Hire insurance virtual assistants: The complete guide for your agency

Insurance agencies are currently handling increasing workloads, high customer expectations, and tight deadlines. To handle this effectively, multiple agencies are hiring insurance virtual assistance to support everyday operations such as policy processing, customer follow-ups, data management, and claims assistance.

Insurance virtual assistants help agencies save time, reduce costs, and enable licensed agents to focus on client relationships and sales. This blog explains how insurance agency virtual assistants work, what tasks they can handle, and how the agency can confidently hire the right support team.

Why insurance agencies are hiring virtual assistants

Insurance agencies face rising workloads, heightened customer expectations, and greater operational pressure. Handling policies, claims, renewals, and client communication can consume valuable time, thus leaving agents with reduced focus on sales and customer relationships.

To overcome the challenges, multiple agencies are hiring virtual assistants to support daily operations cost-effectively and efficiently.

The reason insurance agencies are increasingly hiring virtual assistants includes the following:

- Reduction in administrative workload: Virtual assistants handle repetitive tasks, including data entry, policy processing, and documentation.

- Improves customer response time: Virtual assistants handle emails, follow-ups, and appointment scheduling, thereby improving client satisfaction.

- Lowers operational costs: Hiring virtual assistants reduces expenses for office space, equipment, and full-time overhead.

- Increased focus on licensed agents: Agents can spend increased time on sales, renewals, and client advisory work.

- Quicker turnaround on renewals and claims: Administrative support helps process requests more accurately and quickly.

- Scalable staffing model: Agencies can scale support teams down or up based on workload.

Virtual assistants for insurance agents: roles and responsibilities

Insurance agency virtual assistants play an important role in helping agencies handle daily operations efficiently. By handling administrative and back-office responsibilities, they enable licensed insurance agents to focus on client retention, business growth, and sales. Given below is a clear breakdown of the key responsibilities handled by an insurance virtual assistant.

- Manage the policy data entry, endorsements, documentation, and updates

- Collect the claim data, track claim status, and prepare documents

- Handle follow-ups, appointment scheduling, basic client queries, and emails.

- Track policy renewals, ensure timely processing, and send reminders

- Update client records, maintain accurate databases, and organize documents

- Helps in preparing insurance applications and quotes

- Organize contracts, forms, and compliance-related files

- Prepare the daily, weekly, or monthly operational reports

- Handle calendars, internal workflows, and task coordination

- Monitor pending actions along with carriers and clients.

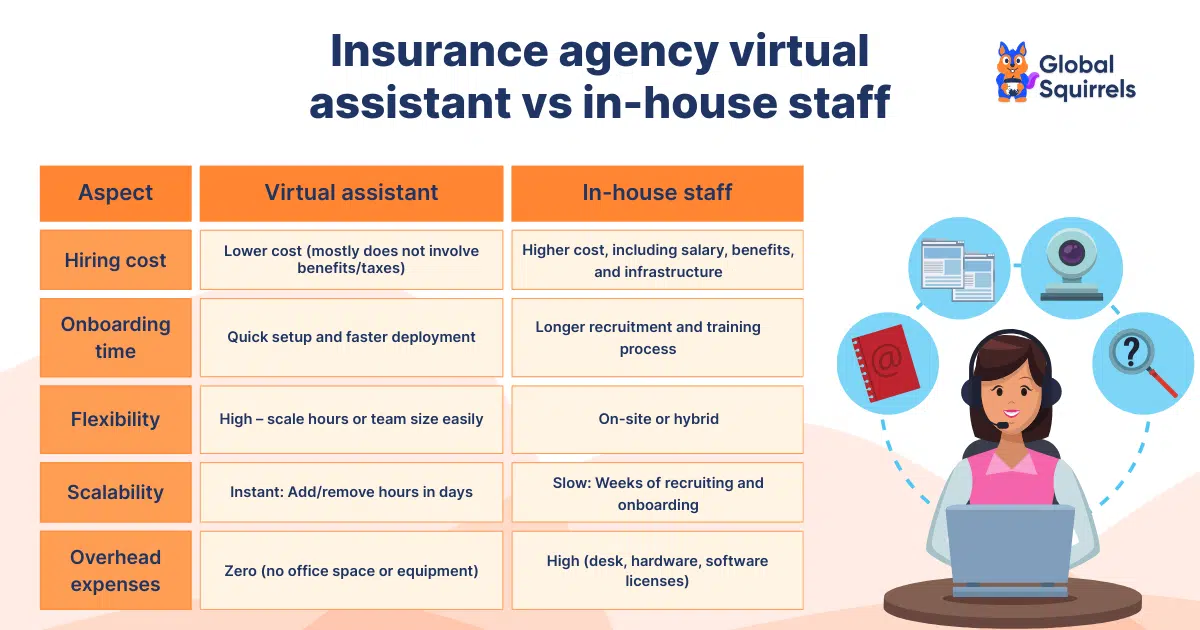

Insurance agency virtual assistant vs in-house staff

As insurance agencies grow, handling administrative workloads and operational costs becomes increasingly challenging. Choosing between an in-house and a virtual assistant for an insurance agency depends on factors such as budget, flexibility, long-term business goals, and workload volume. The comparison below highlights the key differences to assist agencies in determining the most efficient staffing model for the operations.

