Employer of Record (EOR) in Mexico

An Employer of Record in Mexico can be your gateway to hire top talent without having to establish an entity in the country. A 3rd-party entity like an EOR can legally hire and onboard professionals, such as SDRs, cold callers, and account managers, and handle their payroll, HR, and benefits administration. EORs will also ensure compliance with Mexico’s labor laws and tax regulations, keeping your company protected from any risks thereof.

Global Squirrels is an EOR company in Mexico that offers both staffing and payrolling solutions through its all-inclusive platform. Global Squirrels is designed to handle every step of the hiring process, from sourcing profiles and scheduling interviews to onboarding your confirmed candidates and managing their payroll and benefits. We offer three hiring plans that cater to the needs of businesses requiring help with hiring, onboarding, or both.

Our platform operates on a flat fee pricing model where you have to pay only the payroll cost and a flat fee per hire. With pricing transparency, you can view the hiring costs upfront, along with the candidate’s resume and cover letter on the portal.

Global Squirrels also operates as a Professional Employer Organization (PEO) in Mexico, enabling compliant staffing of talent without the need to set up an entity.

Trusted by growing businesses & enterprises

Recognized for excellence across leading review platforms

EXCELLENTTrustindex verifies that the original source of the review is Google. Working as a VA with Global Squirrels has been a nice experience. They connected me with a client, set clear expectations, and maintain smooth communication. The support team is responsive, and the overall process allows me to focus on delivering quality work. I’d highly recommend Global Squirrels to both clients and VAs.Posted onTrustindex verifies that the original source of the review is Google. I feel confortable working with global squirrels because it is a reliable company and, above all, very punctual with payments. I AM very happy and highly recommended themPosted onTrustindex verifies that the original source of the review is Google. Works well for teams hiring across different countries. Keeps payroll and documentation organized.Posted onTrustindex verifies that the original source of the review is Google. A clean interface and logical flow make it easier to manage international HR needs.Posted onTrustindex verifies that the original source of the review is Google. I value Global Squirrels’ communication and support systems the most. Their transparency, timely updates, and responsiveness make it easy to stay informed and confident at every step. Well-structured processes and efficient coordination create a smooth experience and provide real peace of mind, knowing everything is handled with professionalism and care.Posted onTrustindex verifies that the original source of the review is Google. 5* company, allows me to work fully remote with a good salary, they're professional and very helpful, both for talent and employers. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I’ve been working with Global Squirrels for almost a year and a half, and my experience has been excellent. They are a very professional and well-organized company, and everything has always run smoothly. I’ve never had any inconvenience with the arrangements, and everything is handled on time and as expected. What I appreciate the most is that they are always attentive and available—whenever I have a question or concern, they are quick to respond and resolve it. I’m truly happy I came across such a reliable and professional company. I highly recommend Global Squirrels.Posted onTrustindex verifies that the original source of the review is Google. We’ve been working with this company for several months now, and the experience has been excellent. Their team provides highly efficient, professional, and cost-effective support, which has made a big difference in streamlining our operations. The hiring and onboarding process was smooth, and the staff they provided came with strong healthcare backgrounds and good understanding of medical terminology, which made training much easier. They’ve been reliable, flexible with scheduling, and consistently available during our business hours in the U.S. What I appreciate most is that payroll, hiring, and HR tasks are all managed by their team, which saves our management staff a tremendous amount of time.Posted onTrustindex verifies that the original source of the review is Google. I've been a part of Global Squirrels for more than two years now and my experience is nothing short of phenomenal !!! Services provided by global squirrels have been good. Salaries are credited on time.Posted onTrustindex verifies that the original source of the review is Google. Global squirrel simplify things and made it super easy for me to update the timesheet, In short term (Easy to use platform). The team are highly professional and truly responsible towards the client requirement. I never face any issues or error on , they always keep me updated and answering questions quickly. I appreciate their attention and response which having more details and high level of service. it's a reliable solution that has made day to day process much more efficient. I'm truly happy by experiencing Global squirrel platform. Highly recommended!

Customers

Employees

This platform worked out well for us. Instead of working with agencies we were able to hire resources from Philippines on a long term basis. We are currently paying payroll cost and monthly license fee per employee. The value we seen with this company is they were able to source us curated profiles based on our job needed and pricing is great compared to other EOR platforms.

