Minimum wage by country: A quick guide

Understanding minimum wage laws is vital for businesses with local and international operations. Setting the correct pay is not just a matter of legal compliance; it will also directly impact employee satisfaction, productivity, and retention. With constantly changing regulations, rates, and enforcement mechanisms across multiple countries, navigating global compensation can get complicated. This is especially true for companies that are hiring remote teams or using contingent staffing solutions.

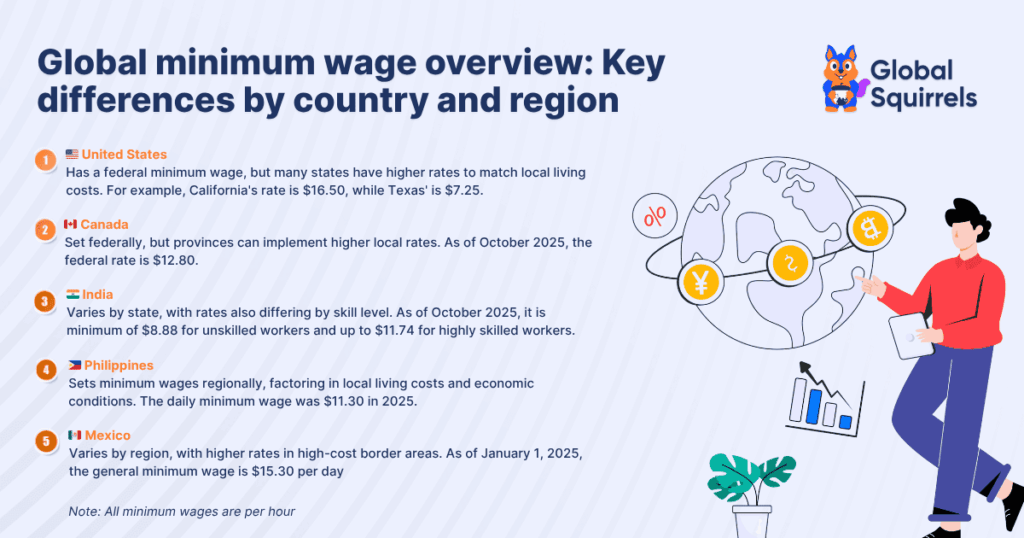

This blog provides a summary of minimum wages by countries, such as the USA, Mexico, Canada, India, and the Philippines, thus highlighting hourly rates, regional variations, and any changes in labor laws. Whether you are expanding your business overseas, handling freelancers, or onboarding remote employees, this blog will help you make the right decisions, ensure fair pay, and maintain compliance across borders. By understanding these, businesses can create an ethical, transparent, and competitive compensation strategy that will benefit the organization and its workforce.

What is minimum wage?

Minimum wage is the lowest legal amount that an employer can pay a worker for labor. This is usually set by a government or regulatory body. It is intended to ensure that employees earn a basic standard of living and are protected from any sort of exploitation.

Some of the key points about minimum wage include:

- Legal requirement: Employers should pay at least the minimum wage. Paying less is considered illegal.

- Depends on the region: Minimum wage around the world tends to change as per country, state, or city.

- Types of workers: It will usually apply to full-time, part-time, and, often, temporary workers. However, exemptions can exist for apprentices, interns, or casual workers.

- Calculation: It can be expressed as hourly, daily, or monthly rates, which depend on the country.

Minimum wage by country for key markets

Understanding minimum wage across countries is important for businesses, HR teams, and employers who are seeking to hire internationally or locally. Here is a snapshot of details related to countries with the highest minimum wage, ie, the USA and Canada, along with minimum wages in primary countries:

1. United States

- The U.S. sets a federal minimum wage per year. However, multiple states have higher rates to reflect local living costs.

- The federal minimum wage for covered nonexempt employees in some of the prominent states is:

- Texas: $7.25

- Arizona: $14.70

- California: $16.50

- Florida: $13

- Illinois: $15

- New Jersey: $15.49

- New York: $15.50

- Ohio: $10.70

Source: US department of labor

2. Canada

- With provinces authorized to set higher local rates, the Canadian minimum wage per year is determined through a federal process.

- It is $12.8 per hour, effective from 1st October 2025.

3. India

- Minimum wages tend to vary by sector and state, with multiple distinctions for skill levels.

- The central government advised a daily minimum of $8.88 for unskilled workers and up to $11.74 for highly skilled workers, effective from October 2025.

Source: Chief Labour Commissioner

4. Philippines

- Minimum wages are set regionally, keeping in mind the local living costs and economic conditions.

- Minimum wages in the Philippines remained unchanged at $11.30/day in 2025

Source: Department of labor and employment

5. Mexico

- Mexico differentiates wages across multiple regions, especially in higher-cost border areas.