Top countries to hire virtual assistants for an insurance agency

When hiring virtual assistants for insurance agencies, choosing the right country can help you find the best balance of cost-efficiency, cultural alignment, skills, and English proficiency. Given below are some of the top destinations where insurance agencies frequently hire dedicated insurance virtual assistant.

Philippines

- Strong English communication skills and a strong customer service orientation.

- Experience in supporting claims, administrative tasks, and insurance.

- Cultural alignment with Western and US businesses

- Cost-effective

- Overlap in time zone with multiple global markets

India

- A huge talent pool with insurance support and back office experience

- High proficiency in CRM management, data tasks, and documentation

- Competitive hourly rates and flexible engagement models

- Strong technical skills for process and workflow automation

- Huge range of skill levels, ranging from entry level to experienced specialists

Mexico

- Advantages in time zone and close proximity to the US

- Strong bilingual language skills

- Great for roles like customer service, policy processing, and claims support.

- Reduced operational cost when compared to onshore hiring

- Cultural understanding close to North American work practices

Latin America

- Increasing the talent pool with great customer service skills

- Great bilingual capacities

- Culturally aligned with North American businesses

- Cost-efficient for support function

The best country to hire an insurance virtual assistant depends on the agency’s priorities. It includes factors such as cost savings, time zone alignment, communication quality, or specialized task handling.

How much does a VA cost per hour?

Virtual assistant (VA) hourly rates typically range from $3 to over $35 per hour, heavily influenced by location, experience, and specialization. Offshore VAs (Philippines, India, and LATAM) generally cost $3–$12/hour for general admin, $6–$15/hour for specialized roles, while US/Canada-based or highly specialized VAs often range from $18–$30+ per hour.

Insurance virtual assistants from the Philippines

With strong proficiency in English, a customer-centric work culture, and extensive experience in insurance support roles, Filipino virtual assistants help agencies operate efficiently while controlling costs.

Reasons to hire insurance virtual assistants from the Philippines include:

- Strong communication skills: Filipino professionals are known to be fluent in both written and spoken English, ensuring professional, smooth client interactions.

- Experience in insurance operations: They have extensive industry experience supporting renewals, claim processing, policy administration, and documentation.

- Cost-effective hiring: Agencies can reduce operational costs by hiring Filipino talent at just 1/4 the cost of their current hires.

- Culturally aligned with US companies: Communication style, business practices, and work ethics align well with US insurance firms.

- Flexibility in working hours: Virtual assistants can support US business hours or extended coverage when required.

Depending on their location, skills, and experience, hiring an insurance virtual assistant from the Philippines can cost $800-$1,200/month (based on recent Glassdoor data). This offers a cost-effective way to handle policy support, renewals, and administrative tasks while improving service efficiency.

Insurance virtual assistants from India

India is one of the leading countries for hiring insurance virtual assistants, offering a large talent pool, strong analytical skills, and extensive experience in insurance-related operations. With proven experience in data management, documentation, and process-driven work, Indian virtual assistants help insurance agencies improve efficiency and reduce operational costs.

Reasons to hire virtual assistants for insurance agents from India include:

- Vast pool of insurance-skilled talent: India has professionals experienced in underwriting support, renewals, policy administration, and claims processing.

- Documentation skills and strong process: Perfect for handling accuracy-dependent tasks, compliance documentation, and high-volume paperwork.

- Affordable hiring model: Hiring a VA from India can be significantly lower than what you are paying now, without any compromise on quality.

- Exposure to US insurance markets: Virtual assistants have prior experience in the US insurance sector.

According to AmbitionBox, hiring an insurance virtual assistant from India can cost you $600-$1,100/month. This makes India a great solution for handling insurance virtual assistance tasks at a cost affordale rate.

Insurance virtual assistants from Latin America

With strong alignment in time zones, bilingual talent availability, and growing insurance support expertise, Latin American virtual assistants help businesses deliver quick response times and improved customer experiences.

Reasons to hire insurance virtual assistants from Latin America include:

- Alignment with the US time zone: Collaboration across time zones during business hours improves communication and productivity within a business.

