Understanding Arkansas employment laws

If you are a business owner in Arkansas and trying to keep up with the ever-changing Arkansas labor laws, non-compliance with Arkansas employment laws can result in hefty fines, lawsuits, and damage to your company’s reputation. It is essential to stay informed about Arkansas workplace laws, including minimum wage, overtime rules, and protection against discrimination.

In this blog, I will break down the main components of Arkansas labor laws and give you actionable insight so that you are compliant. We will also discuss how Global Squirrels can help you with expert guidance and support in navigating the thickets of Arkansas workplace laws. The right support will help you stay compliant, protect your business, and grow.

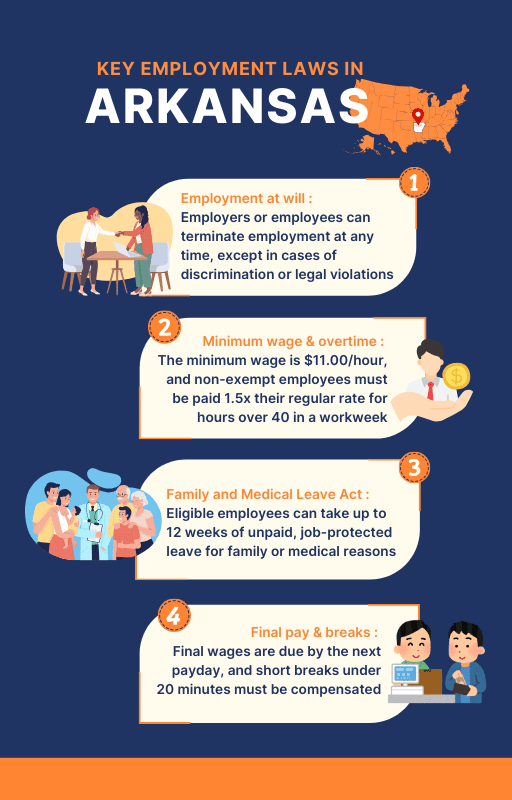

What are the key Arkansas labor laws?

Source: Arkansas government

Minimum wages

Under Arkansas labor laws, the Arkansas Minimum Wage Act mandates that covered employees must be paid a minimum wage of $11.00 per hour by employers with four or more employees. However, there are exceptions to this rule. Full-time students may be paid 85% of the minimum wage as long as they have the appropriate certification. Tipped employees, too, are eligible for a reduced cash wage of $2.63 per hour as long as the total amount of tips they receive adds up to at least as much as the minimum wage threshold. Tipped workers are entitled to a maximum tip credit by their employer of $7.37 per hour.

Work hours & overtime pay

For overtime pay, Arkansas employment laws align with the federal Fair Labor Standards Act (FLSA). An employee is entitled to 1 ½ times that employee’s regular hourly rate for any hours worked over 40 hours in a single workweek. Exempt workers from overtime rules are executives, professionals, outside salespeople, and certain classes like agricultural workers, domestic service workers, and seasonal. These provisions ensure compliance with Arkansas workplace laws, promoting fair wages while accommodating industry-specific needs.

Leaves

Complementary to federal rules, such as the Family and Medical Leave Act (FMLA), Arkansas leave laws provide workers with paid and unpaid leave for personal, medical, or civic reasons. Understanding these laws is critical for compliance with Arkansas labor laws, protecting both your business and your workforce.

Family and Medical Leave Act (FMLA)

Arkansas employees who are eligible for the FMLA are entitled to 12 workweeks of unpaid, job-protected leave in a 12-month period.

A newborn child and the care of the child during ‘birth.’

– The placement of a child for adoption or foster care.

– Providing care for your spouse, child, or parent who has a serious, ongoing health problem.

– Their own serious health condition that precludes them from performing their job.

– Qualifying exigency related to a family member’s active duty military service;

Employees are also entitled to 26 work weeks of leave in one 12-month period to care for a covered service member with a serious injury or illness. The 12-month period can be based on a calendar year, fiscal year, or rolling 12-month period, and employers are able to decide how the 12-month period should be calculated. Compliance with Arkansas workplace laws is crucial to avoid penalties and maintain employee trust.

Sick leave

Sick leaves do not require private companies in Arkansas to provide paid or unpaid sick leave. However, many businesses offer this as part of their benefits package, which aligns with best practices under Arkansas employment laws. The number of sick days that employees receive should be checked with the employer’s policy. Sick leave policies vary from 5 to 10 days per year, according to company and industry.

Paid Time Off (PTO)

Neither does Arkansas have specific state laws mandating Paid Time Off (PTO). Employers have the ability to choose from vacation days, personal days, or combined PTO. The number of PTO days varies by employer but often includes:

– Entry-level positions get 10 to 15 days per year.