How it works?

1. Legal hiring

Global Squirrels has a legal EOR entity in Mexico and can hire professionals while ensuring compliance with labor laws and tax regulations.

2. Payroll and tax administration

We can handle your employees’ payroll, tax withholding, and tax remittance to the respective authorities.

3. Compliance with labor laws

As a legal employer, our platform will comply with the labor laws and regulations while hiring and paying your talent in Mexico.

4. Benefits administration

All your hired staff shall receive the Government-mandated benefits, such as individual/family health insurance, allowances, and other entitlements.

Global Squirrels is one of the best EOR service providers in Mexico. Hire top talent without employer obligations.

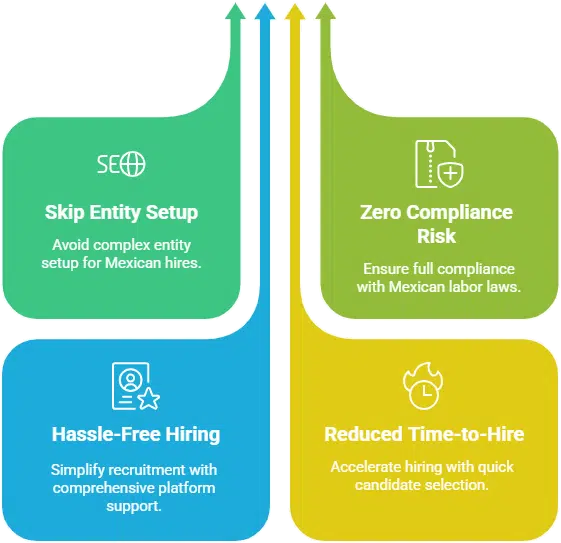

Benefits

- Skip entity setup: Hire anyone, anywhere in Mexico, without the expense, time, or complex legal hurdles of setting up a local entity.

- Zero compliance risk: Eliminate the possibility of non-compliance. Our Employer of Record (EOR) service in Mexico guarantees adherence to all local labor and tax laws.

- Hassle-free and quick hiring: Stop sifting through applications. Simply post your job, and our platform manages the entire recruitment process to seamlessly bring top talent onto your team.

- Reduce your time-to-hire: Receive a curated selection of qualified candidates within just 2-5 business days of posting your job requirements.

Expand your teams with our Employer of Record services in Mexico.

Table of Contents

Worker classification in Mexico

Global Squirrels is your all-in-one staffing and payrolling platform for hiring in Mexico. We ensure you stay compliant with all local laws and regulations, whether you’re hiring new Mexican talent or onboarding your existing self-sourced contractors. Our EOR platform offers three hiring plans to meet your specific business needs. With the Orange Plan, we source and recruit talent based on your job requirements, then manage their entire Agent of Record (AOR) / EOR responsibilities. The Blue Plan includes all the features of the Orange Plan, plus it allows your hired staff to work from one of our dedicated offices in Mexico. This plan is ideal for companies seeking enhanced management and security. The Purple Plan is suitable for onboarding the candidates you’ve already sourced. This includes offer letter generation/negotiation, payroll and payments, legal compliance, and benefit administration.

Connect with qualified Mexican talent, hassle-free, through our Employer of Record in Mexico. Global Squirrels manages your payments and compliance for all workers (employees & contractors).

In Mexico, an employee is defined as an individual who will perform work or service for an employer. The Mexican Federal Labor Law will set out the legal framework that governs the employment relationship in Mexico and will define the rights and obligations of employees and employers.

Understanding worker classification in Mexico is important for businesses to remain compliant with local labor laws and avoid misclassification risks. Multiple businesses also choose to work with an Employer of Record in Mexico to avoid any risks related to misclassification.

The types of worker classifications in Mexico include:

Permanent employees or Tiempo indefinido

This is the most common form of employment in Mexico. Permanent employees are hired for constant and indefinite work, with no certain end date in the contract. They are often entitled to full employment benefits, such as bonuses, paid vacations, social security, and severance pay in case of termination. Employers should also ensure that they register with the social security authorities (IMSS) and comply with payroll tax and benefit obligations.

