How to reduce payroll costs of a global team

Businesses these days are expanding across borders, thus building diverse and distributed global teams to tap into new markets and talent pools. Although this globalization will offer strategic advantages, it will also accompany some complicated financial challenges. The primary challenge is managing the employee payroll costs across multiple countries, currencies, and compliance issues.

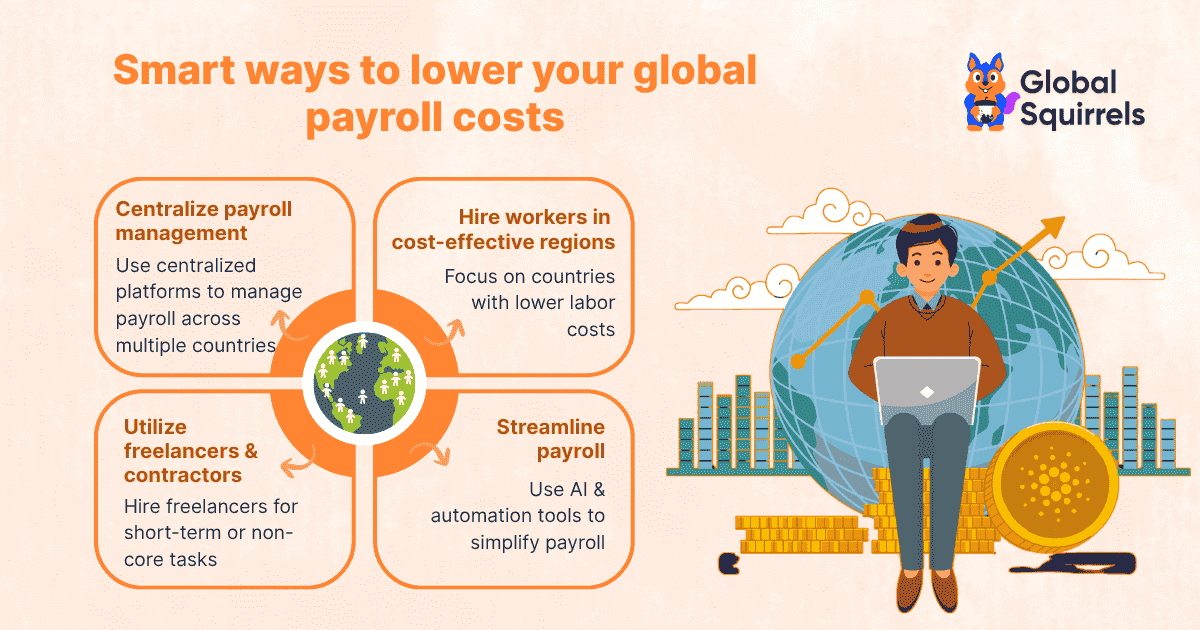

As the economic pressure is mounting and competition is constantly intensifying, companies are looking for sustainable and smart ways to reduce payroll costs without compromising on talent quality, productivity, or legal compliance. Whether you are a startup or an established business with teams across continents, optimizing the payroll strategy is important for long-term success.

In this blog, we have enlisted practical, ethical, and legal strategies to reduce the payroll costs for the global workforce.

3 ways to bring down your global employees’ payroll costs

Reducing the employee payroll costs while also maintaining talent quality and legal compliance will require a well-structured and proactive approach. Given below are a few ways to reduce payroll costs:

A. Optimize the hiring model

1. Contractors vs employees

Hiring an independent contractor instead of full-time employees can offer major flexibility and cost savings, which is especially true for specialized work or project-based work. Contractors will typically not require tax contributions, benefits, or long-term commitments, which will lower the fixed costs. However, it is important to make sure there is proper classification to avoid any legal penalties. To clearly understand how contractors differ from employees, check our guide which talks about the differences between independent contractors and employees.You can use contractors when:

- The work is project-specific or short-term

- The contractor has autonomy over how they complete the work

- Local labor laws support contractor relationships

2. Employer of record (EOR)

An Employer of Record will allow you to hire international talent without legally setting up a local legal entity. It will become the official employer and will handle the payroll, taxes, and compliance on your behalf. The benefits usually include:

- Quick market entry into new areas

- Reduced legal and administrative costs

- Allow expanding workforce globally at affordable rates

Understand the benefits of partnering with an Employer of Record to help your business scale better.

B. Leverage geographic arbitrage

Geographic arbitrage will involve hiring skilled talent in regions where the cost of living and salaries are low. Some of the top talent sourcing destinations include India and the Philippines. With remote work becoming the norm, organizations can easily tap into high-quality talent in emerging markets. Businesses can reduce the payroll costs of the team significantly without compromising output or talent by aligning compensation with local market standards while also maintaining global quality benchmarks.