- Vast bilingual talent: Latin Americans are perfect for businesses that are especially serving Spanish-speaking customers.

- Strong communication skills: Latin Americans are perfect for client-facing insurance support roles.

- Experience with US insurance processes: Various professionals support policy serving, renewals, and claims follow-ups.

Insurance virtual assistants from Mexico

Mexico has lately become a nearshore destination for hiring insurance virtual assistants, usually for US-based businesses. Mexican virtual assistants help businesses deliver quick service while also maintaining cost efficiency using time-zone alignment, bilingual English-Spanish talent, and growing experience in insurance operations.

Reasons to hire insurance virtual assistants from Mexico include:

- Similar to US time zones: Mexican talent allows real-time collaboration during standard business hours.

- Bilingual language support: Mexican talent is ideal for agencies who are serving Hispanic and bilingual customer bases.

- Strong customer communication skills: This talent is well-suited for follow-ups, client support, and policy serving.

- Familiarity with US insurance workflows: Various professionals support renewals, claims coordination, and policy processing.

According to recent Glassdoor data, hiring an insurance virtual assistant from Mexico will cost $1,088- $1,203/month.

How to hire an insurance virtual assistant?

To enhance long-term value, it is vital to follow a structured hiring approach that ensures the right skills, compliance, and workflow alignment.

Given below is a detailed framework to help you hire the right insurance virtual assistant.

Step 1: Identify the tasks you would like to outsource

Begin by listing the responsibilities you would like to delegate. This can include:

- Policy processing and documentation

- Follow-ups and assistance with claims

- Renewal tracking and reminders

- Data management and CRM

- Scheduling and customer communication

Step 2: Define the required experience and skills

You should look for candidates with:

- Exposure to the insurance industry

- Experience with CRM or AMS tools

- Strong verbal and written communication skills

- close attention to detail

- Understanding the compliance-driven workflows

Step 3: Pick the right hiring model

You should decide the engagement structure based on your workload. The hiring model includes:

- Full-time or long-term support

- Contractor or project-based

- Freelancer

Step 4: Select the best hiring location

Popular regions from where you can hire include:

- Philippines: The talent there has a strong communication and insurance support background

- India: Talent here has excellent documentation skills and back-office expertise

- Mexico and Latin America: The talent in this region has nearshore, bilingual, and real-time support

Step 5: Conduct a role-specific screening

You can evaluate candidates using:

- Insurance and task-based interviews

- Documentation assessments and CRM

- Communication tests

- Scenario-related problem-solving

Step 6: Ensure compliance and data security

You should put rules for safe practices in place. This can include:

- NDA agreements and confidentiality

- Controlled access to systems

- Secure data handling policies

- Compliance-aligned workflows

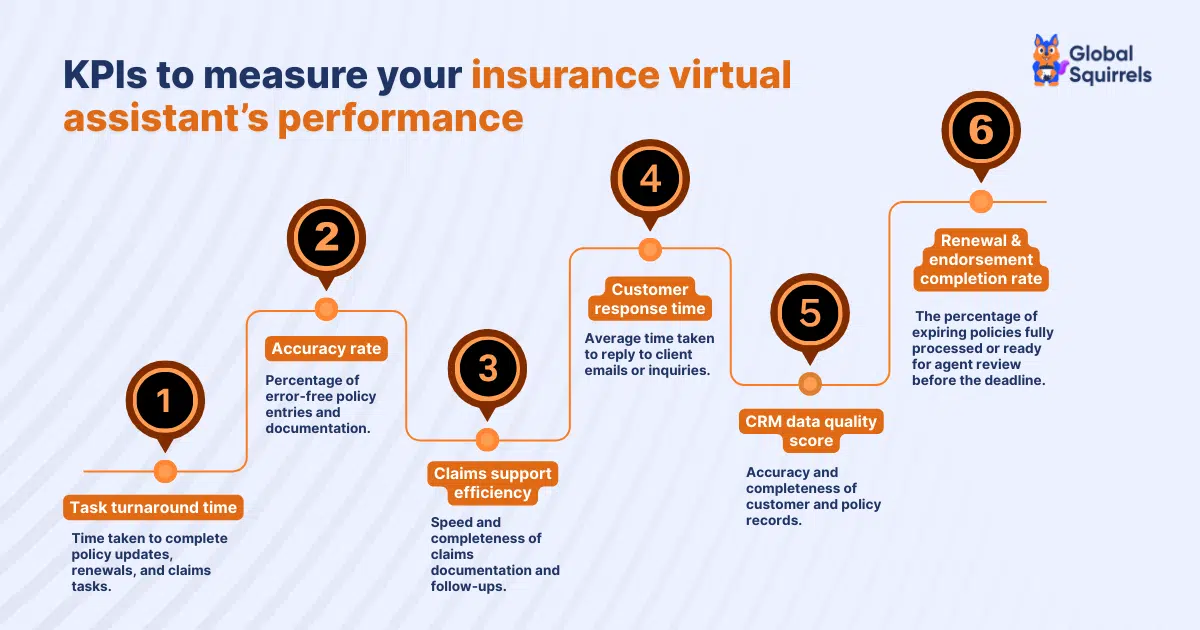

Step 8: Establish a clear KPI and processes

You should define the following clearly:

