W-2 employer responsibilities: What do you need to do?

If you are an employer, knowing what you need to do to keep your tax reporting on track with the IRS is essential. The most important form you’ll deal with is Form W-2, which is used to report employee wages and the taxes withheld for the year. If you do not meet the requirements for filing this form, you can be hit with huge penalties, so it is essential to know the timelines and procedures. In this blog, we will discuss what Form W-2 is, filing requirements, important deadlines, and your employer’s responsibilities. You will come away from it knowing how to deal with Form W-2 without making any costly mistakes.

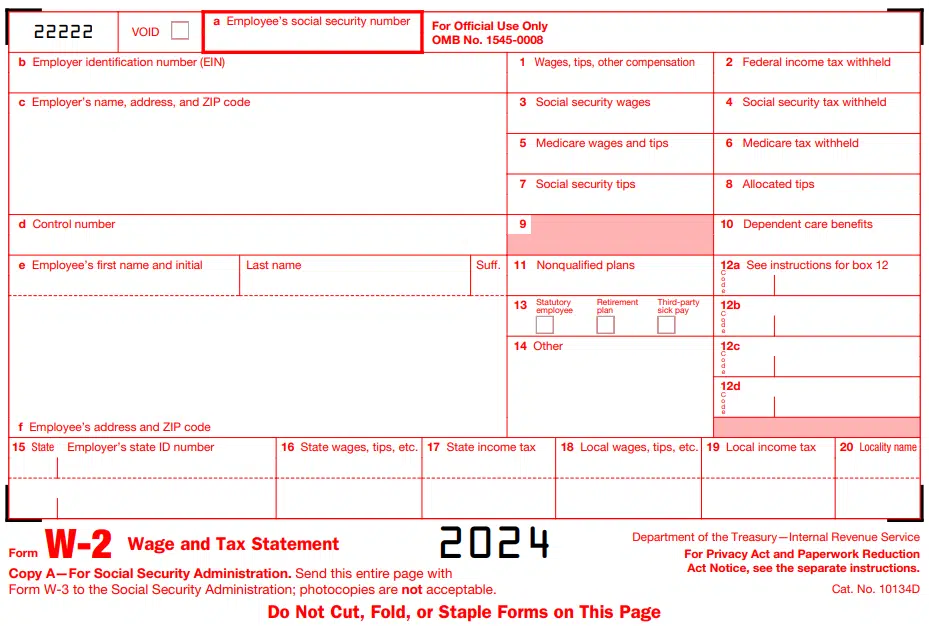

What is Form W-2?

Wage and Tax Statement, commonly called Form W2, is a form employers must give to their employees each year. In this form, they mention their employees’ gross wages and taxes that were withheld during the year. By January 31st of the succeeding year, employers are required to file this form with the Social Security Administration (SSA) and send copies to employees.

Source link: https://www.irs.gov/pub/irs-pdf/fw2.pdf

The form includes important information such as:

- Total wages earned by employees during the year

- Federal income tax withheld

- Social security and Medicare taxes withheld

- State and local taxes, and

- Retirement plan contributions and benefits

The key for employees filing their annual taxes is Form W2, which serves to report income and determine if more taxes are owed or if a refund is due. This form must be completed and submitted correctly to both employees and SSA by employers.

What are the W-2 filing requirements for employers?

The threshold for e-filing

- If filing at least 10 or more information returns in a calendar year, employers must e-file Forms W-2, W-2AS, W-2GU, and W-2VI (collectively referred to as Forms W-2, excluding Form W-2CM).

- To determine if e-filing is required, employers must add together:

- The number of Forms W-2 they must file.

- The number of other information returns they are filing (see list of applicable forms below).

Form 1042-S: It reports income subject to withholding tax paid to foreign persons, including nonresident aliens and foreign corporations, such as scholarships, royalties, or dividends.

Forms in the 1094 and 1095 series

- 1094-C: Used as a transmittal form by employers to report information about employee health coverage to the IRS.

- 1095-B: Health coverage reports confirm whether the Affordable Care Act (ACA) is being complied with.

Forms in the 1098 series

- 1098: Mortgage interest paid by a borrower to a lender is reported.

- 1098-E: It reports student loan interest payments to borrowers for tax deductions.

- 1098-T: Tuition payment information and education-related expenses for students to report for education tax credits.

Forms in the 1099 series

- 1099-INT: Reports interest income it earns from bank accounts or bonds.

- 1099-MISC: It reports miscellaneous income (e.g., non-employee compensation, rents, and royalties).

- Form 1097-BTC: Bond tax credit reports bondholders’ amounts allocated to the bonds reports typically for energy efficient or other federally supported bonds.

- Form 3921: Reports the exercise of incentive stock options by employees while also giving tax information to employees and to the IRS.

- Form 3922: Transfers stock purchased under an employee stock purchase plan, reporting tax-relevant information for the participant.

Forms in the 5498 series

- 5498: Reports contributions to Individual Retirement Accounts (IRAs) and other tax-advantaged accounts, such as rollovers and required minimum distributions.

- Form 8027: Reports tips from more significant food or beverage establishments, including tips scheduled for employees.

- Form W-2G: Reports gambling winnings over specified amounts and, if applicable, the withholding tax.

- Form 499R-2/W-2PR: Reporting wages paid and taxes withheld to Puerto Rican employees.

