Employer of Record (EOR) in Canada

An Employer of Record (EOR) in Canada specializes in legally hiring talent for your business, eliminating the need for you to establish a local entity in a specific province or territory. The EOR assumes all official employer obligations, managing the employees’ onboarding, payroll, benefits, and local HR compliance. Your business retains full control over the employee’s day-to-day tasks and output.

From Account Executives and Human Resources professionals to Content Creators and Software Developers, our Canada EOR service can compliantly hire professionals for any department, ensuring adherence to all Federal and Provincial labor codes and regulations.

Global Squirrels is an Employer of Record that simplifies hiring in Canada by offering both comprehensive recruitment and seamless payrolling through its all-in-one platform. We manage the entire staffing process, including sourcing high-quality profiles, scheduling interviews, and onboarding. Crucially, we also handle all compliance, HR, payroll, and benefits administration in Canada. Global Squirrels offers flexible plans (Orange and Purple) designed to meet your specific job requirements.

Our staffing and payrolling platform offers pricing transparency, charging only the payroll cost plus a flat fee per hire. You can view your total hiring costs upfront, along with the candidate’s resume and cover letter, directly on the portal.

Trusted by growing businesses & enterprises

Recognized for excellence across leading review platforms

EXCELLENTTrustindex verifies that the original source of the review is Google. Love Global Squirrels! Great service!Posted onTrustindex verifies that the original source of the review is Google. Love Global Squirrels! Great service!Posted onTrustindex verifies that the original source of the review is Google. Working as a VA with Global Squirrels has been a nice experience. They connected me with a client, set clear expectations, and maintain smooth communication. The support team is responsive, and the overall process allows me to focus on delivering quality work. I’d highly recommend Global Squirrels to both clients and VAs.Posted onTrustindex verifies that the original source of the review is Google. I feel confortable working with global squirrels because it is a reliable company and, above all, very punctual with payments. I AM very happy and highly recommended themPosted onTrustindex verifies that the original source of the review is Google. Works well for teams hiring across different countries. Keeps payroll and documentation organized.Posted onTrustindex verifies that the original source of the review is Google. A clean interface and logical flow make it easier to manage international HR needs.Posted onTrustindex verifies that the original source of the review is Google. I value Global Squirrels’ communication and support systems the most. Their transparency, timely updates, and responsiveness make it easy to stay informed and confident at every step. Well-structured processes and efficient coordination create a smooth experience and provide real peace of mind, knowing everything is handled with professionalism and care.Posted onTrustindex verifies that the original source of the review is Google. 5* company, allows me to work fully remote with a good salary, they're professional and very helpful, both for talent and employers. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I’ve been working with Global Squirrels for almost a year and a half, and my experience has been excellent. They are a very professional and well-organized company, and everything has always run smoothly. I’ve never had any inconvenience with the arrangements, and everything is handled on time and as expected. What I appreciate the most is that they are always attentive and available—whenever I have a question or concern, they are quick to respond and resolve it. I’m truly happy I came across such a reliable and professional company. I highly recommend Global Squirrels.Posted onTrustindex verifies that the original source of the review is Google. We’ve been working with this company for several months now, and the experience has been excellent. Their team provides highly efficient, professional, and cost-effective support, which has made a big difference in streamlining our operations. The hiring and onboarding process was smooth, and the staff they provided came with strong healthcare backgrounds and good understanding of medical terminology, which made training much easier. They’ve been reliable, flexible with scheduling, and consistently available during our business hours in the U.S. What I appreciate most is that payroll, hiring, and HR tasks are all managed by their team, which saves our management staff a tremendous amount of time.

Customers

Employees

This platform worked out well for us. Instead of working with agencies we were able to hire resources from Philippines on a long term basis. We are currently paying payroll cost and monthly license fee per employee. The value we seen with this company is they were able to source us curated profiles based on our job needed and pricing is great compared to other EOR platforms.

How it works?

1. Legally hires talent

Global Squirrels' EOR entity in Canada employs the talent compliantly, legally protecting your business from local employment risks.

2. Manages payroll and tax

Our platform handles all payroll processing, income tax withholding, and tax remittance to the Canada Revenue Agency (CRA) and relevant provincial authorities.

