Why insurance agencies prefer virtual assistants from the Philippines

Insurance agencies handle increasing workloads, tight deadlines, and high customer expectations. Tasks such as renewals, policy processing, customer follow-ups, and claim support take up a lot of time, thereby reducing a talent’s focus on sales and client relationships.

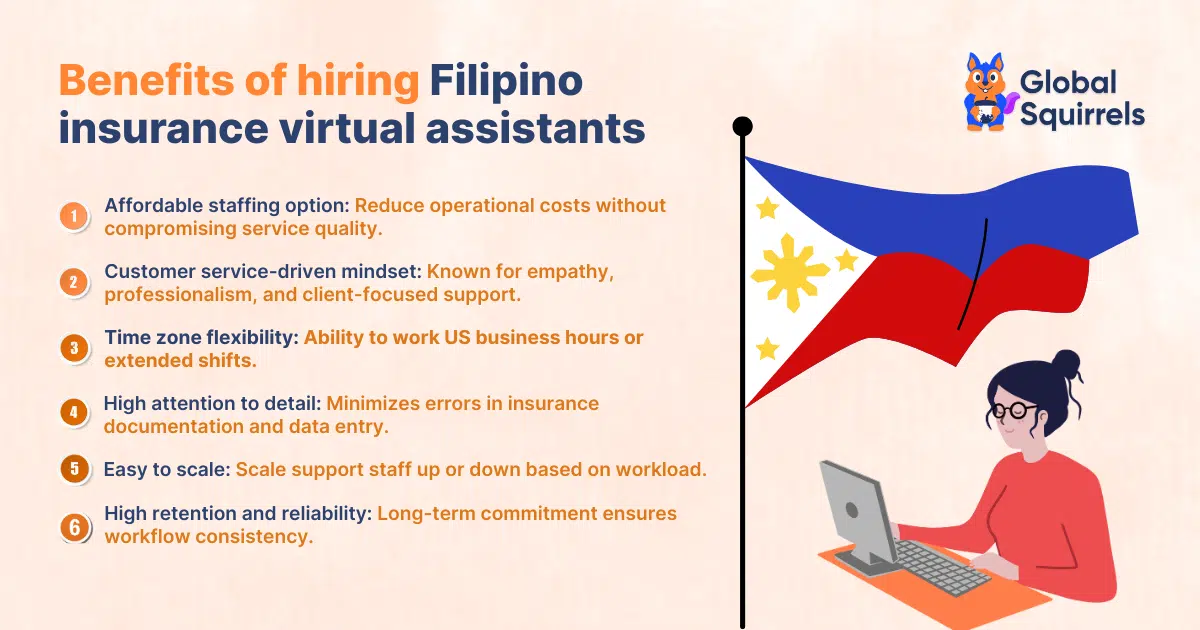

To handle this effectively, various agencies choose to hire virtual assistants from the Philippines. Additionally, Philippine insurance virtual assistants are known for strong English communication, customer service skills, and experience with US insurance processes.

In this blog, we shall explore why insurance agencies are increasingly choosing to hire virtual assistants from the Philippines and how they can support everyday operations efficiently and cost-effectively.

Why is the Philippines the top choice for insurance agencies?

The Philippines is evolving into one of the most sought-after destinations for insurance companies looking to hire virtual assistants. Its strong talent pool, cost-effective workforce, and cultural alignment with the US market make it a perfect choice for insurance operations support. Businesses looking to scale operations efficiently can hire insurance virtual assistants in the Philippines to reduce administrative workload while maintaining high service quality.

Given below are the primary reasons why insurance agencies constantly choose the Philippines to hire support staff:

1. Strong communication skills in English

The Philippines has one of the largest English speaking workforce in the world. Filipino virtual assistants can communicate clearly with carriers, internal teams, and policyholders, thus ensuring smooth client interaction.

2. Valid experience with insurance processes followed in the US

Various Filipino professionals have relevant experience that supports US insurance agencies. They are acquainted with policy administration, renewals, endorsements, claims assistants, and insurance documentation workflows.

3. Affordable hiring without compromising quality

Hiring virtual assistants for insurance agencies from the Philippines is way more affordable when compared to hiring an in-house staff. You can reduce overhead costs while also maintaining high-quality service.

4. Flexibility with time zone

Virtual assistants in the Philippines can easily align with US working hours, thus providing support for renewals, customer inquiries, and policy servicing.

5. High reliability and retention

Filipino virtual assistants usually seek long-term employment and show a strong commitment. This helps agencies in maintaining operational consistency and reducing hiring turnover.

6. Familiar with CRMs and insurance tools

Various insurance virtual assistants in the Philippines have significant experience in working with insurance systems and CRM, popular in the US. This allows productivity and quick onboarding.

How much does it cost hire a VA from the Philippines?

