What is the Federal Unemployment Tax Act (FUTA)?

The Federal Unemployment Tax Act (FUTA) is a federal law that requires employers to pay a payroll tax. This is used to fund unemployment compensation programs across the United States. This tax will assist in providing temporary financial assistance to workers who lose their jobs due to no fault of their own.

For employers, understanding FUTA is important for maintaining payroll compliance strategies, managing the overall labor costs, and avoiding penalties. In this blog, we have broken down what FUTA is, how it works, and what employers require to know to stay compliant.

What is the purpose of FUTA?

The primary purpose of the Federal Unemployment Tax Act (FUTA) is to ensure financial stability and support for workers who lose their jobs because of no fault of their own. FUTA provides the federal funding required to maintain state unemployment insurance (UI) programs. This ensures that eligible workers receive temporary income while they search for new employment opportunities.

FUTA also plays a broader role in stabilizing the economy during downturns. By guaranteeing a consistent source of unemployment funding, the law will assist states in managing periods of increased joblessness without depleting their resources. Additionally, FUTA encourages states to maintain a strong, compliant unemployment system by offering tax credits and federal oversight.

FUTA tax rates and wage base

The Federal Unemployment Tax rules use a standard tax rate and wage base to establish how much an employer should pay every year. Unlike income taxes, FUTA is paid only by employers and not by the employees. This makes it an important part of an employer’s payroll responsibilities.

-

FUTA tax rate

The standard FUTA tax rate is 6.0%. However, most employers receive a credit of up to 5.4% for paying the state unemployment taxes (SUTA) on time. This reduces the effective FUTA rate to 0.6% for most employers. This reduced rate majorly reduces the total FUTA tax burden for compliant businesses.

-

FUTA wage base

FUTA taxes usually apply to the initial $7,000 of every employee’s annual wages. This is known as the FUTA wage base and is the same across all states. After an employee earns $7,000 in a calendar year, the employer no longer has to pay tax on that employee’s wages for the rest of the year.

Source: irs.gov

Who should pay FUTA?

Under the Federal Unemployment Tax rules, multiple employers in the United States are required to pay federal unemployment taxes. These taxes fund unemployment benefits for eligible workers who have lost their jobs. Understanding whether your business falls under FUTA requirements is important for maintaining payroll compliance and avoiding penalties.

FUTA will apply to employers based on certain wage and employment thresholds. You should pay FUTA if your business meets either of the following conditions:

1. You paid employees $1,500 or more in a calendar quarter

If your business has paid $1,500 or more in wages during any quarter of the current or previous year, you will have to pay the tax. This will apply to full-time, part-time, and temporary employees.

2. You had one or more employees for at least 20 weeks

You should pay FUTA if you employed one or more workers for any part of a day in 20 or more weeks during the current or previous year. The weeks do not have to be consecutive.

3. For household employers

If you employ household workers such as nannies, caregivers, or housekeepers, you should pay FUTA if you have paid $1,000 or more in cash wages in any quarter of the year.

4. For agricultural employers

You should pay FUTA if you have paid $20,000 or more in cash wages to farmworkers in any quarter or employed 10 or more farmworkers during the 20 weeks of the year.

Beyond FUTA thresholds, employers should also be aware of broader employment laws in the USA that affect hiring, wages, and terminations.

FUTA taxable wages and non-taxable compensation

To accurately calculate FUTA, employers have to understand which types of payments count as taxable wages and which do not. FUTA applies only to certain forms of compensation, and knowing the difference assists employers in ensuring accurate payroll tax reporting and avoiding penalties.

FUTA taxable wages

FUTA tax applies to the initial $7,000 of taxable wages paid to every employee in a calendar year. Taxable wages usually include:

- Regular wages: This includes hourly pay, salary, overtime, bonuses, and commissions.

- Certain fringe benefits: Certain benefits are considered taxable under FUTA if they are also taxable for federal income tax, such as personal use of company vehicles and a few cash reimbursements.

- Holiday, vacation, and sick leaves: Paid time off is considered taxable compensation under the FUTA.

- Employer-provided benefits: Cash or cash-equivalent benefits provided to employees, like gift cards, are usually taxable.

- Severance pay: Payments made at separation from employment are included in the FUTA wages.

FUTA non-taxable compensation

Not every payment that is made to employees is subject to FUTA tax. Common non-taxable items are:

- Employer contributions to retirement plans: Payments to 401(k), pension plans, and profit-sharing plans are not FUTA taxable.

- Health and medical benefits: Employer contributions for health insurance, dental, or vision plans; HSAs do not count towards the FUTA wages.

- Reimbursements for business expenses: If the expenses meet IRS accountable plan rules, they are excluded from FUTA.

- Workers’ compensation benefits: Payments made because of workplace injury or illness are also excluded.