Additional forms W-2 for box 12

If an employer needs to issue more than four coded items in Box 12, more than four coded items in Box 12 are added to the total number of information returns (refer to the W2 image above)

Mandatory e-filing

The employer must e-file all Forms W-2 if the combined total of all Forms W-2 and applicable information returns exceed 10 in a calendar year.

Additional considerations

- Employers who file fewer than 10 information returns (e.g., Forms W-2) are not required to e-file but may do so voluntarily.

- While not mandatory, employers are encouraged to e-file in order to try to streamline reporting and reduce errors.

When do employers have to submit the W-2?

By January 31st every year, employers must submit Form W-2. This is true whether you file electronically through Business Services Online or on paper. Furthermore, employers must provide Forms W-2 to their employees by that same date. The filing and distribution deadline is moved back to the next business day if January 31st is a Saturday, Sunday, or legal holiday. This is important to satisfy IRS regulations and enable employees to properly file their taxes.

Form W-2 filing extensions

Employers can ask the SSA for an extension of time to file Form W-2, and they get it, but it does not happen automatically, and it is only given under extraordinary circumstances, like a natural disaster. Employers must file form 8809, an application for an extension of time, to file information returns before the due date, stating a reason and signing under penalties of perjury. The extension gives another 30 days for filing if it is approved. Likewise, employers can extend the time to file Forms W-2 with employees by sending a letter to the IRS, faxed, that includes the EIN, reason for delay, and signature. Employee extensions are typically approved for a maximum of 15 days or until further need is shown.

What are an employer’s responsibilities for W-2 filings?

When filing Form W-2, employers have several critical compliance responsibilities to federal, state, and local regulations.

- Filing requirements: Any employer who paid wages or compensation to at least one employee during the tax year is required to submit a Form W-2. This includes reporting wages even if no taxes were deducted if the total wages were greater than $600.

- Submission deadline: Employers must file Form W-2 with the SSA no later than January 31st of the following year. This deadline applies to paper filing as well as electronic filing.

- Distribution to employees: Employers must provide their employees with a copy of Form W-2 before January 31. If employment terminates during the year, forms have to be given at the time of the last paycheck or upon the employee’s demand within 30 days.

- Compliance with accuracy: The employer is legally obligated to complete all fields in Form W-2, including employee SSNs, employers’ EINs, wages, and taxes paid or withheld.

- Record keeping: Employers are required to keep Forms W-2 and W-3 on file for not less than 4 years to use in the event of review or verification.

- Extension requests: Employers can apply for an extension to file with the SSA using Form 8809, and such an extension is only allowed for 30 days and only where specific circumstances have prevailed. Additional time for filing Forms W-2 to employees may also be requested by writing a formal letter to the IRS.

- Electronic filing: Employers who are filing 10 or more information returns must file using Business Services Online. Employers as small as those who have employed only 10 workers are urged to e-file with a view to enhancing effectiveness and precision.

For companies hiring U.S.-based employees without establishing a local entity, partnering with a US Employer of Record is an efficient solution. It helps streamline W-2 compliance, ensures accurate payroll reporting, and reduces the burden of managing IRS and SSA obligations directly.

Penalties for late filing and submitting of the W-2 form

A failure to file the correct Form W-2 by the due date and an inability to demonstrate reasonable cause will subject employers to significant penalties. These are imposed for the delay period and intentional disregard of the failure to file and apply depending on whether the failure is due to electronic or paper filing.

1. Late filing penalties:

- Filed within 30 days: It costs $60 per Form W-2, plus a maximum penalty of $664,500 per year ($232,500 for small businesses).

- Filed after 30 days but by August 1: $130 per Form W-2, with a maximum penalty per year of $1,993,500 ($664,500 for small businesses).

- Filed after August 1 or not at all: $330 per Form W-2; $3,987,000 per year ($1,329,000 for small businesses).

- Failure to furnish correct payee statements: Additional penalties are calculated in the same way as late filings for employers that don’t file accurate Forms W-2 for employees by January 31.

- Intentional disregard: The penalty for the intentional failure to file or furnish correct Forms W-2 is $660 per Form W-2 with no maximum limit.

2. Intentional disregard: The penalty for the intentional failure to file or furnish correct Forms W-2 is $660 per Form W-2 with no maximum limit.

Related read: know about the W-8 BEN form

Are there any exceptions to penalties?

Employers may be able to get their penalties waived if they can show reasonable cause (e.g., unforeseen events or mitigating circumstances). Errors deemed inconsequential (e.g., minor typos that do not interfere with processing) are not punished. There is also a de minimis rule for minor errors of less than 10 forms or less than 0.5% of all filings corrected by August 1st.

Conclusion

An employer’s duty to file Form W-2 accurately and on time is crucial to compliance with IRS regulations and helps employees perform their tax duties. The process of filing Form W-2 is comprehensive. You need to understand what Form W-2 is, what the filing requirements are, and work with strict deadlines and extensions when needed. But employers must also keep accurate records, make sure everything is correct, and fix any mistakes — or face costly penalties.

Erring on the organization’s side and being proactive with late or incorrect filings means significant financial consequences, including as much as $660 per form in penalties for non-compliance. Electronic filing learned exceptions, such as the de minimis rule for minor errors, and streamlined this process, reducing the risk involved.

If followed, these guidelines will aid employers in effectively meeting their W-2 responsibilities without incurring unnecessary penalties and make for a smoother time on their end when filing their taxes as well as for their employees. In addition to a legal obligation, proper preparation and attention to detail in filing employees’ W-2 is critical to maintain transparency and build trust between your business, its employees, and the tax authorities.