Employee Benefits and Compensations in Philippines – All You Need to Know

If you are planning to hire employees from Philippines, you need to have a solid awareness of the employee benefits in Philippines, salary and employee compensation in Philippines under the Department of Labor and Employment (DOLE) and Philippine labor law.

As an employer, understanding the legal requirements and best practices when it comes to your employees is essential. This ultimate guide will provide you with an overview of everything you need to know about benefits and compensation in the Philippines, including government regulations, minimum wages, leaves, and more. Keep reading to learn how to ensure your business complies with all the necessary laws and regulations while providing your employees with attractive and competitive benefits and compensation packages.

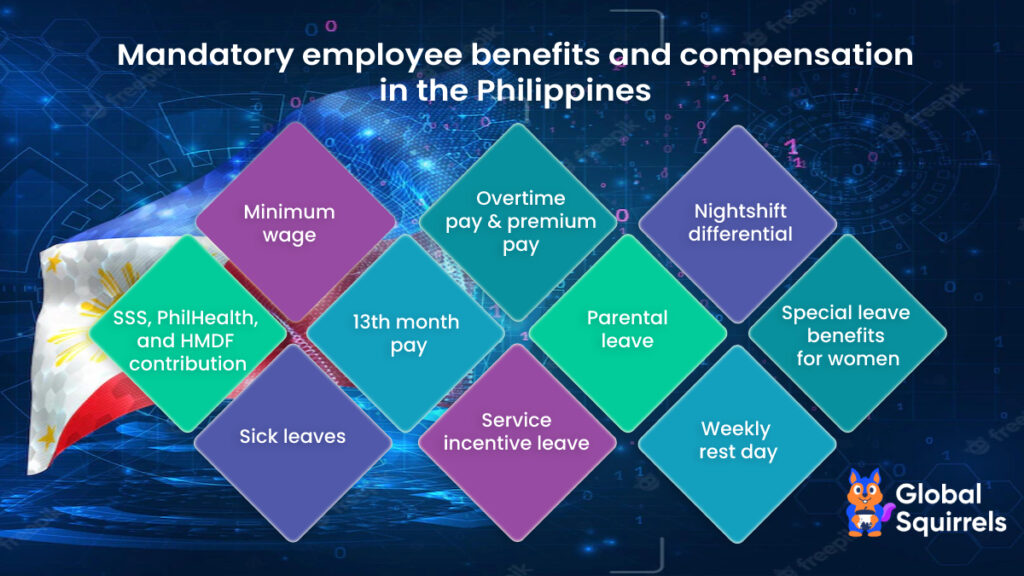

Employee benefits in Philippines

Employee benefits are the additional incentives given other than the basic salary packages to encourage talent retention and engagement. There are statutory or mandatory benefits that should be given to each and every employee under the labor law of Philippines. Negligence of these government-mandated benefits can cause employers to bear huge penalties.

The common benefits are not mandatory ones and can be planned by the employer to retain and attract talent to the organization. Most companies provide supplemental benefits which will enhance their brand value among potential candidates and customers in digital media.

Employee benefits in Philippine -Wage & compensation

1. Minimum wage in Philippines

The minimum wage varies between regions, with both private and public sector wages affected by a range of factors including size of the company, sector, and collective bargaining agreements. The Philippine government sets a nationwide minimum wage rate for private sector employees in the form of Regional Minimum Wage (RMW) orders. These orders are issued by the National Wages and Productivity Commission (NWPC). The minimum wage in Philippines ranges from P247 to P537 as of 2022.

2. Overtime pay

The Philippine Labor Code states that employers must compensate their employees with extra pay when they are required to work beyond the normal 8-hour working day. This means employees must be paid at least 25% more than their normal rate for any hours worked beyond eight hours a day.

3. Premium pay

Employees who work on holidays or rest days are also entitled to receive at least 30% more than their normal rate for any hours worked. Working on a rest day or special holiday is eligible for getting paid 30% more than regular pay. If the employee works on a special holiday that is also a rest day, then the employee can get 50% extra pay.

Working on a regular holiday will be charged 100% of the salary more, i.e. 200% payment will be given. The premium pay will be 260% when the employee works on a regular holiday that is also a rest day. An employer must need to pay a 300% salary if the employee needs to work on a double holiday and/or rest day together.

4. Night Shift Differential

Philippines labor law specifies a mandatory night shift differential for the employees who work between 10.00 PM to 6.00 AM. The night shift differential in the Philippines should not be less than 10% of regular wages. This night shift differential will be added for every employee along with the premium pay if they work on special holidays, regular holidays, and rest days.

