Hire Employees in Pakistan

Pakistan, an Asian country, is filled with rich natural and human resources that attract global employers. Hire in Pakistan, therefore, is a cost-effective process in that global companies take the initiative to run organizations smoothly.

In this guide, we will highlight the entire hiring process from Pakistan.

Table of Contents

Pakistan – A few facts

Capital: Islamabad

Population: 231.4 million

Currency: Pakistan Rupay (PKR)

Cost of living index: 18.58

Payroll frequency: Daily, weekly, bi-weekly and monthly

VAT: Pakistan does not have VAT

Pakistan job market detail

The job market depends on the talent pool, industries, cost-effectiveness, etc. If you plan to hire from Pakistan, you must know the job market in detail.

The talent pool in Pakistan

There is a diverse talent pool available to hire in Pakistan. The talents are promising and unique in terms of their features. The features of the pool are as follows:

Size and growth

Large and youthful: Pakistan boasts a population of over 220 million, with a young workforce exceeding 60%. This translates to a vast and continuously growing talent pool.

Rising education levels: Education rates are steadily increasing, with more individuals attaining higher qualifications, particularly in STEM fields.

Urbanization and digital adoption: Increased urbanization and internet penetration foster access to technology and create a more tech-savvy workforce.

Skillset and specialization

Diverse skill sets: The talent pool covers various skills and expertise, including IT, engineering, healthcare, finance, education, and creative fields.

Tech talent growth: Pakistan is experiencing a growing tech sector, leading to a rising pool of skilled software developers, data analysts, and cybersecurity professionals.

English proficiency: Many Pakistani professionals possess strong English language skills, facilitating communication and collaboration in international teams.

Cost-effectiveness

Competitive salaries: Pakistan’s salaries are generally lower than many developed countries, offering cost advantages for employers seeking remote talent.

Lower operational costs: Remote hiring in Pakistan can reduce office space, equipment, and other operational costs.

Overall, the Pakistani talent pool offers a promising option for employers seeking skilled, cost-effective, and diverse talent with the potential to contribute significantly to their business goals.

Industries in Pakistan

When exploring industries in Pakistan, it’s essential to consider established sectors with strong work potential and emerging areas offering exciting opportunities. Here are some promising options that boost Pakistan salary structure:

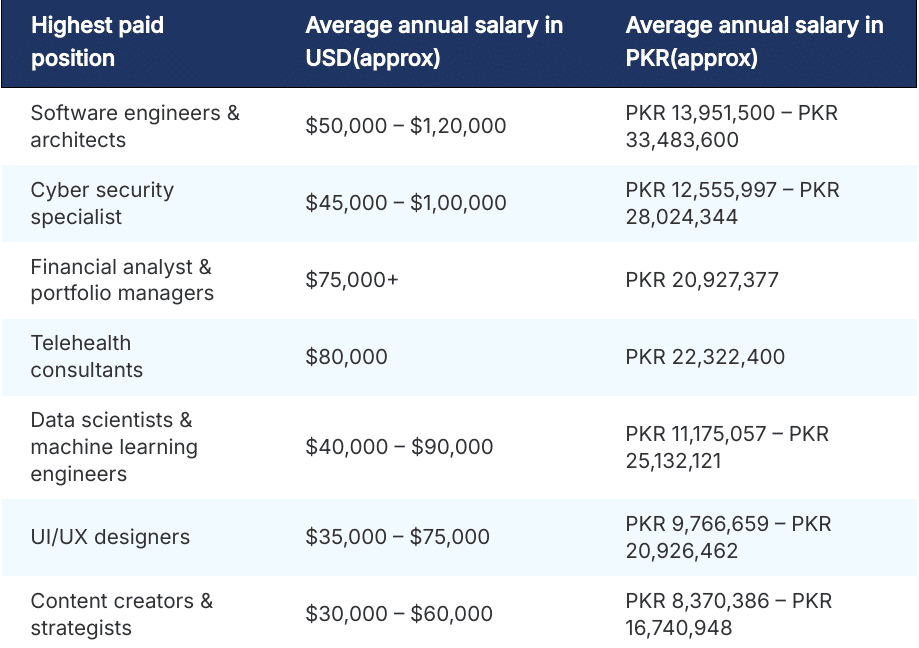

Highest paying job roles in Pakistan

Regarding the “highest” job roles with a basic Pakistan salary structure, it’s important to consider financial compensation and overall career satisfaction. Here are some options that tend to offer both based on current trends and industry growth:

Employment details in Pakistan

In terms of employment details, the rules and regulations in Pakistan come beforehand and include many parameters. Let’s learn the facts about the employment in Pakistan:

Working hours in Pakistan

The working hours in Pakistan are similar to any other Asian country. However, the Pakistan Labor Law Ministry decided the standard working hours that include:

Standard working hours

Daily: 9 hours, including a one-hour break for lunch and prayer time. This typically means a working day between 9:00 AM and 5:00 PM with a break from 1:00 PM to 2:00 PM.