– Long-standing employees or people with senior roles are entitled to additional PTO days.

To comply with Arkansas labor laws, employers are encouraged to establish clear policies on PTO accrual and usage. Transparent PTO policies help avoid disputes and ensure alignment with Arkansas workplace laws.

Bereavement leave

Bereavement leave is not mandated under Arkansas employment laws, leaving it up to employers to decide whether to offer this benefit. Lots of businesses offer 3 to 5 days of bereavement leave so that employees can grieve and care for family after a death.

Additional leave policies

Additional benefits are available to employers in Arkansas to offer more leave.

– Parental leave: Some companies beyond FMLA offer extra paid or unpaid leave to help employees with family changes.

– Emergency leave: Days for unexpected personal or family emergencies.

– Floating holidays: Often included in PTO plans: Additional leave days for personal use.

Benefits

Businesses and employees alike need to understand employee benefits in Arkansas. These benefits often align with Arkansas labor laws, Arkansas employment laws, and federal requirements, such as the Affordable Care Act (ACA) and employer-sponsored programs. Below is an overview of the most common employee benefits available under Arkansas workplace laws.

Health insurance

Health insurance plans in Arkansas cover the full scope of medical needs.

– Deductibles: It is $500 per individual and $1,000 per family, with deductible costs for preventive care excluded.

– Out-of-pocket limits: $3,000 for individuals and $6,000 for families for medical costs; $3,100 for individuals and $6,200 for families for pharmacy costs.

– Coverage types: Out-of-network coverage is included in network coverage. Primary care copayments begin at $25, and specialists at $50.

– Prescription drugs: Generic drugs cost $15, preferred brands $40, and non-preferred brands $80. There is a $100 co-pay for specialty drugs.

These plans typically meet minimum essential coverage and value standards as required by the ACA, ensuring compliance with Arkansas workplace laws.

Retirement plans

Retirement plans are a key component of employee benefits under Arkansas workplace laws, helping employees save for their future.

– 401(k) plans: Plans that employers sponsor in which employees can contribute, sometimes with matching options.

– Pension plans: Pensions that provide guaranteed employee income for years on end.

Robust retirement plans reduce tax liability and help increase the attraction and retention rate of top talent while fulfilling federal and state regulation obligations.

Additional benefits

To remain competitive and adhere to Arkansas labor laws, many employers offer supplemental benefits.

– Vision and dental insurance: Routine eye exams, glasses, and dental checkups.

– Life insurance: Basic life insurance policies available to employees who may purchase additional coverage.

– Disability insurance: Short and long-term plans to protect employees from loss of income in the face of illness.

Benefits that get legal protection

Employers must follow strict guidelines under Arkansas employment laws and federal standards to ensure equitable access to benefits.

– Affordable Care Act (ACA): Revenues ensure health plans have the minimum essential coverage.

– COBRA: Under specified conditions, employees are allowed to complete a group health insurance past employment.

Discrimination and harassment laws in Arkansas

Arkansas Civil Rights Act (ACRA) prohibits discrimination on the basis of race, religion, national origin, gender, or disability in Arkansas employment, accommodations, accommodations, property transactions, and voting rights. Passed as Act 962 of 1993, ACRA was a significant milestone in Arkansas labor laws, though it has its limitations. ACRA, unlike federal civil rights laws, has no state-level enforcement mechanism, and people have to hire private attorneys or file lawsuits to claim discrimination. It makes it more difficult for employees to seek justice in cases of employment. The act covers housing and employment discrimination but leaves out age discrimination and alcoholism as a disability. Additionally, religious entities are exempt from the employment provisions of the act, creating gaps in coverage under Arkansas workplace laws.

ACRA has not proven effective in combating such discrimination and harassment because, despite its provisions, it has minimal enforcement and procedural remedies. Federal laws, not Arkansas state laws, form the basis for many Arkansas judges to interpret cases under ACRA, making state-level claims devoid of clear advantages. This reliance highlights the importance of aligning Arkansas employment laws with robust enforcement mechanisms to address discrimination effectively. Under federal laws, like Title VII of the Civil Rights Act and ACRA, Arkansas employers are required to ensure an inclusive, harassment-free workplace. However, businesses should be proactive by implementing clear anti-discrimination and anti-harassment policies in compliance with Arkansas workplace laws, ensuring equitable treatment and a safe environment for all employees.

What are the consequences of not complying with Arkansas laws?

Compliance with Arkansas employment laws, including Arkansas labor laws and Arkansas workplace laws, is essential for maintaining the integrity of business operations and avoiding significant legal, financial, and reputational repercussions.