Misclassifying taxable vs non-taxable compensation is one of the common payroll mistakes and how to solve them often starts with better FUTA understanding.

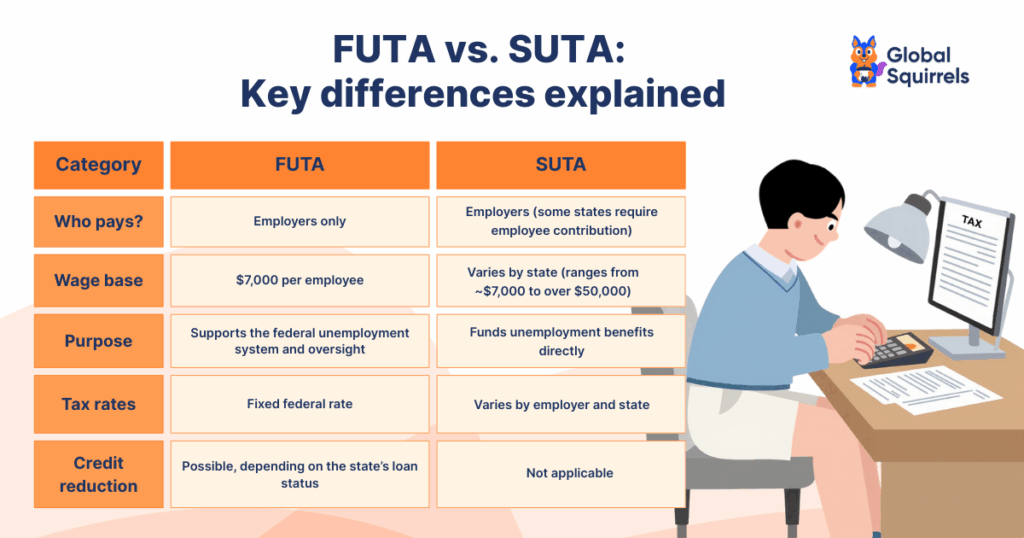

FUTA vs. SUTA

FUTA filing & payment requirements

Employers should comply with the specific filing and payment rules under the Federal Unemployment Tax Act (FUTA). Understanding these requirements assists businesses in staying compliant, avoiding any IRS penalties, and ensuring accurate unemployment tax reporting.

Who should file FUTA?

Employers should file FUTA taxes if either of the following conditions is met:

- Paid $1,500 or more in wages during the calendar quarter in the current or previous year

- Employed one or more workers for at least 20 weeks in the current or previous year.

FUTA filing forms: IRS Form 940

Employers should file Form 940, which is the employer’s annual federal unemployment tax return. It reports the total taxable wages, FUTA tax liability, credits for state unemployment tax contributions, adjustments and corrections, and any remaining balance owed.

Legal ways to reduce FUTA liability

Employers can legally reduce their FUTA tax liability by following federal and state guidelines, which enable certain credits, payroll strategies, and exemptions. Understanding these rules helps businesses stay compliant while reducing unnecessary tax costs.

1. Claim the maximum SUTA credit

The most effective way to reduce FUTA liability is to claim the state unemployment tax (SUTA) credit.

- Employers can receive around 5.4% credit on FUTA for paying the SUTA contributions on time.

- This will reduce the FUTA rate from 6.0% to 0.6% significantly lowering the tax owed.

2. Ensures all employees are classified efficiently

Proper worker classification reduces the overpayment.

- Independent contractors are not subject to FUTA.

- Only employees should be included in FUTA wage calculations.

Misclassifying workers can result in penalties; hence, employers should follow IRS worker classification guidelines.

Following payroll best practices for employers alongside correct FUTA filing helps reduce audit risk and penalties.

3. Exclude the non-taxable compensation

FUTA applies only to the initial $7,000 of taxable wages for every employee.

Businesses can legally reduce liability by excluding payments that are not subject to FUTA. Such as:

- Employer contributions to retirement plans

- Health insurance premiums

- Reimbursements under an accountable plan

- Certain fringe benefits

This accurately identifies which wages are taxable vs non-taxable, helping lower FUTA liability.

4. Monitor multi-state employment rules

For employees working in more than just one state:

- Employers should apply the appropriate SUTA rules to avoid duplicate unemployment taxes.

- Choosing the correct work state can affect FUTA liability.

Following the four-factor localization test ensures correct state selection and prevents overpayments.

Conclusion

The Federal Unemployment Tax Act (FUTA) plays a huge role in supporting workers who lost their jobs by funding unemployment benefits at the federal level. While employers are responsible for paying the tax, understanding how the FUTA works helps businesses stay compliant and avoid penalties. By knowing the rates, filing requirements, and how it interacts with state unemployment taxes, employers can handle payroll more accurately and responsibly. In simple words, FUTA is a key part of the US unemployment system, ensuring financial support for workers and maintaining stability in the workforce.