3. Ensures compliance with labor laws

We ensure adherence to Federal and Provincial laws, including paid leave, termination rules, and employment standards in every province (e.g., Ontario, British Columbia, Quebec).

4. Handles benefits administration

As we assume legal employer responsibility, every employee receives mandatory statutory benefits (e.g., Canada Pension Plan (CPP) contributions, Employment Insurance (EI), and provincial health coverage).

Global Squirrels is one of the best EOR service providers in Canada. Hire top talent without employer obligations.

Benefits

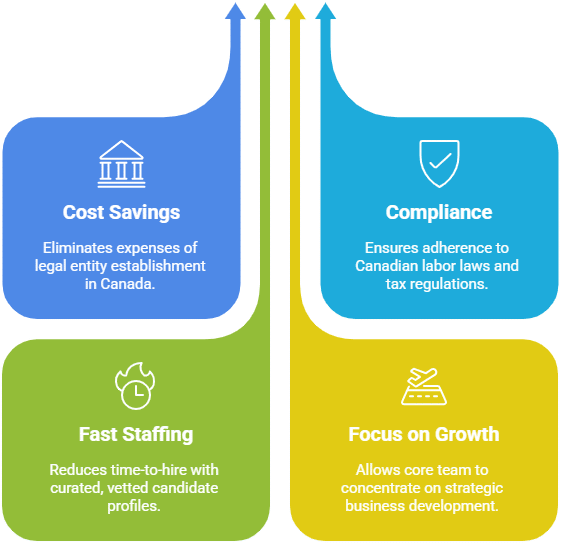

- Saves costs and time: Avoid the expenditure of thousands of dollars and months of effort required to establish a legal entity in Canada.

- Simplified compliance: Our EOR hires talent while strictly adhering to Canadian labor laws and tax regulations, ensuring zero risk to your business.

- Fast staffing: Significantly reduce your time-to-hire. We will source candidates and share curated, locally vetted profiles with you on the portal.

- Focus on growth: Global Squirrels handles all HR and administrative tasks, allowing your core team to focus entirely on business strategy and growth.

Expand your teams with our Employer of Record services in Canada.

Table of Contents

Worker classification in Canada

Global Squirrels is a staffing and EOR/payroll SaaS platform that enables businesses to hire, pay, and manage employees and contractors in Canada without establishing a physical office. Our Employer of Record solution in Canada can simplify the process of securing top talent while ensuring your company remains compliant with local employment laws and tax regulations. Over the years, we have helped businesses like yours employ SDRs, digital marketers, finance managers, software developers, and other professionals for highly specialized roles.

Global Squirrels offers three plans that cater to the staffing needs of businesses of all sizes, from startups to large enterprises. With our Orange Plan, the platform will source and hire talent based on your job vacancy and also manage their Agent of Record (AOR) / EOR. The Purple Plan is suitable for onboarding the candidates you’ve already found in Canada. This plan will also handle HR and administration tasks, including offer letter generation/negotiation, payroll and payments, legal compliance, and benefit administration. The Blue Plan, similar to the Orange Plan, allows your hired staff to work from our offices in India, Mexico, or the Philippines. This will grant you better security and management.

Secure elite talent, hassle-free, through our Employer of Record in Canada. Global Squirrels manages your payments and compliance for all workers (employees & contractors).

The labor market in Canada is dynamic and diverse, which offers a wide range of employment types that cater to the requirements of both employers and workers. Understanding the different types of workers in Canada is important for ensuring compliance with employment laws, tax regulations, and workplace rights. Businesses can work with Canada Employer of Record to assist them in navigating the above.

Canadian employment relationships are usually categorized based on the nature of work arrangement, level of independence, and duration. These also include full-time and part-time employees, seasonal or temporary workers, independent contractors, contract and casual, or on-call employees. Every classification will carry distinct financial, legal, and operational implications, affecting everything from payroll and taxation to benefits and job security.

For employers, correctly identifying the type of worker is important to meeting labor standards, Canada Revenue Agency requirements, and provincial employment legislation. For workers, it will help in clarifying their rights, entitlements, and responsibilities within the workplace.

Employee

This category of workers includes a person who has worked for others in an employer-employee relationship. This will include persons who worked for wages, salaries, commissions, tips, piece-rates, or payments in goods or services rather than money. However, employees do not include working owners of incorporated businesses, even though they may receive wages.