Read more: Global hiring guide in India

What are the challenges of managing the payroll of a remote team?

Managing employee payroll for a global team is way more complex when compared to a domestic workforce. The challenges usually go way beyond just converting currencies or issuing payments. They involve cost variability, compliance, administrative burden, and strategic considerations, which can affect the overall financial health of the organization. Some of the key challenges include:

1. Fluctuations in currency

Paying employees in multiple currencies will expose companies to exchange rate volatility. A change in currency value could unexpectedly increase the cost of payroll or reduce the take-home pay of international employees, which will impact both employee satisfaction and budget.

2. Compliance with the local labor laws

Every country has its own set of labor laws, social security contributions, payroll reporting requirements, and tax regulations. Staying compliant is important to avoid audits, penalties, or legal disputes.

3. Changes in expectations for compensation

Salary benefits, benchmarks, and compensation norms tend to vary across multiple countries. A competitive package in one market might be excessive or inadequate in another.

4. Complexity in administration

Managing payroll across various jurisdictions will require coordinating with local providers, handling the diverse tax systems, maintaining efficient records, and managing various pay cycles.

5. Improper centralized systems

It is challenging to obtain a cohesive picture of worldwide payroll costs since many businesses handle payroll in each nation using different systems or local vendors. Cost optimization and strategic decision-making are hampered by this lack of transparency.

What are the fundamental factors that contribute to high global payroll expenses?

Global payroll costs will escalate efficiently if not managed properly. Beyond the basic salaries, various core factors will contribute to rising expenses when employing a distributed and international workforce. Understanding these fundamentals is important to identify areas for optimizing costs. Some of the key contributors include:

1. Disparities in salary due to geographical changes

Employee compensation will vary greatly depending on the location. Hiring talent in costly regions, such as Mexico, will typically involve high base salaries, taxes, and benefits when compared to low-cost regions like India and the Philippines.

2. Social contributions and local employment taxes

Various countries will need employers to contribute towards social security, pensions, healthcare benefits, and unemployment insurance. These contributions expected from the employer’s side will tend to increase the total cost of employment, which could sometimes add 20% to 50% or more on top of base salary.

3. Legal support costs and compliance

Employing local HR specialists, auditors, or legal consultants is frequently necessary to ensure payroll compliance. Proactive compliance is an inevitable and expensive aspect of handling global payroll since mistakes might result in penalties or legal action.

4. Employee misclassification

Misclassifying employees as independent contractors can result in penalties, reputational damage, and retroactive taxes. These unplanned costs could be substantial if multiple workers are misclassified in a jurisdiction.

5. Absence of automation in the payroll process

Payroll procedures that are manual or only partially automated result in errors, inefficiencies, and higher labor expenses. Businesses spend more time and money on payroll administration than is necessary when they don’t have efficient procedures.

How does the EOR solution offered by Global Squirrels optimize global hiring costs?

The Employer of Record solution offered by Global Squirrels is designed to simplify and reduce the costs associated with hiring global talent without the need for setting up foreign entities or navigating any complex labor laws independently. With our EOR platform, numerous companies have been able to save significantly on hiring key talent from countries like India, the Philippines, Mexico, and more.

Here is how the solution will help in optimizing global hiring costs:

1. Eliminates the need for local legal entities

Global Squirrels will act like the legal employer on behalf of your company, thus eliminating incorporation, legal fees, and any ongoing operational costs.

2. Reduce the compliance risk

Every country has unique employment laws, benefit requirements, and tax laws. Any wrong step can cause legal disputes, fines, or audits. Global Squirrels will ensure complete compliance with local regulations, thus helping you to avoid costly penalties and reputational risks.

3. Handle the payroll and benefit administration

By taking care of payroll, statutory benefits, and tax withholdings through a centralized platform, Global Squirrels will help you avoid any high costs of managing multiple local vendors or internal HR or payroll resources.

Global Squirrels offers three plans to meet the different hiring needs of businesses in the USA. The Orange Plan helps businesses find and hire talent that matches their requirements. The Purple Plan allows you to easily onboard candidates you’ve already identified. The Blue Plan is ideal for managing remote talent who will work from our offices in India, the Philippines, or Mexico. All these plans cover onboarding, payroll, and benefits administration, so you can focus on growing your business.

Understand in detail the functioning of our staffing and payrolling platform and see how Global Squirrels will make a difference in hiring talent globally.

Check our Global Squirrels Interactive Demo