- Daily and weekly responsibilities

- Performance benchmarks

- Reporting structure

Step 9: Provides a structured onboarding

Share the following in detail

- SOPs and direction of workflow

- System access training

- Communication and email templates

- Compliance guidelines

Key skills to look for in an insurance agency virtual assistant

When hiring an insurance virtual assistant, you will need someone who can do more than just the basic tasks. The right blend of technical ability, communication, industry knowledge, and attention to detail will make sure they add real value to the agency.

-

Strong knowledge in the insurance industry

Insurance virtual assistants must understand administrative processes, including renewals, endorsements, policy updates, and claims tracking. Knowledge of insurance workflows will reduce the training time and improve performance.

-

Communication skills

Professional and clear communication is important for internal collaboration and client interactions. Communication skills help virtual assistants understand policy details concisely and handle follow-ups effectively. This is the key to customer satisfaction.

-

Data management expertise and CRM

Proficient use of CRM and agency management systems helps maintain clear client records and improve operational efficiency. You can look for experience in tools like AMS360, Zoho CRM, or Applied Epic.

-

Detail to attention

Accuracy is important in insurance support. Errors in documentation or data entry can result in compliance issues or delays. A virtual assistant with great attention to detail can reduce costly mistakes significantly.

-

Organizational and administrative skills

Insurance virtual assistants require strong organizational skills to handle the paperwork, daily operations, and task follow-ups. These skills raise the overall productivity massively.

-

Mindset for customer service

Multiple insurance tasks involve direct client interaction. A virtual assistant with a customer-centered focus helps in enhancing client retention and experience.

Data security and compliance considerations

Insurance agencies handle highly sensitive data, including customer identities, financial records, claims data, and policy documents. When working with virtual or remote assistants, strong data security and compliance controls are important to prevent breaches, protect client trust, and ensure regulatory adherence.

A secure framework enables agencies to scale operations confidently while also maintaining complete control over compliance obligations and data access.

The key data security and compliance measures include the following:

1. Access to controlled systems

- You can grant access strictly based on the responsibilities of the job

- Apply role-based permissions within policy systems and CRM

- Restrict access to unnecessary files or applications

2. Secure transmission and data storage

- Use encrypted cloud storage platforms

- Avoid local downloads of sensitive documents

- Enforce secure email and file sharing protocols

3. Legal protection and confidentiality

- Define confidentiality obligations as clearly as possible

- Implement signed NDAs prior to onboarding

- Establish policies for data violations or misuse

4. Compliance with data protection regulations

- Follow applicable labor and privacy regulations

- Maintain an audit-temporary documentation

- Ensure alignment with insurance industry compliance standards

5. Network and device security

- This requires secure devices with updated antivirus protection

- Enforce VPN usage when accessing internal systems

- Restrict use of unsecured public networks

6. Security awareness and training

- Provide mandatory data privacy training

- Educate virtual assistants on phishing and cyber risks

- Reinforce secure handling of client information

Common mistakes when hiring remote insurance virtual assistants

Various insurance agencies may face challenges because of avoidable hiring and management mistakes. Identifying these at an early stage helps ensure smooth operations, long-term success, and better productivity.

Given below are the most common mistakes insurance agencies make:

- Hiring without insurance industry experience: Choosing a general virtual assistant without insurance industry knowledge can often lead to errors in policies, claims, and documentation.

- Unclear role definition: Assigning tasks without predefined responsibilities can lead to confusion, missed deadlines, and inconsistent performance.

- Poor communication structure: The lack of scheduled check-ins or unclear reporting results in misalignment and delays.

- Skipping proper screening: Hiring without role-based testing or insurance task evaluation usually results in mismatched skills.

Final takeaways for insurance agencies

Hiring insurance virtual assistants from key countries, such as India, the Philippines, and Mexico, can help your organization reduce administrative burden, enhance response times, and manage operating expenses. They allow agents to concentrate on sales and client relationships when they are hired with the appropriate abilities, transparent procedures, and robust data security safeguards. For insurance companies, a methodical, compliance-first approach ensures reliable support, increased productivity, and scalable growth.