Self-employed

This category includes people whose job consists mainly of operating a farm, business, or professional practice. This can be done alone or in partnership. This also includes those working on a freelance or contract basis to do a job, such as architects and private-duty nurses, operating a direct distributorship selling and delivering products like cosmetics, newspapers, brushes, and cleaning products.

The businesses can be incorporated or unincorporated. Self-employed persons include those with and without any paid help. Additionally, unpaid family workers are considered self-employed too. They are technically the people who work without pay in a business, farm, or professional practice owned and operated by another family member living in the same dwelling.

What are the penalties for misclassifying workers in Canada?

Businesses that misclassify employees as contractors in Canada face significant financial risk. Given below are some of the potential costs, penalties, and fines associated with misclassifying employees in Canada:

- Penalties of 10% to 20% on unpaid income tax, EI, and CPP premiums plus interest

- Unpaid workers’ compensation premiums, plus fines and interest

- Both the workers’ and employers’ share of the unpaid Canada Pension Plan premiums

- Minimum wage, overtime, parental leave, vacation pay, and other unpaid statutory benefits

- Potential claims for wrongful dismissal damages

There is more to the financial risk than just that. Companies found to misclassify workers can potentially suffer from other consequences, like legal disputes, reputational damage, difficulty recruiting new workers, negative impact on employee morale, and increased scrutiny from government agencies.

The Canada Revenue Agency and other federal and provincial agencies and ministries are motivated to audit and investigate businesses they suspect are misclassifying workers so that they can increase their tax revenue. Misclassification, whether accidental or intentional, is risky and potentially very costly. Hence, working with EOR Canada can help businesses stay compliant and avoid significant penalties.

Employment agreements/contracts in Canada

Global Squirrels ensures the contracts/offer letters comply with Canadian laws for your hired workers. Want to see our Canada EOR provider in action?

Every employment relationship is governed by an employment contract, whether written, unwritten, or a combination of both. An employment contract will set out the terms and conditions of the employment relationship. In the absence of a written contract, the employment contract will be made on the basis of the parties’ oral representations. Additionally, multiple terms might be implied at common law if any employment contract is either unwritten or only partially written. The types of employment contracts include the following:

Fixed-term or open-ended contracts

Most employment agreements are for an indefinite period. This contract can only be terminated by the employer by the provision of reasonable notice at common law. However, the parties might agree to limit the employee’s entitlement upon termination to the minimum entitlements provided for under the applicable employment standards legislation. In general, the statutory notice period is way shorter than the notice period under general law.

While an employment agreement states that employment will be for a fixed term, the employee will not be entitled to notice of termination if his or her employment is terminated. However, if an employee remains employed after the contractual term has expired, courts will find that the employment contract was of indefinite duration and that notice of termination should be provided. Employment standards legislation might also establish maximum time frames for fixed-term employment contracts to operate as such.

Permanent employment contract

It does not have a predefined end date and will continue until either the employer or the employee decides to terminate it, provided proper notice requirements are met. Employees under permanent contracts will have greater job security, benefits, and entitlements, including health coverage, paid time off, retirement contributions, and parental leave. These agreements are appropriate for long-term positions where the employee will become an integral part of the organization’s growth and culture.

Part-time employment contract

Part-time contracts apply to employees who work fewer hours than a full-time shift, usually fewer than 30 hours per week. While part-time employees will perform similar duties to full-time workers, their compensation and benefits might vary based on hours worked. Although they work fewer hours, part-time employees are still covered by the same employment standards legislation as full-time workers, including rules on overtime pay, workplace safety, and holidays.

Casual or on-call employment contract

A casual or on-call employee will work only when needed, without any guaranteed hours or a predictable schedule. These workers are contacted by the employer based on workload demands or seasonal fluctuations. Although their hours are flexible, casual employees are still entitled to minimum wage, overtime pay, and other statutory rights. Employers should carefully manage these arrangements to ensure compliance with labor standards and avoid unintended permanent employment relationships.

Independent contractor agreement

An independent contractor, often known as a freelancer, is a self-employed person who works for a business under a service agreement rather than an employment contract. Contractors are responsible for their own taxes, insurance, and equipment, and retain discretion over when, where, and how they complete their tasks.

