What is the Difference Between PEO and EOR?

Today, with business increasingly becoming globalized, companies are reaching out to new markets and talent pools by developing across borders. This expansion, however, presents numerous administrative and compliance challenges, particularly in regard to an international labor force. Understanding the PEO vs EOR models is essential for businesses aiming to navigate these complexities effectively.

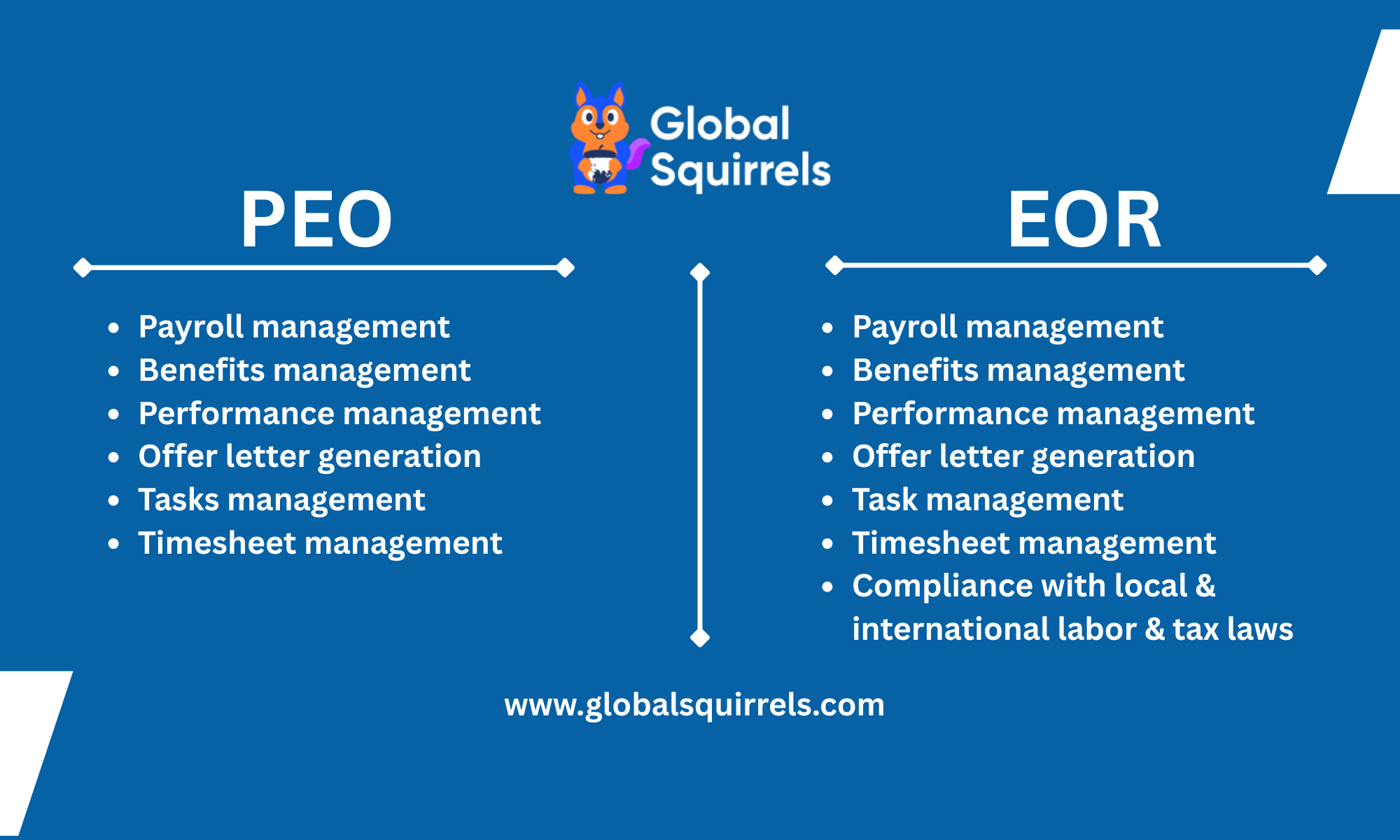

A Professional Employer Organization and an Employer of Record help a lot of organizations streamline workforce management and mitigate risks. While these two models share similarities, the difference between EOR and PEO lies in their scope, responsibilities, and the level of control they provide. The debate around EOR vs PEO often centers on the type of solutions required, with PEOs focusing on co-employment relationships and EORs acting as legal employers in foreign jurisdictions.

