denying rightful benefit payments are liable for past payments with interest (Sec. 415.008).

Frivolous actions:

- Initiating claims or actions without a basis in fact or law is an administrative violation (Sec. 415.009).

Sanctions

- Penalties for violations may reach up to $25,000 per day per occurrence.

- Repeat violations can result in cease-and-desist orders, suspensions, or revocations of licenses or certifications (Sec. 415.021).

How does Global Squirrels help eliminate all the challenges?

Global Squirrels is a staffing and payrolling platform that helps you manage top talent in the USA. Our Purple plan helps you handle all HR functions, such as payroll and timesheet setup, benefits administration, task and performance management, and compliance with all local and national labor and tax laws.

What does the Purple plan offer you?

The Purple plan allows you to onboard an already-sourced candidate or your current freelancer as a full-time employee. To be able to do this, you must log in and choose the Purple plan, where you can fill in your candidate’s details such as their full name, email address, your business’s email address for the candidate, job title, job duties, expected start date, and any onboarding document you wish to add. Once the onboarding process starts, our platform will handle all the HR functions.

The Purple plan simplifies compliance with Texas’ employment laws and other states, such as Florida employment laws, empowering you to focus on growth without worrying about legal risks. Our platform ensures adherence to local employment regulations, minimizing risks like employee misclassification and non-compliance with payroll and tax requirements. By leveraging country-specific tools such as customized timesheets, automated leave management, and real-time compliance analytics, our platform helps you navigate complex labor laws across multiple regions seamlessly.

Additionally, the Purple plan handles payroll with precision, calculating salaries, taxes, and statutory deductions while ensuring timely payments. Our AI-powered features streamline processes like offer letter generation and compliance assessments, while our user-friendly portal simplifies sensitive tasks such as pay raises and termination requests. By partnering with our platform, your business stays compliant, efficient, and ready to thrive in the workforce.

Finding it challenging to keep up with all the employment laws in Texas? Eliminate all the challenges by requesting a demo today!