Fixed-term contract or Tiempo determinado

A fixed-term employment contract is only valid in legally defined circumstances, which can range from completing a particular project covering temporary needs to replacing an absent employee. Employers should clearly specify the duration and reason for the contract in writing. Once the term ends, the employment relationship will automatically conclude unless both parties agree to renew or convert it to an indefinite term.

Probationary period or periodo a prueba

Employers tend to establish a probationary period to evaluate if the employee will fit the role.

- For a non-managerial role, the probationary period will not exceed 30 days

- For managerial, technical, or specialized talents, it might extend up to 180 days

During this period, employees are entitled to all legal benefits, and any termination should be justified based on objective evaluation criteria.

Independent contractors or servicios profesionales, or freelancers

Independent contractors, or Servicios Profesionales, will operate under civil or commercial contractors and not labor contracts. They will work autonomously and are responsible for their own taxes and social security contributions.

Authorities in Mexico, however, closely examine this classification. A contractor’s connection with the company reflects characteristics of an employment relationship, like fixed hours, direct supervision, or dependency; it might be categorized as misclassification. This can result in legal penalties, back payments, and mandatory employee reclassification.

Penalties for misclassification of workers in Mexico

The penalties for misclassifying Mexican workers are among the most compelling reasons to properly define the employment connection your organization has with them. Misclassifying employees as independent contractors or subcontractors can result in significant penalties for businesses. When you work with an EOR company in Mexico, it will keep your business protected from the significant risks of worker misclassification.

Some of the potential risks will include:

- Back pay and benefits: Employees who have been misclassified may claim that they are due compensation for their labor as well as reimbursement for statutory benefits to which they were not entitled.

- Government penalties and fines: Companies may have to pay hundreds of thousands of dollars in fines imposed by the Mexican government.

- Severance pay: Employees are entitled to severance pay if their work agreement is terminated. If a contractor is terminated and later found to have been misclassified, you could be ordered to pay them severance.

- Legal damages: Misclassified employees are allowed to take legal action and pursue damages against the company that has misclassified them.

- Criminal charges: In some cases, it is even possible for representatives of a company that misclassifies workers in Mexico to be charged with a crime.

Employment agreements/contracts in Mexico

Global Squirrels auto-generates contracts/offer letters as per local laws for your hired staff in Mexico. Want to see our platform in action?

Written employment agreements in Mexico are mandatory. Every employee should enter into an individual employment agreement with the employer and note down the terms and conditions of the employment. Keep in mind that there is no ‘employment-at-will’ in Mexico. An employer should have a justified cause to terminate the employment relationship; if not, the employer should compensate the unjustly terminated employee accordingly. The Federal Labor Law (FLL) will stipulate the amount for severance payments. Despite the mentioned remark, the employee’s constitutional and statutory rights are not surrendered or impacted when an employment connection exists, but no written agreement is present.

The types of contracts in Mexico are described below.

Indefinite period employment contract

Remember that the Mexican labor law follows one fundamental principle of “work stability,” which simply means that the government wants Mexican employment contracts to be permanent instead of temporary. If not otherwise mentioned, an employment contract in Mexico is considered indefinite. This means that the employee is permanently hired unless someone terminates the relationship.

Determined period employment contract

Determined-period labor contracts will exist in Mexico, but only under certain circumstances. Article 37 of the LFT states the circumstances under which this type of contract is allowed. There are two fractions under this:

- Act 37, Fraction I: When required by the nature of the work to be performed

- Act 37, Fraction II: When its purpose is to temporarily replace another worker

Fixed-term employment contract

The fixed-term work contract is similar to the determined-period contract but focuses on certain projects. The difference is that you wouldn’t know at the beginning of the contract how long the labor relationship would last. The most common industry for these types of contracts is construction.

Seasonal employment contract

This type of contract is not common in practice. A seasonal employment contract in Mexico is indefinite. This means employees will work permanently in the company but seasonally. It is important to note that you should pay all employee benefits, such as vacations and Christmas bonuses.

Initial training contract

As per Article 39-B of the LFT, the initial training employment contract can last up to three months for a regular worker and up to six months for managers, directors, and specialized professional workers. After this period, the relationship will automatically turn indefinite. Once the initial training period is over, the employer can consider the employee’s lack of competence and dismiss the employee without liability.