Independent contractors are not eligible for severance, vacation compensation, or employment benefits like employees are. To reflect this independence, they frequently command higher rates. In order to avoid penalties from the Canada Revenue Agency (CRA) and provincial labor authorities, employers must accurately designate workers as contractors.

Important components of an employment contract in Canada

Job title and responsibilities | This section should define the employee’s position, duties, and scope of work within the organization. It should also specify the employee’s official job title or role, core responsibilities and reporting structure, performance expectations, and goals. |

Working hours | Employers should outline the expected working hours every week, which include start and end times, breaks, and workdays. This section should also reflect compliance with provincial Employment Standards Acts (ESA) regarding maximum daily or weekly working hours. |

Overtime | The contract should specify how overtime hours are calculated and compensated. Under Canadian employment law, non-exempt employees are usually entitled to 1.5 times their regular hourly rate for any hours worked beyond 44 per week. Employers should clarify whether overtime requires prior approval and which roles are exempt from overtime provisions. |

Probation period | Many Canadian employers include a probationary period, usually ranging from three to six months, to allow time to assess the employee’s performance and suitability for the role. The contract should specify the probationary period, evaluation criteria, and termination rights during this period. |

Anti-discrimination laws | Employment contractors should include a commitment to equal opportunity and non-discrimination, in line with the Canadian Human Rights Act and relevant provincial human rights codes. Employers cannot discriminate based on race, religion, gender, age, disability, sexual orientation, or other protected grounds. |

Health and Safety Act | Employers in Canada are legally obligated to provide a safe and healthy work environment under the Occupational Health and Safety Act (OHSA) and its provincial equivalents. The section should also include the employer’s responsibility to maintain workplace safety standards and the employee’s duty to follow safety protocols. It can also have the reporting procedures for accidents or unsafe conditions |

Notice period | The notice period clause will define how much advance notice is needed when either party wishes to terminate the employment relationship. According to provincial Employment Standards Legislation, minimum notice periods depend on the employee’s length of service. Employers may choose to provide pay during the notice period. The contract should specify the minimum statutory notice, any additional contractual notice offered, and conditions for termination with or without cause. |

Intellectual Property (IP) | This clause ensures that all intellectual property created during employment, which includes inventions, designs, software, research, or written materials which remains the property of the employer. The employers should also include confidentiality and non-disclosure agreements to safeguard proprietary information. |

Dispute resolution | This section will include common mechanisms, such as internal resolution procedures that are followed by the company, and external methods such as arbitration or conciliation. Defining a dispute resolution process will help avoid lengthy legal battles and promote fair conflict management. |

Post-employment (Post-termination) | The post-employment clause should include the following:

|

Payroll in Canada

Our Canada EOR service provider will handle payroll, taxes, and ensure legal compliance for your employees, contractors, and freelancers.

Mandatory federal payroll taxes and contributions in Canada include the pension fund and employment insurance. Employers and employees should also pay into provincial and territorial programs, which include healthcare and workers’ compensation, and employers must withhold and remit federal and provincial income tax on employees’ gross pay.

Pension

Employers and employees in Canada should pay toward the public retirement fund, which is accessible to employees when they turn 65. The fund you pay for each employee depends on where the employee lives. All employees across Canada, except in Quebec, pay into the Canada Pension Plan (CPP), while employees in Quebec pay into the Quebec Pension Plan. The CPP tax rate for employers and employees in 2025 is 5.95% each, capped at CAD $4,034.10 annually for employers and employees. The QPP tax rate is 10.8% each for employers and employees.

Employment insurance

Employment insurance (EI) provides income support for individuals who are unemployed but are willing and able to work. It also provides income support for people who are on leave for maternity, paternity, illness, or another covered life event.

The table below lists the EI contribution rates and annual caps for employers and employees in Canada and Quebec:

Federal EI rate | Federal EI cap | Quebec EI rate | Quebec EI cap | |

Employer | 2.28% | CAD $1,527.30 | 1.82% | CAD $1,253.98 |

Employee | 1.63% | CAD $1,123.07 | 1.30% | CAD $895.70 |

Survivor insurance

As a part of the CPP and QPP, survivor benefits provide financial support to related survivors of the deceased and include three benefits:

- Death benefit: This is a one-time payment to the deceased person’s estate.