5. 13th Month Pay

13th month pay is paid to employees who worked a minimum of one month with an employer. This extra salary must be processed before December 24 each year. This is a mandatory salary that is given for the rendered service of an employee. As it is given in December, it is mistakenly treated as a Christmas bonus. But the Christmas bonus is a supplementary benefit given by the company and not mandated by the labor code.

6. Separation pay

The employer should pay at least a half month salary per year of service if the employee got terminated under authorized causes. The separation pay is not applicable if the person had to leave the company due to crime, negligence of duty, fraud, or any offensive reasons.

The pay is ½ month pay per year of service if the separation reasons are retrenchment of the company to save from loss, the sudden closure of functions due to bankruptcy, and incurable illness causing threat to colleagues.

The separation pay is 1-month pay per year of service if the employee got terminated because of the implementation of machinery or devices which doesn’t require labor, overstaffing, and impossible situations to reinstate the job position.

Employees leave benefits in the Philippines

7. Sick leave

If the employee is covered under the Social Security System, he/she is eligible for 90% of the average daily wage in case of hospitalization or incapacitation at home. The employees can claim this benefit up to 120 days in a year and not more than 240 days for the same illness. The SSS contributions must be done for at least 3 months in the prior 12 months.

8. Service incentive leave

Service incentive leave (SIL) is considered as 5 paid days for employees who complete one year of service. These paid leaves can be used for sick leaves or vacations. The unused SIL can convert to cash every year.

9. Maternity leaves

Maternity leaves are paid leaves and it is entitled to employees who worked for a minimum of 6 months. The leaves can be two leaves prior to the expected delivery date and 4 weeks after delivery or miscarriage.

10. Paternity leaves

Paternal leaves are 7 paid days of leave to fathers for the first four pregnancies of their legitimate spouses as per their choice of days.

11. Solo parent leaves

Male or female employees who worked for a minimum of one year with the company are entitled to paid solo parent leave. These leaves are for 7 days of any emergencies to fulfill the parental duties.

12. Special leave benefits for women

If any female employee requires gynecological surgery, they can claim two months of fully paid leave under the labor code of Philippines. The employee must have worked for a minimum of 6 months to be eligible for this benefit.

13. Bereavement leave

Bereavement leaves are unpaid leaves for 3 days that can be taken by employees during the demise of close family members.

14. Weekly rest day

Employers should make sure of consecutive 24 hours of rest for every Filipino employee after continuous 6 days of work. Working on rest days is considered to be paid extra under the Philippines labor law.

15. Leave for victims of violence against women and their children

Victims of violence are eligible for 10 days of paid leave under the Labor Code and Civil Service Rules and Regulations.

Know more: Leave Policy in the Philippines – An Overview

Employer contributions to the government in Philippines

There are 3 government contributions by employers as per the salary of your employee. These are some crucial obligations as an employer of Filipino talent.

16. Social security system (SSS) contribution

Social security system contribution is administered by the Social Security Commission to cover maternity, retirement, sickness, death, and pension benefits. The SSS contribution is calculated based on the salary range of the employee. The monthly contribution is shared as 7.37% of the salary by the employer and 3.36% by the employee.

17. PhilHealth contribution

PhilHealth contribution is the health insurance contribution to the government where all health emergencies will be covered non-taxable. The PhilHealth contribution is shared between the employer and the employee. The benefits include subsidies for hospitalization, inpatient benefits, outpatient benefits, Z benefits (expensive treatment), SDG benefits (malaria, TB, AIDS, etc.), and other medical emergencies.

18. Pag-IBIG contribution or Home development mutual fund (HDMF)

The Home Development Mutual Fund or Pag-IBIG contribution is a beneficial national saving program for the affordable housing finance system. It will enable the employee to the savings, short-term loans, low-cost housing programs, etc. If the monthly salary is less than P1500, they should contribute 1% of the salary to HDMF. Employees need to contribute 2% of the salary if it is above P1500. Regardless of the salary range, the employer must contribute 2% to this Pag-IBIG fund.

Related Read: What is Employer of record (EOR) – Complete Guide.

Hiring from Philippines, Know why should you choose Global Squirrels?

Employee benefits and compensation are overwhelming subjects for both employers and employees. Understanding the rules and regulations surrounding employee benefits and compensation in the Philippines can be a daunting task if you don’t want to invest in setting up a local legal entity in the Philippines.

Global Squirrels is one of the leading EOR service providers can help you fixing your hiring and payrolling problems. Want to say goodbye to the complications of Philippines labor laws and regulations and establish smooth employment? Please schedule a demo with our experts and get it done today!