The contract type is similar to the Mexican trial period, with a few rules as follows:

- Companies cannot extend the initial training period

- An employee can only have one initial training period

- After the period is concluded, the employer should either dismiss the relationship or make it indefinite

- The employer should pay social security and all mandatory benefits

- Initial training is included in the employee’s service period

Important components of an employment contract in Mexico

When hiring employees in Mexico, having a well-structured employment contract is a legal requirement under the Federal Labor Law. These contracts will clearly outline the rights, responsibilities, and expectations of both the employer and employee, which prevents misunderstandings and ensures compliance with Mexican labor regulations.

|

Job title and responsibilities |

The roles, duties, and responsibilities should be explicitly defined. Employers should ensure that the job description reflects the employee’s daily tasks to avoid future disputes about role expectations. |

|

Working hours |

Mexican labor law strictly regulates working hours to protect employee well-being. A total of 8 hours per day is allowed for the day shift and up to 7 hours per day for the night shift. For a mixed shift, a combination of day and night hours up to 7.5 hours per day is permitted. |

|

Overtime |

Overtime is allowed but is limited to 3 hours per day and no more than 3 times per week. It is paid at a premium rate, which is often double the regular wage. |

|

Probation period |

Employers may include a probationary period to evaluate whether an employee is ideal for the position. It is up to 30 days for general roles and up to 180 days for managerial, technical, or highly specialized positions. During this time, employees receive full legal benefits and protection. |

|

Anti-discrimination laws |

Employers are legally prohibited from discriminating based on gender, age, ethnicity, religion, sexual orientation, or marital status. The Federal Labor Law and the Federal Law to Prevent and Eliminate Discrimination require equal pay and opportunities for all employees. |

|

Health and Safety Act |

Employers should comply with the Health and Safety Act. This will include providing a safe workplace, training, and protecting equipment. Health and safety obligations must be explicitly stated in the employment agreement or company policy attachments. |

|

Notice period |

Under the Mexican labor law, there is no fixed statutory notice period, but it is a standard practice to provide a reasonable notice. For voluntary resignation, employees should give a 15-day notice period. |

|

Intellectual Property (IP) |

If the employees create intellectual property or handle proprietary data, the contract should clarify ownership rights. In most cases, IP created during employment for company purposes belongs to the employer. Confidentiality clauses should protect businesses’ data, trade secrets, and client information. |

|

Dispute resolution |

In case of disagreement or claims, employment disputes in Mexico are usually handled via the Federal Center for Conciliation and Labor Registration (CFCRL) or local conciliation boards. |

|

Post-employment (Post-termination) |

Contracts should include the conditions under which employment can be terminated, whether due to resignation, dismissal with cause, or mutual agreement. It should also outline the corresponding notice period. |

Payroll in Mexico

Global Squirrels, an Employer of Record in Mexico, handles payroll, taxes, and ensures legal compliance for your hired employees, contractors, and freelancers.

Managing payroll in Mexico will require a clear understanding of the country’s labor laws, tax obligations, and statutory contributions. Employers should comply with multiple federal and state-level requirements to ensure fair compensation, social benefits, and worker protection. The key components every employer should consider when managing payroll in Mexico are:

Social security (IMSS – Instituto Mexicano del Seguro Social)

Employers are legally required to contribute to Mexico’s Social Security Institute (IMSS). These contributions will cover the healthcare, maternity, disability, and occupational risk benefits.

- Employer contribution: Approximately 15% – 25% of the employee’s salary

- Employee contribution: This is usually around 2% – 3% of the salary

These contributions are reported and paid every month through IMSS, which ensures that employees have access to public health services and social protections.

Housing fund (INFONAVIT – Instituto del Fondo Nacional de la Vivienda para los Trabajadores)

Employers should contribute to INFONAVIT, which will support employees in purchasing or improving homes. Employer contribution is often 5% of the employee’s base salary. These funds are managed by INFONAVIT and can be used by employees for mortgage financing or rent payments.

Retirement contributions (SAR – Sistema de Ahorro para el Retiro)

Under the retirement savings system (SAR), the employers and employees will contribute to the employee’s retirement account, which is managed by private AFORE funds.