- In Mexico, the general minimum wage as of January 1, 2025, is $15.3 per day.

Source: Trading Economics

What factors affect minimum wages in a country?

Several factors tend to influence the minimum wage in a country. These factors are often a mix of economic, social, and political considerations:

1. Cost of living

The minimum wage around the world is directly impacted by the price of housing, groceries, medical care, transportation, and other necessities of everyday life. Wage floors are frequently changed by governments to guarantee that workers in a certain area can maintain a minimal quality of life.

2. Economic conditions

Inflation rates, GDP growth, and the overall health of the economy will affect how much businesses can afford to pay and how governments set wage policies. During economic slowdowns, wage increases could get delayed to avoid burdening the employers.

3. Dynamics in the labor market

The supply and demand for labor play a vital role. High unemployment can slow down wage growth. Also, a shortage of skilled or unskilled workers can push employers to increase pay to attract talent.

4. Levels of productivity

Minimum wages are usually linked to the value employees create. Higher productivity can justify higher pay, as workers contribute more to the output and profitability of businesses.

5. Government legislation and policies

The minimum wage is set by regional and national pay-setting organizations, labor laws, and regulations. Decisions about labor rights and salary changes are often influenced by social programs and political priorities.

6. Industry and regional differences

Because living expenses and economic activity vary by sector or region, some nations have varied minimum wages. For instance, pay floors may be greater in urban areas with higher costs than in rural locations.

Consequences for an employer’s non-payment of minimum wages

Failing to comply with a country’s minimum wage laws can have serious implications for employers, which affect not just the employees but also their reputation, finances, and legal standing. Below are the key consequences employers might face for non-payment of minimum wages:

1. Legal fines and penalties

Employers who fail to pay the legally mandated minimum wage may be subject to penalties imposed by government agencies or labor boards. These fines can vary depending on the jurisdiction, but are usually substantial, especially for repeated offenses. In certain cases, employers might face daily fines for every single day the wage violation continues.

2. Legal action from employees

Employees who are not paid the minimum wage have every right to take legal action against the employer. Employees may file complaints with labor authorities or pursue civil lawsuits to seek compensation for unpaid wages. In certain cases, employees might be entitled to pay back, damages, and interest.

3. Damage to reputation

Companies that fail to pay the minimum wage risk incurring serious harm to their reputation. Negative publicity can harm an organization’s reputation, whether it originates from news sources, social media, or word of mouth. This could turn off prospective workers, customers, or business partners, resulting in missed opportunities and eroded confidence.

4. Increased employee turnover

Non-payment of minimum wages could result in low employee morale and dissatisfaction. Workers who are not fairly compensated might choose to leave, thus resulting in high turnover rates. This could lead to increased recruitment and training costs as well as a loss of valuable talent.

5. Regulatory examinations

Labor organizations may investigate the employer’s payroll procedures when wages are not paid. If infractions are discovered, employers may be required to undergo audits or take corrective action, which can be a time-consuming and resource-intensive process.

Hire top global talent without any business risk with Global Squirrels

Ensuring compliance with minimum wage laws is both a legal obligation and a reflection of ethical employment. Yet for companies operating across various countries, frequent updates, shifting rates, and country-specific labor rules make it very challenging. Global Squirrels is a staffing and payrolling platform that helps companies hire, manage, and pay top global talent while ensuring 100% compliance with local employment and labor laws, thereby eliminating business risks. Our Employer of Record (EoR) platform can help you stay compliant with global hiring in a number of ways. Our platform will automate payroll calculations in local currencies, thus taking into account minimum wage laws, currency fluctuations, and statutory deductions. This ensures employees are paid correctly and on time, thus reducing the risk of non-compliance and penalties.

In addition to minimum wage amounts, labor laws in different nations differ greatly in terms of enforcement, sanctions, and compliance procedures. Legal issues, penalties, and damage to one’s reputation might result from misinterpreting local laws. The EOR and payroll services by Global Squireels are designed to handle regional variations and legal complications. From proper employee classification to adherence to statutory benefits, our platform will ensure that your workforce remains fully compliant across multiple locations.

Our EOR platform stays up-to-date on minimum wage requirements across top talent sourcing countries, including India, the Philippines, Canada, and Mexico. Businesses can access accurate local wage data, which includes regional differences, industry-specific rates, and statutory benefits, thus helping companies in planning salaries/payments correctly.

We offer three hiring plans that cater to a company’s specific recruitment and EOR/payrolling needs.

Interested in knowing more about how our platform works?

Take a tour of our staffing and payroll platform and see how Global Squirrels makes a difference in hiring and managing top talent globally.