Washington state labor laws

Washington State has a comprehensive set of labor laws that are designed to protect the rights of employees while also providing clear guidelines for employers. These laws will cover areas such as minimum wages, workplace safety, overtime pay, employee benefits, workers’ compensation, and anti-discrimination protections.

For employers, complying with and understanding these regulations is important to avoid any legal penalties, reputational damage, and fines. For employees, awareness of labor laws will ensure fair treatment, proper compensation, and safe working conditions.

In this blog, we will provide an overview of the important state labor laws in Washington, which highlight important rules and regulations that govern wages, employee rights, working hours, and workplace protections, thus helping businesses and workers to navigate the state’s legal landscape effectively.

What are the key Washington labor laws?

Washington state has a flexible framework of labor regulations that governs employee rights, workplace conditions, and employer responsibilities. Understanding the employment labor laws in the USA is important for both employers and employees to ensure compliance, fair treatment, and a safe working environment. Given below are some of the key labor laws in Washington State:

1. Minimum wage in Washington

- Washington has one of the highest state minimum wages in the USA. This is adjusted annually for inflation.

- Employers are mandated to pay their employees at least the current state minimum wage, with separate provisions for tipped employees.

- This law will ensure that workers receive fair compensation for all hours worked, which includes overtime where applicable.

2. Overtime regulations

- Washington adheres to the state and federal rules over time

- Non-exempt employees are entitled to 1.5 times their regular pay for hours worked over 40 in a work week.

- Certain industries, such as healthcare and law enforcement, can have specific exemptions or modified overtime rules.

3. Paid sick leave

- Washington mandates that most employees accrue paid sick leave at a minimum of 1 hour every 40 hours worked.

- Employees can use accumulated leave for family care, personal illness, and preventive medical care.

- This will ensure workers have time to recover from illness without losing any pay and promote workplace health.

4. Family and medical leave

- Employees will be eligible for Washington Paid Family and Medical Leave, which will provide paid leave for personal illness, family care, or bonding with a new child.

- This law will ensure job protection and wage replacement during qualifying leave periods.

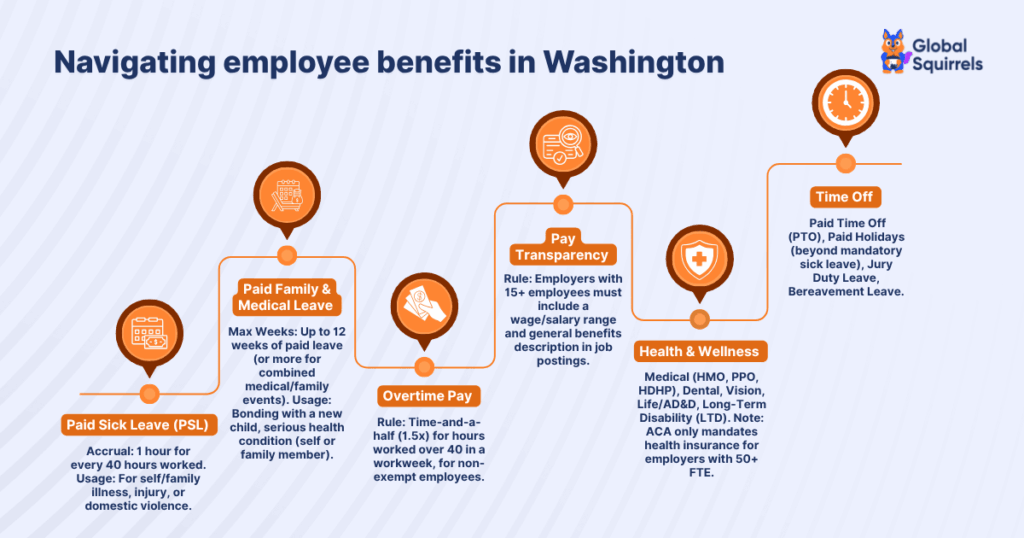

Employee benefits under the Washington labor laws

Washington state offers competitive employee benefits, which are essential for attracting top talent, ensuring compliance with state and federal laws, and maintaining a motivated and engaged workforce. Employers in Washington State will provide a mix of mandatory and voluntary benefits to meet legal requirements and support employee well-being.

1. Health insurance benefits for Washington employees

- Employers will often provide dental, medical, and vision coverage.

- Plans will cover preventive care, prescription medications, specialist visits, and hospitalization.

- Employees will usually have options for dependent coverage and cost sharing via premiums and co-pays.

- Health insurance will promote employee wellness and increase retention.

2. Retirement plans

- Common retirement plans will include 401(k) and 403(b) plans.

- Various employers offer matching contributions to encourage participation.

- Retirement benefits will provide employees with long-term financial security and assist in attracting and retaining talent.

3. Paid time off and holidays

- Employers will usually offer vacation days, paid holidays, and personal leave.

- Washington labor laws will mandate paid sick leave, which employees can use based on hours worked.

- PTO and holiday policies will help employees balance work-life demands and also reduce burnout.

4. Workers’ compensation

- Employers should provide workers’ compensation insurance for job-related injuries and illnesses.

- This coverage will provide medical care, rehabilitation, and wage replacement benefits.

- Workers’ compensation will protect both employers and employees from legal and financial liabilities.

5. Unemployment insurance

- Employers will contribute to the Washington State Employment Security Department (ESD) fund.

- Unemployment benefits will provide temporary income for employees who lose jobs because of no fault of their own.

- Proper administration will ensure compliance and help in maintaining trust with employees.

6. Disability insurance

- Employers can offer short-term and long-term disability insurance to provide financial support during any illness or injury.

- These benefits will protect employee income and reduce stress, which contributes to workplace stability.

Consequences of non-compliance with Washington laws

Failure to comply with Washington State employment and labor laws can expose businesses to high risks, both legally and operationally. Non-compliance will not just invite penalties but can also damage a company’s reputation, employee trust, and long-term success. Some of the key challenges employers might face include:

1. Legal penalties for non-compliance with Washington employment laws

Employers who violate Washington labor laws, including wage and hour regulations, anti-discrimination rules, workplace safety, or paid leave requirements, can face substantial penalties and fines. These might include interest, back wages, and civil penalties, which depend on the nature and severity of the violation.

2. Litigation and lawsuits

Non-compliance will lead to lawsuits from employees or regulatory agencies. Discrimination claims, wage disputes, harassment complaints, and failure to provide mandated benefits can result in expensive legal battles. Even if the employer prevails, legal fees and time invested can be important.

3. Damage to reputation

Companies that fail to follow labor laws risk harm to their public image. Negative publicity can reduce trust among partners, clients, and future employees. In a competitive market, this can affect brand perception and make it difficult to recruit or retain top talent.

4. Financial risks and operational disruption

Beyond fines, employers might incur unexpected costs from back pay, wage adjustments, and settlements. Additionally, time spent on audits, investigations, and corrective actions can divert resources from core business operations, thus affecting efficiency and growth.

How can Global Squirrels help you comply with Washington employment and labor laws?

Global Squirrels is a staffing and payrolling platform that helps USA-based businesses hire, manage, and pay local contractors. For Washington-based companies, we ensure compliance with state and federal labor laws, which includes standardizing contracts, tax documentation, etc. This way, you can focus on results and not regulations. Based on your job requirements, you can choose from our hiring plans. The Orange Plan allows you to source and hire new talent in Washington. The Purple Plan is suitable when you have already identified a talent and require us to onboard and manage their payroll and benefits through our platform.

Finding it challenging to keep up with all the employment laws in Washington? Eliminate all the challenges by requesting a demo today!