Legal penalties and criminal charges

Penalties for non-compliance with Arkansas laws, such as procurement regulations, discrimination laws, or wage-hour requirements, can be substantial.

- Fines of up to $10,000 and imprisonment for up to five years, or both, under Arkansas Code Title 19, Chapter 11, are the possible results of procurement law violations.

- When businesses are convicted of non-compliance with discrimination laws, such as the Arkansas Civil Rights Act (ACRA), they can be sued for monetary damages or the re-employment of affected employees.

- A misdemeanor is using state or county property for any purpose other than authorized. Fines may be between $50 and $100.

Legal penalties can snowball quickly, especially when an act is intentional, and instead of being a misdemeanor, it could become a felony.

Financial and operational risks

Non-compliance with Arkansas workplace laws can disrupt business operations, leading to significant financial burdens such as:

– Wage and hour law back wages and overtime payments for violations of wage and hour laws.

– Heavy bills to pay for lawsuits and settlements for discrimination, harassment, or retaliation claims.

– Fines for failing to comply with fiscal management regulations under the State Fiscal Management Responsibility Act or improper reporting.

It also can prevent businesses that depend on public sector contracts from being eligible to contract with the state for three years after violating state contracting laws.

Financial and operational risk

Non-compliance with Arkansas workplace laws can disrupt business operations, leading to significant financial burdens such as:

– Wage and hour law back wages and overtime payments for violation.

– Lawsuits and settlements over discrimination, harassment, or retaliation claims that are costly.

Non-compliance with Arkansas workplace laws can disrupt business operations, leading to significant financial burdens such as:

– Back wages and overtime payments for violations of wage and hour laws.

– Costly lawsuits and settlements for discrimination, harassment, or retaliation claims.

– Fines for noncompliance with fiscal management requirements pursuant to the State Fiscal Management Responsibility Act or failure to report appropriately.

Loss of eligibility to contract with the state for three years after a violation of state contracting laws can also be a tremendous blow to any business that depends on public sector contracts.

Reputational damage and employee turnover

Failing to comply with Arkansas employment laws erodes trust among employees, customers, and the community. Turning people into oppressive employees certainly results in an increase in turnover rates and costs associated with recruitment. Once publicized, violations can also hurt a company’s reputation and make it more challenging to draw in top talent or win new business.

More administrative burden

Legal disputes, investigations, and audits resulting from non-compliance distract time and resources from the business’s core function. For instance, under Arkansas public record laws, businesses must respond to public requests within a certain period of time, or at most, do it properly or face penalties. Such requirements can be mismanaged, which can only create further legal complications and administrative inefficiencies.

Discover key Colorado employment laws, including wage regulations, workplace rights, and compliance guidelines, to ensure your business operates within the law.

How does Global Squirrels help eliminate all the challenges?

Global Squirrels is a staffing and payrolling platform that helps you hire and manage your employees efficiently. Our platform helps you manage all HR functions, such as payroll management, benefits administration, task and timesheet management, compliance with Arkansas employment laws, and performance management. Unlike other staffing agencies, which charge 50% more, our platform allows you to save up to 20% on hiring costs.

Partnering with Global Squirrels eliminates all challenges related to non-compliance with Arkansas labor laws. Our solutions ensure seamless compliance with Arkansas labor laws and other jurisdictional requirements, eliminating risks associated with non-compliance. Our platform assists you in circumnavigating the convolutions of legal frameworks, illuminating the nuances of employee misclassification, and time travel through regulatory changes proactively through compliance analytics with expert guidance.

Let us look at what solutions our platform offers to help you meet all your business requirements.

Orange plan

The Orange plan simplifies the process of finding and onboarding the right talent for your business needs. After signing up and selecting the Orange Plan, you’ll be guided to a form where you can provide details such as the job title, description, budget, start date, educational requirements, desired skills, and preferred hiring countries. Within 2 to 5 business days, you’ll receive a list of curated candidate profiles. You can then choose which candidates to interview and share feedback following the interviews. Once you’ve selected the candidates you wish to onboard, our platform takes over, managing all administrative responsibilities such as performance management, payroll & benefits management, compliance with Arkansas employment laws, task and timesheet management, and generating offer letters.

Purple plan

With our Purple Plan, we’ve built a process to help streamline the process of making your freelancer a full-time employee or the process of onboarding a candidate you’ve already sourced. Our platform allows us to produce an offer letter with the key employment clauses that will make your employee work exclusively for your business with an appropriate notice period should your employee decide to leave the job. We begin activating the key HR functions such as payroll setup, benefits management, performance tracking, and compliance with local and international labor and tax regulations as soon as onboarding starts.

Are you ready to comply with Arkansas employment laws? Get a demo today!