- Survivor’s pension: This is a recurring monthly payment to the surviving spouse of a common-law partner of the deceased.

- Children’s benefit: This is a recurring monthly payment to the dependent children of the deceased.

However, the candidate will be required to have certain qualifications to avail the benefits. For example, individuals between 60 and 64, whose spouse or partner has passed away, who have not remarried or found another common-law partner, and whose annual income is less than CAD$29,976 qualify for the survivor’s pension. A portion of CPP and QPP taxes and contributions comprises payments to survivor insurance.

Workers’ compensation

Worker’s compensation insurance in Canada is an employer-paid benefit that provides medical treatment and income support to employees who cannot work because of a work-related injury or illness.

Every province and territory manages the workers’ compensation program via a workers’ compensation board, with policy terms and rates varying across the jurisdictions. Employers in selected industries like dentistry and banking are exempted from providing workers’ compensation insurance to the employees.

Quebec parental insurance

The Quebec Parental Insurance Program (QPIP) funds paid leave for parents of newly adopted children or newborns. This will only apply to employees who work in Quebec and employers who engage talent in the province. The employer contribution rate in 2025 is 0.692%, capped at CAD$678.16 annually, while employees pay 0.494% up to CAD$484.12.

Labour standards

Act Respecting Labor Standards in Quebec establishes workplace protections for employees in most industries in Quebec, thus setting out minimum standards for things like holidays, wages, leave, and termination notices. Like the QPIP, the Labor Standards Act only applies to employers and employees in Quebec. Employees don’t pay a tax under this act.

Vacation pay accrual

When calculating payroll, employers in Canada should also factor in vacation pay, a portion of wages an employee will earn while on vacation. Vacation pay is calculated as a percentage of the employee’s pay, and that percentage is based on how much vacation an employee is entitled to, which varies by province. Typically, the employer will contribute from 4% to 10%.

Employee income taxes

Employers in Canada should deduct and remit income taxes from employees’ gross monthly earnings on behalf of their employees. While payroll taxes fund insurance programs like healthcare and provide income substitution for events like maternity and sick leave, income tax funds more general public services, such as transportation, education, fire services, and road maintenance.

Employees in Canada pay income taxes to federal and provincial or territorial levels of government. Employers will only have to remit taxes from employee earnings once to the federal government, which then distributes provincial and territorial portions accordingly.

Employee benefits in Canada

As your Canada Employer of Record, Global Squirrels will provide your hired staff with the benefits mandated by law.

Employee benefits in Canada play an important role in supporting the financial security, health, and overall well-being of workers. Beyond regular wages or salaries, these benefits form an essential part of the total compensation package offered by employers. Canadian employee benefits can include both mandatory programs, such as the Canada Pension Plan (CPP), Employment Insurance (EI), and Workers’ Compensation, as well as voluntary or employer-sponsored benefits like health insurance, retirement savings plans, and paid leave. The specific combination of benefits often depends on factors such as the employee’s province, industry, and employment type. Some of the Canadian employment benefits include:

Minimum wages

Canada’s federal minimum wage applies to all workers who are employed in federally regulated industries such as banking or shipping. Currently, the minimum wage is $17.30 per hour. Suppose the company is not a part of a federally regulated industry. In that case, it’ll be required to refer to the minimum wage guidelines for the province of the employees’ place of residence, assuming the employees are hired on an hourly basis and are not salaried-based.

Provincial Healthcare Insurance

Every Canadian has access to the public healthcare system in Canada. This will cover the basic health needs of all Canadians, which also includes the hospital stays. Healthcare is federally funded and mandated in Canada, but managed by the individual provinces and territories. This will mean there are specific requirements in every province. While the basic health benefits are provided by the government, other medical services like eye care, dental work, and medications are not covered.

Employment insurance benefits

Employment insurance benefits will provide financial assistance to Canadians who lose their jobs or who work seasonally and require help temporarily to replace their income. Typically, employment insurance provides up to 55% of an employee’s average weekly earnings. Employers will be required to deduct employment insurance from every dollar earned by the employee. Additionally, they should also contribute 1.4 times the amount they deduct from their employees.