Weekly: 48 hours, spread across six days (Sunday is typically a rest day).

Overtime:

- Overtime is allowed, but with limitations:

- Daily maximum: 12 hours, including regular working hours and overtime.

- Weekly maximum: 56 hours, including regular working hours and overtime.

- Overtime pay must be at least twice the average rate of pay.

- Female employees cannot work overtime past 7:00 PM.

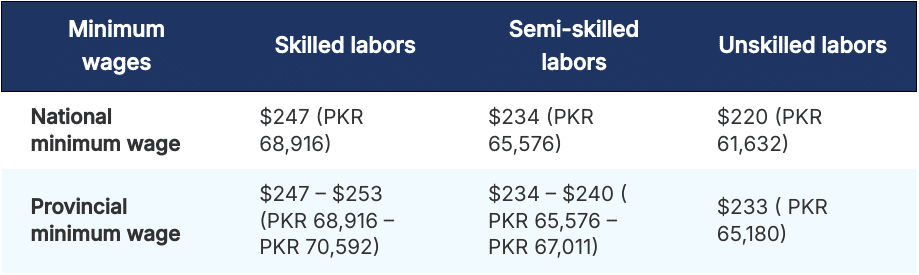

Minimum wage in Pakistan

The minimum wage in Pakistan is categorized into three subdomains – skilled, semi-skilled, and unskilled. See the table below to understand the basic Pakistan salary structure.

Payroll cycle in Pakistan

In Pakistan, the payroll cycle can vary depending on the employer’s preference but generally falls within one of these options:

Monthly: This is the most common type of payroll cycle, with employees typically receiving their salaries at the end of each month. This aligns with many companies and employees’ monthly budgets and financial planning.

Bi-monthly: Some employers pay their employees twice a month, usually on the 15th and 30th. This can benefit employees who prefer more frequent paychecks to manage their finances.

Weekly: This is less common, but some companies, particularly in the hospitality or retail sectors, may choose to pay their employees weekly. This can be helpful for low-wage earners who need to cover immediate expenses.

On-boarding rules in Pakistan

Probation period

According to employment laws in Pakistan, the probation period is governed by the West Pakistan Shops and Establishments Ordinance, 1969. It varies depending on the type of employment and the agreement between the employer and the employee. Here’s a breakdown:

Standard probation period

- unskilled workers: 3 months

- semi-skilled workers: 6 months

- skilled workers: 9 months

Exceptions

- collective bargaining agreements: If a company has a collective bargaining agreement with its employees, the probation period may differ from the standard duration’s mentioned above.

- specific industry regulations: Some industries might have specific regulations regarding probation periods.

- mutual agreement: Employers and employees can mutually agree on a different probation period, provided it doesn’t exceed the maximum allowed by law.

Important notes

- During the probation period, employers can assess an employee’s performance and suitability for the job.

- Employees can also evaluate the work environment and decide whether to continue with the company.

- Employers must provide written notice to the employee before the end of the probation period if they decide not to confirm their employment.

- If an employer does not provide written notice, the employee is automatically considered confirmed after the probation period ends.

Termination: rules and regulations in Pakistan

According to employment laws in Pakistan, termination of employment is governed by the West Pakistan Shops and Establishments Ordinance, 1969, along with additional regulations and specific industry requirements. Understanding these rules is crucial for both employers and employees to ensure a fair and respectful process.

Here’s a breakdown of critical aspects

Cause of termination

Employers can only terminate employment for just cause, which includes:

- Misconduct: Gross negligence, theft, dishonesty, violence, or violation of company policies.

- Inability to perform: Incompetence, consistent poor performance, or lack of necessary skills.

- Redundancy: Restructuring or closure leading to job elimination.

- Medical reasons: Permanent illness or disability rendering the employee unfit for work.