- Employer contribution: 2% of the employee’s salary toward retirement savings

- Employee contribution: 1.125% of salary, which is automatically deducted from payroll.

The government might also contribute a small percentage to encourage long-term retirement savings.

Payroll tax (ISN – Impuesto Sobre Nominas)

The payroll tax is a state-level tax, not federal, and its rate will vary depending on the region.

- The rates will typically range from 1% to 3% of the total payroll.

- This tax is paid by the employer and supports local infrastructure, training initiatives, and employment programs.

Mandatory Annual Bonus (Aguinaldo)

The Aguinaldo, or annual Christmas bonus, is mandatory under the Mexican labor law.

- Employers should pay the equivalent of at least 15 days’ salary to all employees

- The payment deadline is usually before December 20 of every year

- Failure to comply with this could result in fines and labor claims

Profit sharing (PTU – Participación de los Trabajadores en las Utilidades)

Employers in Mexico are also required to share profits with employees under the PTU system.

- Companies should distribute 10% of their taxable profits among the eligible employees.

- Distribution is usually made within 60 days after the company files its annual tax return

- PTU does not apply to new companies in their first year or non-profit organizations.

Avoiding payroll mistakes

Payroll in Mexico can be complicated, and small errors could result in significant penalties. Employers should pay special attention to the following:

- Accurate employee classification: Misclassifying contractors or temporary workers could trigger fines and retroactive benefits.

- Correct and timely contributions: Delayed IMSS, INFONAVIT, or SAR payment will result in surcharges.

- Currency consistency: Payroll should be processed in Mexican Pesos (MXN) for legal and tax compliance.

- Staying current on state tax rates: ISN percentages will change periodically and vary across states.

Regular audits and the use of certified payroll software or employer of record services in Mexico can help ensure full compliance and reduce administrative risks.

Payroll contributions | Cost |

Social Security Contributions (IMSS) The contributions include; * Illness and maternity * Disability and life * Retirement * Severance at advance/old age * Childcare and social benefits * Labor risk insurance | Approx. 25% of the employee’s gross salary |

Housing fund (INFONAVIT) | Around 5% of the employee’s gross salary |

State payroll tax (depends on the employee’s state and gross salary) | 1.8% to 4% |

Christmas bonus (Aguinaldo): 15 days of pay | 4.11% |

Vacation pay premium (A 25% salary premium needs to be paid for paid vacations. The Number of PTO in a year varies from 12 to 32, depending on the employee’s tenure) | 0.82% to 1.5% |

Employee benefits in Mexico

As your Employer of Record in Mexico, Global Squirrels will provide your hired staff with the benefits mandated by law.

Employee benefits in Mexico are managed by the Federal Labor Law or Ley Federal del Trabajo, which states that workers will receive fair treatment and support in primary areas, which include healthcare, family leaves, retirement, and severance. Employers should comply with these legal requirements, and failing to do so can cause significant penalties. Hence, working with EOR services in Mexico can be effective in ensuring compliance with Government-mandated benefits and eliminating the risks.

Let us look into some of the employee benefits in Mexico.

IMSS / INFONAVIT / SAR (social security, housing fund, and retirement)

As part of the payroll system in Mexico, employees are entitled to contributions to IMSS (Mexican Social Security Institute), INFONAVIT (National Housing Fund Institute), and SAR (Retirement Savings System):

- IMSS covers disability, healthcare, and occupational risks

- INFONAVIT supports housing benefits for employees

- SAR is a mandatory retirement savings system

Aguinaldo (annual bonus)

The Aguinaldo is a mandatory annual bonus that all employees in Mexico are entitled to receive. This is at least 15 days’ salary of the employee.

- The payment deadline is usually before 20th December of every year.

- Failing to pay this bonus on time or in full can result in fines and legal claims from employees.

- The bonus is calculated based on the employee’s salary at the time of payment.

Vacation

All employees in Mexico are entitled to a minimum number of paid vacation days. They include:

- First year of employment: The employees are entitled to 12 paid vacation days.

- Increases with tenure: The number of vacation days will increase by 2 days every year until the employee reaches 20 days of paid vacation, which is achieved after the fourth year.

Employers should ensure that vacation days are used every year and that employees receive full compensation during their time off.