According to Glassdoor, the average cost to hire a virtual assistant from the Philippines ranges from $480/month (entry-level) to $2,400/month (expert). Here is the breakdown of the key cost factors and tiers to consider:

- Entry level (0-1 year): $3–$5 per hour ($480–$800/month).

- Mid-level (1-3 years): $5–$8 per hour ($800–$1,280/month).

- Expert/specialized (5+ years): $12–$15+ per hour ($1,920–$2,400+/month).

- Location impact: VAs based in Metro Manila generally charge 20-30% more than those in provinces like Cebu or Davao.

Skills to look for in a Filipino insurance virtual assistant

Hiring an insurance virtual assistant goes beyond just general administrative skills. To ensure compliance, accuracy, and daily operations, you should look for Filipino virtual assistants with insurance industry experience and strong professional capabilities.

Given below are the primary skills to assess when hiring a Filipino insurance virtual assistant:

1. Knowledge in the insurance industry

The virtual assistant should understand basic insurance concepts, including endorsements, renewals, claims, premiums, policies, and underwriting terminology.

2. Experience with insurance processes in the US

Familiarity with US insurance workflows helps ensure faster onboarding and fewer operational errors.

3. Good communication skills in English

Clear written and verbal communication is important for handling follow-ups, client emails, and documentation.

4. Experience in CRM and insurance systems

Knowledge of CRM and insurance management systems enables smooth handling of client records, traking and policy updates.

5. Organizational and administrative skills

The virtual assistant should be able to organize files, track renewals, handle documentation, and maintain clean records.

6. Reliability and time management

Following schedules, meeting deadlines, and managing multiple tasks efficiently are important for insurance operations.

Common mistakes you can avoid when hiring an insurance virtual assistant

Hiring an insurance virtual assistant can greatly improve efficiency; however, it has to be done correctly. Multiple agencies fail to achieve results due to avoidable mistakes made during onboarding, hiring, or management.

Remote insurance staffing allows agencies to access skilled insurance professionals who can support everyday operations, reduce overall hiring costs, and improve efficiency.

Given below are the most common mistakes insurance agencies should avoid:

1. Hiring virtual assistants without experience in the insurance sector

Not all virtual assistants understand the insurance workflows. Hiring without industry knowledge can result in errors in policies, documentation, and renewals.

2. Focusing only on the cost instead of the skills

Picking the cheapest option can result in low productivity, poor quality, and high long-term costs because of frequent replacements and rework.

3. Not defining the role clearly

Unclear responsibilities can result in confusion, missed tasks, and inconsistent performance. Every virtual assistant should have well defined scope of work.

4. Poor training and onboarding

Skipping the structured onboarding can significantly limit productivity. Virtual assistants will need proper training on tools, workflows, and agency processes.

5. No documented standard operating procedures

Without any documented SOPs, secure access, or role-based permissions, can put sensitive client data at risk.

6. Ignoring compliance and data security

Failing to implement NDAs, secure access, or role-based permissions can put sensitive client data at risk.

How to hire insurance virtual assistants from the Philippines

There are various benefits of staffing offshore insurance virtual assistants, including helping agencies reduce workload, improve efficiency, and control staffing costs. However, success primarily depends on following a structured hiring approach that ensures compliance, long-term reliability, and skill fit.

Given below is a guide to hiring the right insurance virtual assistant from the Philippines:

1. Clearly define the hiring requirements

Begin by identifying the tasks you want to outsource, such as policy processing, claims assistance, renewals, customer communication, or CRM updates. A clear role definition can help avoid confusion and improve productivity from the beginning.

2. Picking the right model

You should initially decide whether you need a full-time or part-time support, a dedicated or shared virtual assistant, or even long-term or project-based engagement. This right model depends on your business’s workload and growth plans.

3. Seek insurance-specific experience

Prioritize candidates with experience in supporting US insurance agencies. Familiarity with insurance terminology, documentation, and workflows will reduce training time and errors.

4. Thoroughly assess communication skills

Strong English communication is important for serving policyholders, carriers, and for internal coordination. You should evaluate both written and verbal communication during interviews.

5. Evaluate system and technical knowledge in detail

Check experience with insurance CRMs, document tools, agency management systems, and workflow platforms commonly used by the insurance teams.

6. Set clear performance metrics and KPIs

Track performance using measurable indicators, including turnaround time, accuracy rate, renewals processed, and response time.

Final thoughts

The Philippines is becoming a preferred destination for insurance agencies that seek reliable virtual assistant support. With strong English communication skills, experience in US insurance processes, a customer service work culture, and cost-effective hiring models, Filipino virtual assistants offer the right balance of quality and efficiency.

If you hire insurance virtual assistants from the Philippines, it may greatly reduce administrative workload, increase response times, and free up agents to focus on sales and client interactions when hired in an organized and compliant manner. The Philippines is a sensible and reliable option for organizations seeking to expand operations without raising overhead.