In this blog, we will dive into the intricacies of PEO and EOR, exploring their fundamental differences, benefits, and ideal use cases. For instance, EOR/PEO solutions cater to different business needs. For companies with existing entities, a PEO is a good option, while an EOR can be considered by businesses entering new markets and do not have a local presence at present. We’ll also discuss the factors to consider when choosing between PEO vs Employer of Record and highlight how Global Squirrels delivers value as a leading provider of global talent solutions.

Awareness of the PEO vs EOR difference helps businesses make the right decisions to maximize their global workforce strategies. Whether you are comparing employer of record vs PEO or evaluating the benefits of PEO and EOR, this guide will help you align your choice with your long-term goals for sustainable growth.

What is PEO?

A Professional Employer Organization (PEO) is a company that provides small to medium-sized businesses with a full array of human resources solutions. Under a co-employment arrangement, a PEO is the legal employer for tax purposes and handles the important HR tasks of payroll processing, employee benefits, compliance with labor laws, and risk management. This partnership enables businesses to outsource many of the HR responsibilities while still keeping their hands-on control of daily operations and employee management. When comparing PEO vs EOR, a PEO is often more suitable for businesses with an existing legal entity, while an Employer of Record (EOR) acts as the legal employer for companies entering new markets without establishing a local entity.

Why use PEO?

Businesses opt for PEO solutions for several reasons:

- Cost savings: Small businesses can cut their costs by using PEOs to negotiate better rates for employee benefits and insurance because PEOs have collective bargaining power. PEO solutions have a lot of benefits, one of which is this.

- Improved employee benefits: With PEOs, smaller businesses get access to competitive health insurance and retirement plans they may not be able to afford on their own, which is great for talent attraction and retention.

- Enhanced compliance: They help businesses navigate complex employment laws and decrease the risk of non-compliance and legal penalties. It is crucial for this expertise when dealing with EOR compliance in foreign jurisdictions.

- Increased focus on core business: Outsourcing HR tasks will allow businesses to have more time to work on growth and operational goals.

- Higher employee retention: Having a PEO helps employees get better benefits and support systems, which improves employee satisfaction and improves turnover rates.

- Access to expertise: PEOs specialize in HR management, helping businesses with recruitment, training, and performance management, with insights on par with what global PEOs can offer.

When should you use PEO?

- Rapid growth: PEOs can offer scalable HR solutions that help enterprises handle operations well during the growth of the company.

- Limited HR resources: For small businesses with a lack of human resources, a PEO guarantees compliance and easy management of employees.

- The desire for competitive benefits: If you can’t attract top talent, a PEO can help you affordably increase the benefits package.

- Navigating complex regulations: A PEO is a boon to businesses dealing with complicated employment laws because they can seek expert guidance and EOR compliance solutions.

If you’re a small business owner, Learn Top 10 Best PEO for Small Business

What is an EOR?

An Employer of Record (EOR) is a third-party company that takes on a company’s responsibilities, such as legal liabilities. With this arrangement, companies can employ employees without needing to create a local legal entity in an employee’s location. The EOR takes care of all employment responsibilities, including compliance with local labor laws, processing of payroll, paying taxes, and providing employee benefits.

Why use EOR?

Using an EOR offers several advantages for businesses navigating international markets:

- Simplified compliance: An EOR represents adherence to local employment laws and regulations that can be quite different from one jurisdiction to the next. It minimizes legal risks, and compliance is ideal for companies that are exploring EOR as a means of global expansion.

- Faster onboarding: Onboarding employees into new markets happens quickly without the need to establish a local entity. It manages admin so that businesses can focus on growth.

