Employment and labor laws in Ohio

Understanding employment and labor laws is important for both employers and employees to ensure a compliant and fair workplace. In Ohio, businesses should adhere to a combination of federal regulations and state-specific labor laws, which handle wages, working hours, workplace safety, anti-discrimination policies, and employee rights. Understanding these laws will assist employees in avoiding legal pitfalls, maintaining smooth operations, and fostering a positive work environment. Similarly, employees who are aware of their rights can better protect themselves and ensure that they receive fair treatment.

In this blog, we will provide a summary of Ohio’s key employment and labor laws, which will cover everything ranging from minimum wage regulations to workplace safety requirements, thus helping both employers and workers navigate the state’s legal landscape efficiently.

Understanding Ohio’s minimum wage and overtime laws

Understanding Ohio labor laws is important for both employees and employers to ensure compliance, fair treatment, and a safe work environment. Given below are some of the most important regulations to keep in mind:

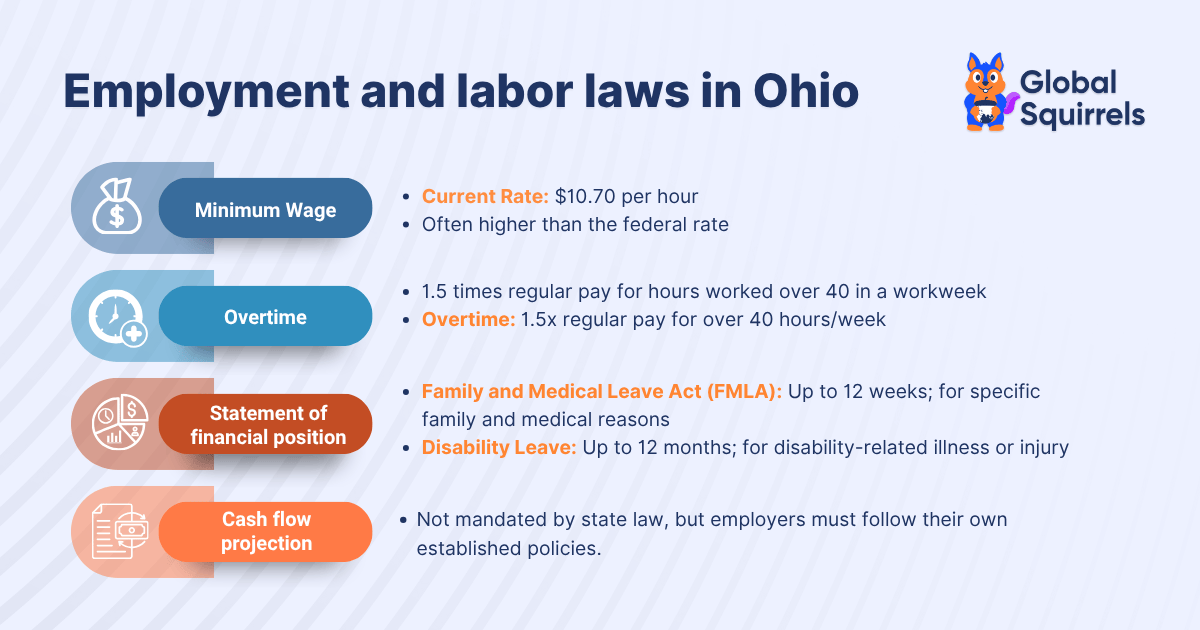

1. Minimum wage in Ohio

Ohio follows a state-specific minimum wage, which is usually higher than the federal rate for most employees. Employers are required to pay at least the current state’s minimum wage, which might vary depending on factors like the employee’s age, location, and job type. The basic minimum rate every hour in Ohio is $10.70.

2. Overtime regulations

Ohio will follow the federal Fair Labor Standards Act (FLSA) for overtime. Non-exempt employees are required to receive 1.5 times their regular pay for any number of hours worked over 40 in a working week. This will ensure that employees are fairly compensated for extra work and discourage excessive hours without any proper pay.

Types of leaves to be granted as per Ohio labor laws

It is important to stay informed about the multiple types of employee leaves available and the laws that govern them. Understanding these leave policies will help you support your employees during challenging times, but also ensure your company remains compliant with state and federal regulations. Ohio’s employee leave laws cover a wide range of situations, from medical emergencies to military service. Some of the most common types of leave include:

1. Family and Medical Leave Act (FMLA)

As per FMLA, employers must provide eligible employees with up to 12 weeks of unpaid, job-protected leave for qualifying medical and family reasons, which include birth or adoption of a child, a serious health issue, or caring for a family member with a serious health condition.

2. Paid sick leave and vacation time

Paid sick leave and vacation time are also covered by Ohio’s employee leave rules, which can be important for workers who require time off for personal reasons or who are coping with temporary ailments. Although paid sick leave and vacation time are not mandated by Ohio law for private firms, many do so to draw and keep skilled workers. There is no set accumulation rate or maximum amount of sick days that an employee may accrue under Ohio law.

3. Disability leave

Ohio employment law will allow employees to take unpaid disability leave for up to 12 months if they have exhausted all of their accumulated sick leave and are unable to perform the job because of disability related illness, injury, or condition.