Vacation premium

In addition to paid vacation days, employees are also entitled to a vacation premium:

- Minimum premium: At least 25% of the salary corresponding to the vacation days.

- The vacation premium is paid in addition to the regular vacation pay and is meant to support employees while they take time off.

Severance pay

Severance pay is required when an employee is terminated without any justified cause, and it includes the following:

- Three months’ salary (especially for unjustified dismissal)

- Vacation days that were accrued but not taken

- A proportionate amount of the Aguinaldo was earned up to the termination date

- The total severance pay will depend on the length of employment, salary level, and the circumstances of termination

Employers should ensure that they follow the legal process for termination and severance payments to avoid costly legal challenges.

Leave policy in Mexico

Leverage our EOR platform’s built-in tools to manage and track your staff’s leaves. Track everything from leave balance, leave application, and approval to public holidays.

In Mexico, the leave policy is governed by the Federal Labor Law, which ensures that employees are entitled to multiple types of leave, which include vacation, paternity, maternity, and sick leave. These policies are curated to provide workers with the necessary time off to maintain work-life balance, health, and family responsibilities while protecting their income. Understanding the leave entitlements in Mexico is important for both employers and employees to ensure compliance with legal requirements and to promote a fair, healthy, and supportive work environment.

Sick leave

Employees in Mexico are entitled to paid time off if they become sick or injured. However, to be eligible for this, employees must submit a doctor’s note from the Instituto Mexicano del Seguro Social (IMSS) to their employer. Employees are entitled to up to 52 weeks of paid leave as long as it is deemed medically necessary. However, employers can appeal to the IMSS for reimbursement for some of the paid leave time.

To be eligible for this leave, an employee must be employed with the company and have contributed to the social security fund for a minimum of four weeks. Employees are only eligible for their total rate of pay for the initial three days of illness or injury. After this, they are compensated at 60% of their typical pay rate.

Maternity leave

Under Mexico’s Federal Labor Law, pregnant employees are entitled to 12 weeks of paid maternity leave, which is usually six weeks before birth and six weeks after. Employees can adjust the leave as well. In extreme cases of difficult labor or the child’s health issues, employees might receive additional leave. However, only 50% of their salary is paid during this extended period, and it cannot exceed 60 days. Employees are eligible for maternity benefits through IMSS if they have contributed to social security for at least 30 weeks within the year before their leave.

Paternity leave

In Mexico, paternity leave is usually granted under the Federal Labor Law to support fathers during the birth of their child. The duration is usually five working days of paid paternity leave following the birth of their child. The leave is typically paid by the employer, and the employee will receive their full salary during this period. The leave is valid regardless of whether the father is married to the mother or not.

Childcare leave

If an employee’s child is diagnosed with cancer, they are entitled to paid leave to care for them, provided that the child is 16 years old or younger and requires parental care for treatment. Employees can take up to 25 days of paid leave per period, with the option to take multiple periods. The total leave allowance is 364 business days over a three-year period. Employees are compensated at 60% of their salary, with IMSS covering this payment. To qualify for IMSS benefits, the employee must have contributed to social security for at least 30 weeks in the year before the diagnosis or 52 weeks before the leave.

Bereavement leave

Employees who have lost a parent, spouse, child, sibling, or other close family member are eligible for bereavement leave. Bereavement leave allows workers to grieve, plan funerals, and attend memorial services during this trying time without having to worry about work obligations. Bereavement leave is a caring policy that recognizes the emotional and practical challenges employees face during such times, although the duration varies from employer to employer.

Employment laws in Mexico

As an EOR in Mexico, Global Squirrels assumes the legal liability of complying with the labor laws and regulations in Mexico.

Mexico’s employment laws are designed to safeguard the rights of workers while also ensuring that employers maintain legal compliance. The Federal Labor Law is the foundation of labor regulations in Mexico and governs employment relationships across all sectors. Here is an overview of the key employment laws and regulations in Mexico:

Federal Labor Law

The Federal Labor Law (LFT) is the principal legislation governing employment in Mexico. It will establish basic labor rights, which include:

- Employment contracts that are written and clearly define the terms of employment

- Employee benefits, such as vacation time, paid annual bonuses, and severance pay

- Termination conditions require a valid cause for firing employees and mandating severance compensation in multiple cases.