Notice period

According to Pakistan labour law, the notice period for employees to resign or employers to terminate employment is governed by the West Pakistan Shops and Establishments Ordinance, 1969, with potential variations based on employee type and agreement:

Standard notice periods

- unskilled workers: 15 days

- semi-skilled workers: 30 days

- skilled workers: 60 days

Exceptions

- Collective bargaining agreements: If a company has a collective bargaining agreement with its employees, the notice period may be different from the standard durations mentioned above.

- Specific industry regulations: Some industries might have specific regulations regarding notice periods.

- Mutual agreement: Employers and employees can agree on a different notice period, provided it adheres to legal minimums.

Compensation

If an employee is terminated without just cause or proper notice, they are entitled to compensation, typically calculated as:

- Salary for the remaining notice period

- Other benefits or bonuses due

- Potential additional compensation based on specific circumstances

Holidays in Pakistan

The number of total holidays in Pakistan depends on the calendar year. You need to know the breakdown for hiring employees in Pakistan:

National public holidays

The Pakistani government declares 12 official national public holidays each year. These typically include:

- Islamic holidays: Eid-ul-Fitr (3 days), Eid-ul-Azha (3 days), Muharram (1 day), Shab-e-Barat (1 night)

- National holidays: Pakistan Day (23 March), Independence Day (14 August), Quaid-e-Azam’s Birthday (25 December)

- Other holidays: May Day (1 May), Kashmir Solidarity Day (5 February), Iqbal Day (21 April)

Types of leaves in Pakistan

According to employment laws in Pakistan, employees are entitled to various types of leave as part of their employment benefits. Pakistan labour law is designed to ensure work-life balance, attend to personal matters, and maintain good health. The common types of leaves include:

Annual leave (Casual leave)

This is the standard leave for personal matters, rest, or travel. Employees typically get a certain number of days per year (usually around 15 to 20 days), which they can avail of with prior notice to their employer.

Sick leave

Sick leave is provided when an employee is ill and unable to attend work. The number of sick leave days can vary, but a certain number of days are usually offered without requiring a medical certificate, beyond which a certificate may be necessary.

Maternity leave

Maternity leave is granted to female employees for childbirth and postnatal care. In Pakistan, the duration of maternity leave is typically around 12 weeks, and it’s paid.

Paternity leave

Although not as common as maternity leave, some organizations in Pakistan have started offering paternity leave to male employees. The duration of paternity leave is usually much shorter than maternity leave.

Hajj leave

For Muslim employees, special leave is sometimes granted to perform the Hajj pilgrimage, a once-in-a-lifetime obligation for Muslims who can physically and financially undertake it. This leave is apart from annual leave and can range from 15 to 40 days.

Bereavement leave

Also known as compassionate leave, this is given in the event of the death of a close family member. The duration can vary based on the employer’s policies.

Study leave

Some organizations offer leave for educational purposes, allowing employees to pursue higher education or professional development courses. This might be paid or unpaid leave, depending on the company’s policy.

Emergency leave

This type of leave is taken in unforeseen circumstances, such as a family emergency. The employer usually sets the terms for emergency leave.

Leave without pay

If an employee has exhausted their entitled leaves, they can opt for leave without pay, subject to their employer’s approval.

Public holidays

Apart from these, employees are also entitled to leave on public holidays, which can vary based on Pakistan’s national and religious calendar.

It’s important to note that the specifics of these leaves, such as the number of days and conditions attached, can vary greatly depending on the company’s policy, the nature of the employment, and the sector in which the employers must know before hire in Pakistan.

Tax calculations as per Pakistan labor law

Calculating income tax in Pakistan can seem complex, but understanding the basic steps and using available resources can help to navigate the process smoothly. Here’s a breakdown:

Determine the taxable income

- Identify the income sources, including salary, business income, capital gains, rental income, and other sources.

- Deduct any allowable expenses from each income source (e.g., business expenses, medical expenses).

- Combine your net income from all sources to determine your total taxable income.

Identify the tax bracket

Pakistan has a progressive tax system with five tax brackets:

- 0% for income up to PKR 600,000 ( $2,150)

- 7.5% for income between PKR 600,000 and PKR 800,000 ( $2,150 & $2,887)

- 15% for income between PKR 800,000 and PKR 1,200,000 ( $2,887 & $4,300)

- 20% for income between PKR 1,200,000 and PKR 2,400,000 ( $4,300 & $8,569)

- 25% for income exceeding PKR 2,400,000 ( $8,569)

1. Calculate the tax liability

- Apply the respective tax rate to the income within each tax bracket.