Employment insurance also helps cover types of leave, like:

- Sickness

- Parental leave

- Critical illness leave

- Compassionate care leave

Pension contributions

All Canadian employees and employers are required to contribute to the Canada Pension Plan. This is a federally managed system that provides financial assistance to Canadians once they reach retirement age. The employer and employee contribution amount is usually based on the employee’s income.

Survivor’s pension

Canadians who are married or in lawful relationships are entitled to claim their deceased partner’s CPP. There is nothing required of employers in this situation. It is managed by either the Canadian government or the Quebec government which depending on where the employees live.

Workers’ compensation insurance

Canadian employers must pay into the provincial workers’ compensation fund for each employee. This fund is in place to help workers who are injured or become sick on the job. Each province in Canada manages its own workers’ compensation program, and it’s up to employers to make sure they’re following the proper rules and guidelines for each province where their employees work.

Leave policy in Canada

Leverage our Canada EOR platform’s built-in tools to manage and track your staff’s leaves. Track everything from leave balance, leave application, and approval to public holidays.

Leave policies in Canada are curated to protect employees’ rights while also ensuring that workplaces remain fair, flexible, and compliant with provincial and federal employment standards. These policies provide employees with the opportunity to take time off for personal, medical, or family-related reasons without any fear of losing their jobs or facing penalties. Under Canadian law, employees are entitled to a range of statutory leaves, which include vacation leave, sick leave, maternity leave and paternal leave, bereavement leave, and compassionate care leave. The leave policy in Canada includes the following:

Maternity-related reassignment

This law will provide maternity-related reassignments and leave. If an employee is pregnant or nursing, they can ask their employer to:

- Modify the job

- Reassign them to another job if continuing with the present role will pose a risk to the health of the child or the mother.

This request should include a certificate from a healthcare practitioner. The certificate should indicate:

- How long will the risk last

- What conditions/activities should be avoided

The employer should consult with the employee when examining the request. Where reasonably practicable, the employer will modify the job functions or reassign them to another person. While the job functions are modified or during a reassignment to another person, the employee will continue to hold the job that they had when they made the request.

Maternity leave

Pregnant employees are entitled to up to 17 weeks of maternity leave. They can take this leave any time during the period, which:

- Begins 13 weeks before the expected date of birth, and

- Ends 17 weeks after the actual birth date

Employees should provide their employer with a certificate from a healthcare provider confirming their pregnancy. Employers should also give a written notice at least 4 weeks before starting the leave. If the child is not born during the 17 weeks of the maternity leave, the maternity leave is extended till the date of birth.

Employees are not required to take maternity leave as a pregnant employee unless the employer can demonstrate that they are unable to carry out a necessary work function. Paid maternity leave is not covered by the code.

Parental leave

Employees are also entitled to up to 63 weeks of parental leave as adopted or natural parents. In order to receive an extra eight weeks of leave, parents who both work for companies subject to government regulation may share parental leave. 71 weeks of parental leave are available to parents who share it. Workers are free to take this leave whenever they like within the following periods:

- The 78-week period starting the day your child is born, or

- The day your child comes into your care

Additionally, at least four weeks before the commencement of the leave, the employee should provide written notification to their employer. The employer must be informed of the duration of the leave in this notice. Paid parental leave is not covered by the Code.

Compassionate care leave

Employees can take up to 28 weeks of compassionate care leave within a 52-week period to look after a family member who has a serious medical condition with a major risk of death. The leave will begin during one of the following weeks:

- The week, the health care practitioner will sign the certificate

- The week, the health care practitioner will examine the ill family member

- The week the family member will get ill, if the health care practitioner can determine the date

The leave will end when:

- The 28 weeks of compassionate care are completed

- The ill family member passes away or no longer requires care.

- The 52-week period has expired

When caring for the same family member, two or more workers may take compassionate care leave together. However, during the 52-week term, the total amount of leave taken by everyone cannot exceed 28 weeks.

If you are qualified, you can take consecutive critical illness leaves to care for the same person. However, if one or more employees are taking leave for a critical illness on behalf of the same person, you are not permitted to take compassionate care leave.

Secure the highly skilled professionals you need. Global Squirrels acts as your Employer of Record in Canada, taking on all complex local payroll processing, tax compliance, and legal onboarding, so you can expand without the burden of entity establishment.