- Worker protections, which include non-discrimination policies and rights to unionize and collectively bargain.

Social Security Law

Employers and employees are required to make contributions to the Mexican Social Security Institute (IMSS) under the Social Security Law (LSS). These payments pay for employees’ retirement, maternity, disability, and health care benefits.

INFONAVIT Law

Employers are required by the INFONAVIT Law to make contributions to the National Housing Fund Institute (INFONAVIT), which facilitates workers’ access to housing benefits and mortgage loans.

Subcontracting reform

The subcontracting reform, which was implemented in 2021, was a major change in Mexico’s labor laws. This reform heavily regulates and, in multiple cases, bans traditional outsourcing or subcontracting practices. This aims to prevent companies from evading labor and tax obligations by using external contractors. It mandates that outsourcing companies directly hire employees, making the use of compliant Employer of Record services in Mexico essential for foreign companies or those relying on outsourcing. It also imposes stricter reporting and compliance obligations for companies using subcontracted workers, ensuring they meet all labor rights and social security contributions.

Income tax in Mexico

As your Employer of Record in Mexico, Global Squirrels ensures full compliance. We manage all statutory and payroll obligations, including the accurate calculation, deduction, and remittance of personal income taxes in adherence to local Mexican regulations.

In Mexico, tax obligations are defined by residency, not nationality. Tax residents are required to pay income tax on their worldwide earnings. Non-residents, including Mexican citizens who are proven tax residents of another country, are only taxed on income sourced within Mexico.

Personal income tax rates

The following tax rates are effective for resident individuals for the calendar year 2025:

Taxable income (USD) | Basic tax | ||

From | To | Tax on column 1 (USD | Tax on excess (%) |

0.01 | 486.6 | 0 | 1.92 |

486.7 | 4130 | 9.3 | 6.40 |

4,130.1 | 7,258.1 | 242.5 | 10.88 |

7,258.2 | 8,437.3 | 582.8 | 16.00 |

8,437.4 | 10,101.7 | 771.5 | 17.92 |

10,101.8 | 20,373.8 | 1,069.8 | 21.36 |

20,373.9 | 590,795.9 | 3,263.9 | 23.52 |

590,796 | 1,127,926 | 6,024.7 | 30.00 |

For employees classified as Mexican non-residents, compensation is subject to a progressive tax rate of 15% to 30%. The first USD 6,841.2 of employment income earned within any 12-month period is tax exempt. The following tax table is applicable to income tax with respect to income earned by non-residents for the calendar year 2025:

Taxable income (USD) | Tax rate (%) | |

Over | Not over | |

0 | 6,843.1 | Exempt |

6,843.2 | 54,353.6 | 15 |

54,353.7 | and above | 30 |

Requirements to run payroll in Mexico

Let Global Squirrels handle the complex payroll of your remote employees and contractors.

Government requirements

Registration requirements

Employers are responsible for managing and remitting various taxes and contributions. Their core obligations include:

- Withholding: Deducting and remitting federal income tax and specific social tax contributions.

- Paying contributions: Funding mandatory social security, housing fund, and state payroll tax contributions.

- Electronic reporting: Reporting all employee payments and withheld taxes to the government. Every payment must be electronically certified to ensure adherence to labor laws.

Mexico’s tax authority, the Tax Administration Service (SAT), assigns the required tax identification numbers (RFC) to both individuals and employers for use on all payroll documentation.

Ongoing compliance requirements

To ensure compliance with Mexican labor and social security laws, most foreign businesses hire staff through a local subsidiary. Here’s how Mexico limits foreign employment:

- A maximum of 10% of a company’s workforce can be foreign nationals.

- Foreigners cannot be hired for technical roles if a qualified Mexican national is available.

- General directors, administrators, and managers are exempt from these restrictions.

Employers are also required to register with several national agencies—including the IMSS (Social Security), INFONAVIT (Housing Fund), and INFONACOT (Workers’ Welfare Fund)—as well as the relevant state tax authority for payroll tax purposes.

Local payroll tax (State Level)

A local payroll tax is levied by individual states where employees are based, typically at rates ranging from 1% to 3% of employee payments. The tax base for this levy often excludes specific benefits, such as savings fund contributions and pantry vouchers.