- Add the resulting tax amounts from each bracket to get the total tax liability.

2. Deduct any applicable tax credits

- Eligibility for certain tax credits, such as those for dependent family members or charitable donations.

- Deduct these credits from the total tax liability to determine the final payable tax amount.

Competitive insurance benefits for the employees in Pakistan

Comprehensive insurance to hire in Pakistan typically covers a wide range of aspects to ensure the well-being and financial security of the workforce.

Below is the list of insurance benefits you can see:

Health insurance: This is one of the most common and essential components. It covers medical expenses, hospitalization costs, and sometimes even outpatient care. This can be a crucial benefit in Pakistan, where public healthcare facilities might be limited.

Life insurance: Life insurance provides financial support to the employee’s family during their untimely demise. This is especially important in Pakistan, where many families rely on a single-income earner.

Disability insurance: This insurance offers income protection if an employee becomes temporarily or permanently disabled and cannot work. This can be a vital safety net considering the lack of widespread social security systems in Pakistan.

Accident insurance: Specifically covers expenses and losses due to accidents. This can include medical treatment costs, disability compensation, or death benefits.

Retirement plans: While not traditional insurance, comprehensive packages often include retirement benefits like provident funds or pensions, helping employees secure their future financially.

Travel insurance: For employees who travel for work, this insurance covers risks like lost luggage, flight cancellations, and medical emergencies abroad.

Legal assistance insurance: Some comprehensive packages might include support for legal issues that employees might face, which is not commonly found but can be a valuable addition.

Maternity/paternity leave benefits: Supporting new parents is increasingly becoming a part of comprehensive packages, acknowledging the importance of work-life balance.

In Pakistan, the availability and extent of these insurance benefits can vary significantly between companies and sectors. Larger corporations and multinational companies often offer more during hire in Pakistan as comprehensive packages compared to smaller local businesses.

Why do employers prefer to hire in Pakistan?

Employers from various countries and industries might prefer to hire employees from Pakistan for several reasons:

Cost-effective labor: Pakistan offers a relatively lower labour cost than many other countries. This can be particularly attractive for companies looking to reduce their operational costs.

Highly skilled workforce: Pakistan has a significant pool of well-educated and skilled professionals, especially in IT, engineering, textiles, and medicine. The country’s education system, particularly in technical and vocational areas, produces a competent workforce ready to engage in specialized tasks.

English proficiency: English is widely spoken and understood in Pakistan, especially among the educated and professional classes. This makes communication more accessible for international employers, especially those from English-speaking countries.

Work ethic and adaptability: Pakistani workers are often known for their strong work ethic and adaptability. They are generally willing to work flexible hours, which can benefit companies in different time zones.

Remote work trends: With the rise of remote working arrangements, Pakistani professionals have become an attractive option for companies seeking remote workers, thanks to their skills, work ethic, and lower wage demands compared to other countries.

Cultural diversity: Employing people from diverse backgrounds, including Pakistan, can bring different perspectives to a business, fostering creativity and innovation.

Large youth population: Pakistan has a large and growing youth population, providing a vast pool of young and energetic talent eager to enter the workforce and bring fresh ideas.

Employers must set up the entity to harness the remote hire from Pakistan. If you want to bypass the local rules and regulations in Pakistan, Global Squirrels can help you hire in Pakistan.

How does Global Squirrels assist you to hire from Pakistan?

Global Squirrels is a one-stop solution that can help you bypass Pakistan labour law yet hire professionals from Pakistan. The AI-integrated platform helps you navigate the talent pool in Pakistan as per your requirements.

Additionally, the platform also helps in payroll management. Employment laws in Pakistan are complex; Global Squirrels simplify the payroll process by calculating the compensation, managing the leave sheet, checking the tax slabs and compliance’s based on international laws.

Why is Global Squirrels unique in the hiring and payroll management industry?

Global Squirrels is unique in this industry because –

- You do not need to pay any bloated markups or agency fees, only a license fee per hire

- The pricing started at $199/employee/month – one of the lowest charges

- You do not need to set up any local entity

- You can access a rich talent pool from Pakistan

- The signup process is free

In Conclusion

The guide demonstrates how to hire in Pakistan. You can avoid the complex Pakistan labour laws and sign up with Global Squirrels to access Pakistan’s talent pool. Besides hiring, the platform also helps you with payroll management, which covers a significant recruitment process and turns it into a smooth journey.