- Cost efficiency: It is expensive and time-consuming to set up a local legal entity. By partnering with an EOR, however, these costs are reduced and become a practical solution for businesses looking to expand internationally.

- Risk mitigation: EORs handle payroll management, compliance, and worker classification so that businesses don’t have to worry about employment-related liabilities. For companies comparing employer of record vs PEO, the EOR provides an edge for managing risk in new regions.

When should you use EOR?

Consider using an EOR in the following scenarios:

- International expansion: An EOR makes it easier to hire employees in foreign countries without a presence there. It is beneficial for startups and companies who rely on EOR for global expansion.

- Complex employment environments: An EOR simplifies compliance and administrative tasks in countries or areas where employment laws are different.

- Startups and staffing agencies: EORs help new businesses or staffing agencies operating workers across multiple locations to effectively handle back-office operations.

Check out Global Squirrels’ EOR platform to simplify your global hiring and payroll management.

Major differences between EOR and PEO

For businesses, workforce management can be a tricky route to take, making the decision between an Employer of Record (EOR) and a Professional Employer Organization (PEO) difficult. Understanding the difference between EOR and PEO is critical, particularly for those considering domestic versus international hiring strategies. In this post, we’ll break down the basics to help you decide which solution is right for your business.

1. Legal employment structure

- EOR: Your employees are hired by the EOR in their role as legal employers. It handles all employment contracts, and it’s legally responsible for making sure the company complies with and is legally responsible for employment issues. As businesses with no legal entity in a region hire, this is particularly beneficial.

- PEO: On the other hand, under a co-employment model, a PEO works with the client company, but the client retains legal responsibility for its employees, and the PEO takes care of its HR functions. The client has to follow the safety, legal, and compliance in the workplace.

Example:

An EOR vs PEO comparison would help you understand that EORs are more suited for companies expanding into new international markets without setting up entities, while PEOs are ideal for managing domestic HR operations.

2. Scope of solutions

- EOR: It offers solutions like hiring, payroll processing, benefits administration, and compliance with labor laws. It allows companies to hire internationally without setting up a legal presence in the region.

- PEO: Mainly supports domestic HR functions like payroll, tax filing, benefits management, and compliance. PEOs can only be used in jurisdictions in which the client already has a legal entity, and they cannot be used for international hiring.

3. Risk management

- EOR: As the employer, EORs take over the legal liabilities of employment laws and regulations, thereby drastically decreasing the risk exposure of the clients.

- PEO: PEOs handle some of the client’s HR risks but do not absolve the client of liability. Workplace safety and compliance are the client’s responsibility.

4. Cost implications

- EOR: Frequently, EORs will cost less over the long term because they provide insurance and benefit services bundled together. It frees up further financial burdens for the client.

- PEO: The co-employment model of PEOs may come at a cost as well: higher fees for things such as workers’ compensation and employee benefits.

5. Control over employees

EOR: Clients control day-to-day operations within the EOR, as well as performance evaluations.

PEO: Outsourcing HR administration to a PEO leaves clients in control of employees while they outsource HR administration.

Not sure how to decide between providers? Here are 10 factors to consider when selecting the right PEO or EOR partner.

Why Global Squirrels is unique when compared to other staffing agencies

Global Squirrels is a Software-as-a-Service (SaaS) staffing and payrolling platform that allows you to manage and hire top talent efficiently. Our platform helps you save up to 20% on hiring instead of charging 50% more like other staffing agencies by adding extra charges and huge markups.

Our platform is one of the top global PEO providers. PEO for domestic managing HR functions domestically in the U.S. These functions include:

Global Squirrels the staffing & payrolling platform, ensures that your business does not face any issues in finding and hiring top talent by offering comprehensive plans based on your requirements.

The purple plan allows you to onboard an already-sourced candidate or convert your current freelancer to a full-time employee. Additionally, our platform will handle all administrative functions mentioned above.

The Orange plan ensures you are able to find and hire talent who meet all your business needs. This is done after you sign up and choose the Orange plan. Our platform will ask you to fill in details that include job title, job description, budget, educational background, skills, and the countries you want to hire from. Once the onboarding process begins, our platform also starts managing the HR functions.