4. Military leave

Workers are eligible for unpaid military leave and reinstatement upon their return from active duty or training in the U.S. armed forces.

5. Jury service leave

Employers in Ohio are required to give their staff members unpaid leave for jury service and are not allowed to punish them for serving.

Employee benefits under Ohio employment laws

Offering employee benefits is important for employers in Ohio to attract top talent, thus ensuring compliance with the state and federal labor laws and maintaining a motivated and engaged workforce. A well-structured package will go beyond just the basic salary and demonstrate an organization’s commitment to employee well-being, professional growth, and financial security.

1. Health insurance benefit under the Ohio employment laws

- Employers in Ohio will typically provide a comprehensive health insurance coverage that includes medical, vision, and dental plans.

- Coverage might extend to preventive care, hospitalization, specialist visits, and prescription drugs.

- Multiple employers will offer flexible contribution models, which will allow employees to share costs, include dependents, and also choose between multiple plan options.

2. Retirement and savings plan

- Common retirement options include 401(k) or 403(b) plans, often with employer matching contributions to encourage participation.

- Some employers will usually offer pension plans or other compensation programs to secure long-term financial stability for employees.

- Providing retirement benefits will demonstrate a commitment to employee financial well-being, which will enhance retention and loyalty.

3. Workers’ compensation

- In order to cover occupational illnesses and work-related injuries, employers are required to maintain workers’ compensation insurance.

- This shields both workers and employers from future legal action by providing medical treatment and a portion of lost wages to injured workers.

- An organization’s commitment to safety and employee protection is demonstrated by a robust workers’ compensation policy.

4. Unemployment insurance

- Employers usually contribute to Ohio’s unemployment compensation fund, which will ensure that employees who lose jobs through no fault of their own will receive temporary income support.

- Proper administration of unemployment insurance is important for compliance and helps maintain trust between employees and employers.

5. Employee Assistance Programs (EAPs)

- Various employers will provide EAPs to support employees’ mental, emotional, and financial well-being.

- These programs will include counseling services, stress management, legal and financial advice, and crisis intervention.

- EAPs are valuable in maintaining productivity and promoting a healthy work culture.

For a deeper understanding of workplace rights, wages, and compliance requirements beyond Ohio, check out our comprehensive guide on labor laws in the USA

Discrimination and harassment laws in the USA

Employment laws in the USA, including Ohio, prohibit discrimination in employment and related activities. These protections will apply to employers, employment agencies, labor organizations, and joint labor management committees, thus ensuring that individuals are treated fairly regardless of personal characteristics. Employers cannot make decisions based on the protected characteristics unless there is a bona fide occupational qualification (BFOQ) that will legally justify this requirement. This law will extend to all aspects of employment, which include hiring, compensation, promotions, job training, firing, workplace conditions, and benefits.

Harassment, a form of discrimination, will involve unwelcome conduct based on a protected characteristic that creates an intimidating, hostile, or offensive work environment. In Ohio, harassment can include offensive slurs, jokes, physical assaults, or other verbal or physical conduct that interferes with an individual’s work performance or creates an intimidating, hostile, or offensive work environment.

Consequences of non-compliance with Ohio labor laws

Non-compliance with Ohio employment and labor laws could create significant challenges for businesses. These challenges tend to extend beyond impacting finances, reputation, legal penalties, and workplace culture. Given below are the primary risks and consequences that employers face when failing to adhere to Ohio laws:

1. Legal penalties as per Ohio employment laws

Businesses that violate state labor laws tend to face substantial fines and legal penalties. This will include violations related to minimum wage, child labor restrictions, overtime pay, discrimination, and workplace safety.

2. Litigation and lawsuits

Non-compliance will lead to lawsuits from employees or government agencies. Discrimination claims, wage disputes, safety violations, and harassment complaints can result in costly legal battles. Even if the business eventually prevails, settlement costs, legal fees, and time spent on litigation can be substantial.

3. Increased regulatory scrutiny

Ohio state agencies, which include the Ohio Civil Rights Commission (OCRC) and the Department of Job and Family Services (ODJFS), might place non-compliant businesses under closer scrutiny. This can result in frequent audits, inspections, and reporting requirements, thus creating operational disruption and administrative burden.

How does Global Squirrels help companies comply with USA labor laws?

Global Squirrels is a staffing and payrolling platform that helps businesses in the USA hire, manage, and pay local contractors as well as remote workers in India, the Philippines, and Mexico. When you hire local contractors in Ohio through our platform, we will ensure 100% compliance with all the labor and employment laws in the state. Our staffing platform assures zero risks to your business by eliminating any possibility of legal penalties, litigation, or lawsuits mentioned above. With us, you get to work with top contractors without worrying about legal compliance or business risks. Global Squirrels has three hiring plans that will suit your staffing and payrolling requirements. The Orange plan is ideal for businesses looking to find and hire new talent in Ohio. If you want our platform to onboard a self-sourced contractor, you can choose our Purple Plan.

Need help with hiring employees in Ohio, but find it challenging to navigate the employment and labor laws? Request a demo, and we will simplify it for you.