Federal income tax withholding

Employers must withhold federal income tax based on a system of 11 progressive brackets (1.92% to 35%). The taxable base is broad, covering gross payments including salary, overtime, bonuses, commissions, seniority premiums, and all other cash benefits. While most fringe benefits are exempt, they are subject to certain caps.

For lower-income employees (earning up to twice the minimum wage), the employer applies a direct government subsidy of up to USD 22.12 per month to reduce the tax burden. Compliance mandates the issuance of a digital pay slip (CFDI) for every payment, which is essential for the employer’s tax deductibility. Finally, employers must retain all payroll records for at least five years. Employees are required to file an annual tax return if they earn more than USD 21741.4 or have worked for multiple employers in the year.

Social security

Social tax contributions are divided into seven branches, calculated on a base known as the Base Contribution Salary (SBC). This formula primarily includes salaries and certain fringe benefits, though it has exceptions for periods like sickness and maternity leave.

- The maximum SBC is capped at 25 times the daily UMA (Unit of Measurement and Update).

- The “Work Accidents and Sickness” contribution is calculated using rates determined by the employer’s activity risk level, falling into one of five categories.

- Employee contributions are mandatory and calculated monthly, unless an applicable tax treaty with the employee’s home country grants an exemption or credit.

Calculation values

- The minimum wage is used as a reference point for calculating contributions.

- The maximum base for calculating contributions is 25 times the legal daily UMA. The legal daily UMA is equivalent to approximately USD 5.93.

Housing fund (INFONAVIT)

- The housing fund contribution is 5% of the SBC and is paid every two months, due by the 17th of the second month, instead of the monthly schedule used for other social taxes.

- Employees with an INFONAVIT mortgage will have an additional amount deducted from their salary. This amount is calculated using a set multiplier applied to the UMI rate (Unit of Mixed Infonavit).

- The legal daily UMI is equivalent to approximately USD 5.50.

Pension requirements

The mandatory pension fund receives contributions from both the employer and the employee, calculated based on the Base Contribution Salary (SBC).

Contribution breakdown (as a percentage of SBC):

1. Employer obligations:

- Retirement: 2% of SBC

- Unemployment and seniority insurance: 3.15% of SBC

2. Employee obligations:

- Pension contribution for unemployment and seniority insurance: 1.125% of SBC

Tax treatment and benefits

Contributions made to the Mexican Social Security Institute (IMSS) are exempt from income tax for the employee, while being deductible as an expense for the employer. Pension payments benefit from a partial tax exemption; only the remaining excess amount is subject to income tax at the normal rate. Employees who began working prior to 1997 may receive pension payments granted by the IMSS, provided they have recorded at least 500 weeks of contributions.

Employment obligations

The Mexican government enacted a significant 20% increase in the minimum wage for 2023, affecting approximately 11 million Mexican workers.

The new daily minimum wage rates are:

- General minimum wage: USD 11.28 per day

- Northern border zone: USD 16.98 per day

Standard work hours and overtime rules

The official maximum workweek is 48 hours, typically spread across six 8-hour shifts, granting one rest day. Many companies adopt a condensed schedule, reducing the 48 hours to five days to provide workers with two full days off each week. Overtime worked for the first nine hours per week must be paid at double the normal hourly wage. Any overtime exceeding nine hours per week must be compensated at triple the normal hourly wage.

Statutory payments in Mexico

Paid time off & supplemental pay

Employees must receive a supplemental bonus equal to 25% or more of their normal pay corresponding to their vacation days. This premium, along with any unused time off, must be paid out to the employee upon termination of the contract. The vacation entitlements specified in the Federal Labor Law (FLL) were significantly modified on January 1, 2023. The starting benefit for new employees was raised from six days to 12 paid days, with the number of days progressively increasing with seniority. A Christmas bonus, representing at least 15 days of salary, is a required annual benefit. Employers are obligated to process the full bonus payment by December 20th each calendar year.

Secure the highly skilled Mexican professionals you need. Global Squirrels acts as your Employer of Record (EOR), taking on all complex local payroll processing, tax compliance, and legal onboarding, so you can expand without the burden of entity establishment.